Will foreign investors turn net buyers of Vietnamese stocks in 2025?

Since the year began, foreign investors have net sold almost VND 88 trillion worth of shares on the Vietnamese stock market. Nonetheless, in recent sessions, indications of net buying have surfaced.

Following the release of the U.S. unemployment report and anticipation of a rate cut by the Federal Reserve, international investors witnessed a spike in net buying on Vietnam's stock market last week.

The market is significantly supported by the return of foreign net buying, especially for the VN30 index. Foreign investors' preferred large-cap equities, such as SSI, CTG, TCB, HPG, and DXG, saw price hikes.

The sustainability and stability of international purchasing, however, are still up for debate. What hopes does December hold for foreign capital?

Foreign Capital Trends in November

On Vietnam's stock market, foreign investors consistently engaged in net selling during November, according to SSI Research. Net buying only resumed in the last week as the domestic exchange rate dropped. For the month, net selling by foreign investors came close to VND 12 trillion. By the end of November, their trade percentage had risen to 13.92%, the highest level since April 2023.

This is consistent with global capital flow patterns, which are marked by robust inflows into equity funds, primarily from the United States, and persistent outflows from emerging markets (EM).

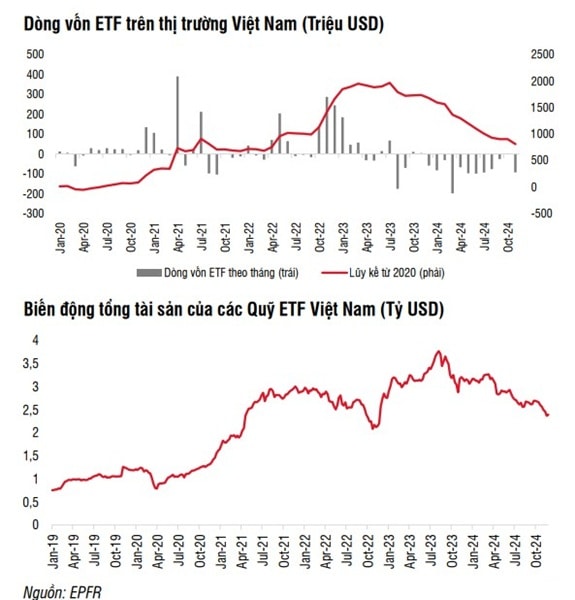

After two months of slower activity, ETF funds increased their withdrawals in November, totaling VND 1.48 trillion, as opposed to VND 700 billion in September and VND 300 billion in October, according to SSI Research. By the end of 2023, ETF assets will have dropped to VND 56.5 trillion, representing the 11th straight month of net outflows in 2023. Year-to-date net withdrawals total VND -22.78 trillion, or -30% of total assets.

Significant withdrawal pressure was observed among U.S. and European ETFs, notably VanEck (VND 642 billion) and Xtrackers FTSE Vietnam ETF (VND 214 billion), mirroring strong outflows from emerging markets. Domestic ETFs such as DCVFM VN30, DCVFM VNDiamond, and MAFM VNDiamond also reversed to net outflows in November, with respective values of VND 301 billion, VND 204 billion, and VND 82 billion.

Conversely, the Fubon fund showed a more positive trend after six months of heavy selling. Net outflows significantly reduced to VND -28 billion in November. SSIAM VNFIN Lead ETF reversed to a slight net inflow of VND 16 billion after eight months of outflows, while KIM Growth VN30 ETF (VND 34 billion) maintained consistent net inflows for several months.

In the second half of November, there was a surge in activity on the Fubon fund, which is the biggest ETF in Vietnam. In order to improve liquidity for domestic ETFs and open doors for recently listed ETFs, the Ministry of Finance is also modifying Decree 155 to let securities firms to register as market makers for ETF certificates, according to SSI Research.

Fubon has historically demonstrated a tendency to increase purchases as the year draws to a close, which is in line with its previous activities and suggests that this fund may make significant market inflows.

Active Funds: Mixed Movements

In November, active funds showed varying patterns. Multinational active funds continued to see robust withdrawals of over VND 1.2 trillion, while active funds with a focus on Vietnam reduced net outflows to about VND 500 billion. In November, there were VND 1.7 trillion in net outflows from active funds overall.

Both active and ETF funds are trending toward net outflows from emerging markets, according to SSI experts, and December predictions are still modest because the U.S. market continues to garner the majority of attention.

In 2025, positive results from the recently introduced NPS product and positive assessments from FTSE Russell may draw international investment back to Vietnam. Analysts predict that when capital moves toward emerging markets, it will return.

According to Mr. Đoan Minh Tuan, Head of Analysis at FIDT, foreign capital flows have shown responsiveness and positivity to global developments.

“We believe the pressure of foreign net selling in 2024 is nearing an end, particularly by year-end. This marks the beginning of new foreign inflows seeking opportunities, especially with the optimistic outlook that Vietnam’s stock market will be upgraded to Secondary Emerging Market status by FTSE in the March 2025 review,” Mr. Tuan stated.