Will a recession hit the U.S economy?

After a fall in Q1 GDP of 1.6%, market estimates for Q2 currently range from -0.6% to 1.2%. If GDP is negative, it will mark a recession in many people’s eyes given two consecutive negative prints.

After a fall in Q1 GDP of 1.6%, market estimates for Q2 currently range from -0.6% to 1.2%.

However, Mr. Steve Barrow, Head of Standard Bank G10 Strategy said it won’t really be a recession because a two-quarter slide in GDP in the first half of this year is unlikely to be labelled as an official recession by the committee that adjudicates these things. More importantly, should data show a two-quarter fall in GDP, it will probably overstate the weakness that’s evident in the economy.

First, a bit of national income accounting, which is a bit boring but shows why all is not as it might appear. When we look at economic growth, it's the Gross Domestic Product (GDP) measure that’s used. This measures all the expenditures made by the different sectors of the economy.

But there are other ways to measure the economy. One is Gross Domestic Income (GDI), which measures all the income earned from producing GDP. A second way to measure the economy is to take an average of these two measures, which is generally called Gross Domestic Output.

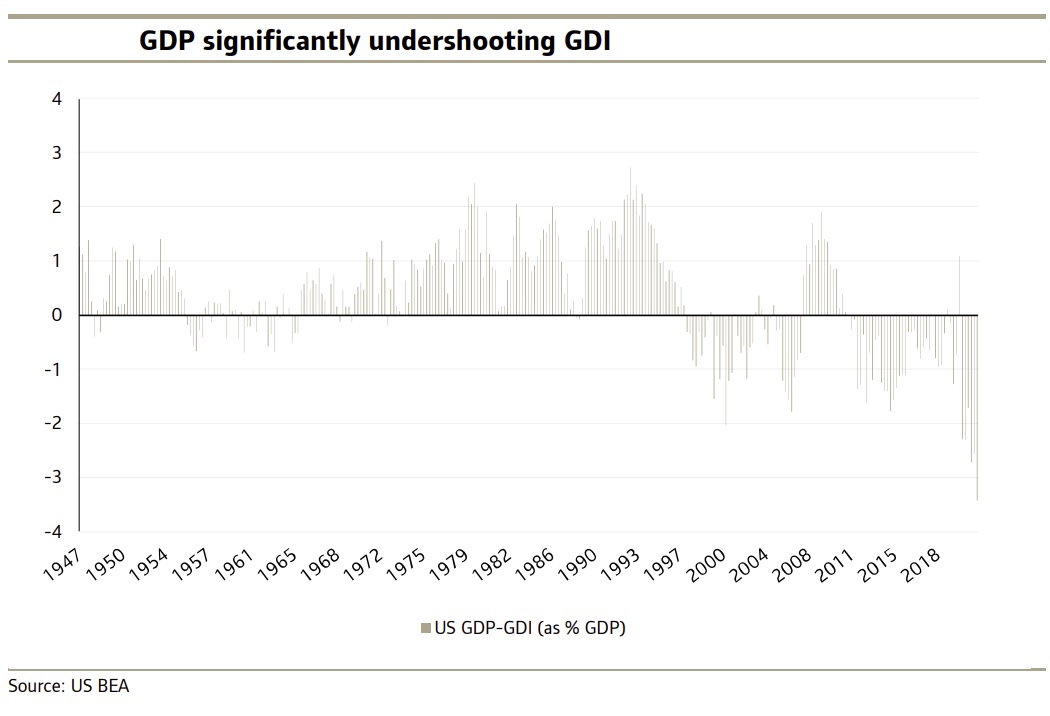

In theory, GDP and GDI should be the same, but in practice they are not. This is because the data comes from different sources in the economy, and with the economy being of such a huge size, it is only reasonable to expect differences. If these differences were small and random, they could be justifiably ignored. But the problem now is that they are very large and persistent. For instance, in Q1, GDP was below GDI by USD836bn which is 3.6% of GDP (as seen in the following chart).

The chart shows data back to 1947 and Q1 2022 marks the largest discrepancy by far and comes after prior quarters had also shown GDP undershooting GDI by some distance. The discrepancy was actually so big in Q1 that while GDP fell an annualised 1.6%, GNI increased 1.8%. Hence, if we were to use the GNI measure for growth, then there would not be a recession in the first half of 2022 even if Q2 GDP fell again.

But does this matter if everyone focuses on GDP, not GNI? In Mr. Steve Barrow’s view, it does because official recessions in the US are not determined by two consecutive quarters of negative growth but, instead, by the Business Cycle Dating Committee of the National Bureau of Economic Research (NBER). This can mean that recessions are declared even if GDP does not fall for two consecutive quarters, and it can mean that two consecutive quarters of negative growth are not necessarily declared to be an official recession.

Importantly, the NBER weighs GNI data as well as GDP in its calculations. What’s more, many believe that GNI is a better measure than GDP because, after all the revisions are done, the final GDP growth figure for any quarter tends to lie closer to the original GNI measure, not GDP. This discussion might have all sounded a bit technical and a bit dull, but the two important points are: 1) that the economy may be stronger than GDP data suggests and 2) this will be taken into account by the NBER and, in our view, will probably mean that it won’t list H1 2022 as being a recession even if Q2 GDP declines.

This being said, it is worth asking the question again: Does it matter? For instance, a two-quarter fall in GDP would be labelled by the media as a recession, and if this spurs consumers and businesses to be more cautious in their activity as a result, it might not matter that the economy is not really in a recession at all.

However, Mr. Steve Barrow doesn’t take this view. He thinks the key is whether consumers and firms feel that they are in a recession from their day-to-day activities. Secondly, the Fed knows only too well that a two-quarter fall in GDP won’t constitute a "real" recession right now and hence would knock the Fed out of its stride when it comes to tightening monetary policy.