Where to Invest Your Money in 2025?

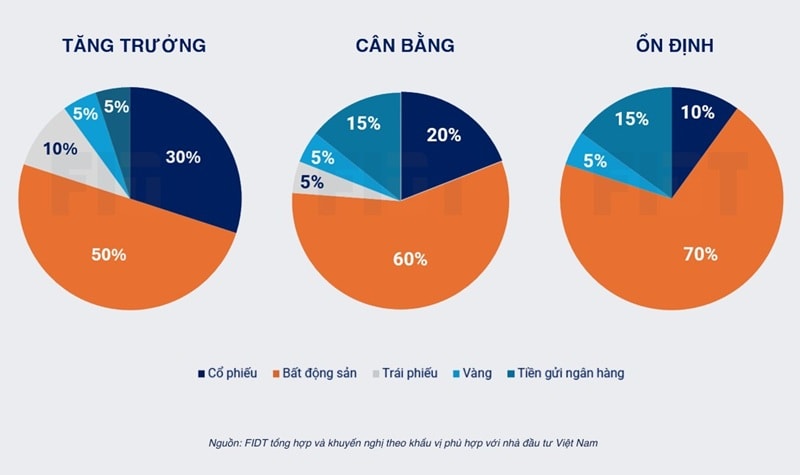

According to Mr. Bùi Văn Huy, Head of Research & Investment Analysis at FIDT, the asset allocation strategy for 2025 should focus on stocks, real estate, deposits, bonds, and gold.

Depending on specific markets, investors can develop tailored strategies to minimize risks and maximize returns.

Stocks – The Primary Investment Channel

The stock market's overall profitability is expected to increase by 16% in 2025, up from more than 13% in 2024. Key sectors such as banking, real estate, and information technology will be primary drivers. With the current P/E ratio at 13x, the Vietnamese stock market is well valued, providing sufficient space for growth. The VN-Index might rise to 1,300 - 1,500 points by the end of 2025, indicating a bright outlook and a substantial market rebound.

Given its robust performance and exceptional growth potential, FIDT recommends Vietnamese stocks as the primary investment channel for 2025. Compared to other asset classes, the Vietnamese stock market offers higher growth opportunities, especially in the context of an economic recovery and favorable macroeconomic factors. This is a strategic time to optimize returns and leverage the market's long-term growth potential.

Which Real Estate Segments to Choose?

The real estate market (BĐS) hit its bottom in 2024. Legal processes are gradually being streamlined, and housing demand is expected to continue recovering.

Segments catering to real residential needs, such as apartments, townhouses, and land in populated areas, will attract capital and interest from individual investors. Real demand makes Ho Chi Minh City apartments a key segment for capital flow in the first half of 2025. Speculative assets, such as project land in provinces, agricultural land, and resort real estate, will likely remain stagnant. Apartments in Hanoi may face short-term illiquidity as prices have risen significantly, shifting investment focus to land plots in densely populated areas.

Selecting Banks and Deposit Terms

Interest rates on savings accounts are likely to climb modestly in 2025, in line with the State Bank of Vietnam's monetary easing policy. Vietcombank's 12-month deposit rate is expected to rise by 75 to 100 basis points in either of two scenarios: "high exchange rate pressure" or "low exchange rate pressure."

Investors may consider prioritizing mid-sized banks with moderate capitalization and significant capital mobilization needs in 2025, such as HDBank and VPBank, to secure higher interest rates. Simultaneously, opting for shorter deposit terms of 6 to 12 months can take advantage of future interest rate adjustments.

Bonds – A Promising Asset Class

Low savings interest rates also encourage capital flow from investors toward higher-yielding channels like corporate bonds. The 2025 trend of strong growth and market recovery presents an opportunity for investors to diversify portfolios and optimize returns. Listed bonds with attractive interest rate spreads are expected to attract fresh capital. These factors give corporate bonds (TPDN) significant potential in 2025. The riskiest phase has passed, as new legal regulations have been implemented, improving market transparency and sustainability.

Given corporate bond yields exceeding current deposit rates, growth- and balance-oriented investors are advised to allocate 5–10% of their asset portfolios to safe corporate bonds.

Gold and Market Volatility

Amid complex global geopolitical and economic conditions, gold maintains its position as a critical asset, with prices expected to rise at a slower pace than in 2024.

The domestic gold market will continue to benefit from State management. Barring major disruptions, domestic gold prices in 2025 are expected to align with global trends. In most scenarios, only 5–10% of total assets should be allocated to gold to diversify risk. Investors should adjust allocations during market volatility and avoid purchasing gold bars with excessive price premiums over global rates.

Bringing up the cryptocurrency market

Since cryptocurrency is a relatively new asset class, it requires careful and gradual research in the broader investment landscape. Despite this, investors should remain cautious of volatility and inherent risks. Many institutions view the 2025 cryptocurrency market as promising, driven by factors like the halving of Bitcoin and participation from major financial organizations.