Will gold prices rebound on economic recession concerns?

The gold price may continue to go up next week as investors worry that the Federal Reserve (FED)'s quick rate hike will push the US economy into recession.

The price of SJC gold bars has also dropped from 70.5 million dong/tael to 70.1 million dong/tael.

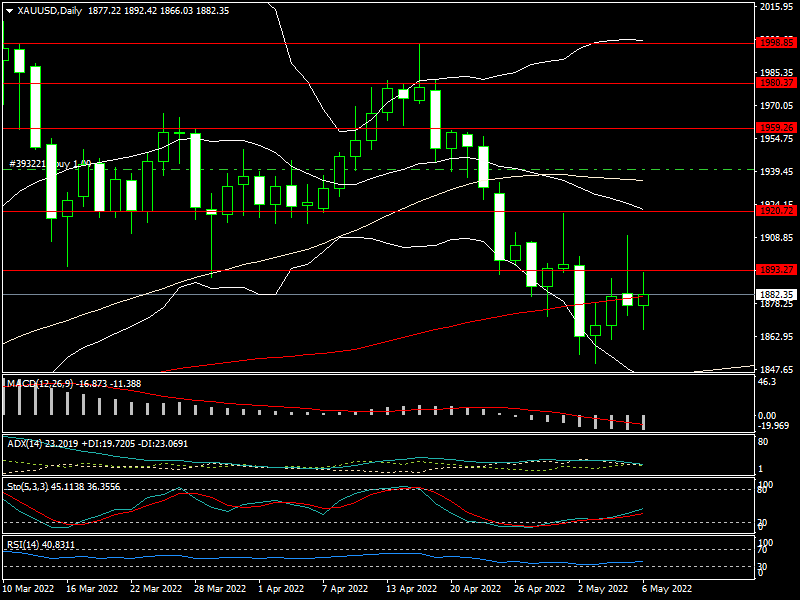

The gold price fell below $1,900 per ounce this week as markets responded negatively to the Fed's decision to raise rates by half a percentage point while ruling out a 75-basis-point boost at its June meeting. This week, gold prices fell 1.6 percent to $1,882 per ounce.

The price of SJC gold bars has also dropped on the Vietnamese gold market, from 70.5 million dong/tael to 70.1 million dong/tael, with extremely quiet transactions.

Despite the fact that the FED's rate hike has been priced into the market, it pushed the USD index above 104 points, the highest level in 20 years. Because the market continues to expect the FED to raise interest rates in upcoming sessions, the USD's interest rate will become even higher than those of other major currencies. As a result of the FED's decision, the gold price has been under severe pressure.

However, many analysts and investors are concerned that the FED's rapid increase in interest rates in the face of a severe drop in US GDP (which fell by 1.4 percent in the first quarter of 2022 compared to the same period last year) could send the country's economy into a spiral of recession. This is demonstrated by the fact that 2-year bond yields tend to rise sharply because investors expect the FED to keep raising interest rates; while 10-year interest rates rose more slowly, and in some cases even fell, as investors worried that the Fed's interest rate hike would stymie the US economy's recovery. As a result, the yield difference between these two terms is only 0.38 percent at the moment, and it can even be reversed.

What's more concerning is that US inflation continues to rise. In March, the CPI increased by 8.5 percent year on year, owing primarily to higher fuel and food prices.This demonstrates that the Russia-Ukraine conflict, as well as US and Western sanctions on Russia and China's zero-covid policy, have all contributed to US inflation. If the conflict continues, US inflation will rise even more.

According to Mr. Colin, an FX analyst, the significant rise in US inflation was primarily attributable to cost-push, and so the Fed's interest rate hike would not quickly bring inflation down. Therefore, if the Fed raises interest rates too quickly, the US economy will enter a recession, resulting in a global recession. "The slowing economy, along with rising inflation, will put the US economy at risk of stagflation, which will worsen. After around 2-3 more rate hikes, the Fed would most likely be more cautious," Colin predicted.

Gold price is still in the medium and long-term uptrend

Mr. Colin believes that the gold price's drop to $1,850/oz this week is required to maintain momentum in the near term. Because of rising inflation in the context of geopolitic crisis in many parts of the world are becoming more problematic, enhancing gold's position as a safe haven. "Gold price is still in the medium and long-term uptrend; if it declines to $1,800-1,835/oz, it will be a fantastic long-term investment opportunity", Mr. Colin said.

The consumer price index (CPI) and producer price index (PPI) for April will be released next week, which are two essential indicators for assessing the US's present inflation pressure. As a result, if these indicators continue to rise strongly year over year, gold prices may experience a temporary drop next week as investors expect a higher Fed rate hike rise. A gold price correction, on the other hand, will be a good opportunity for investment. On the other hand, if CPI and PPI fall below their previous levels, gold prices will continue to rise next week.

Mr. Edward Moya, Senior Analyst at OANDA, believes gold prices will likely continue to rise next week as fears of a US recession grow, with significant resistance at $1,900-$1,920/oz, and initial support at $1,850/oz, followed by $1,800/oz.