Will lending rates fall further?

Despite the fact that deposit rates have been rising, lending rates may continue to fall as a result of supportive policies.

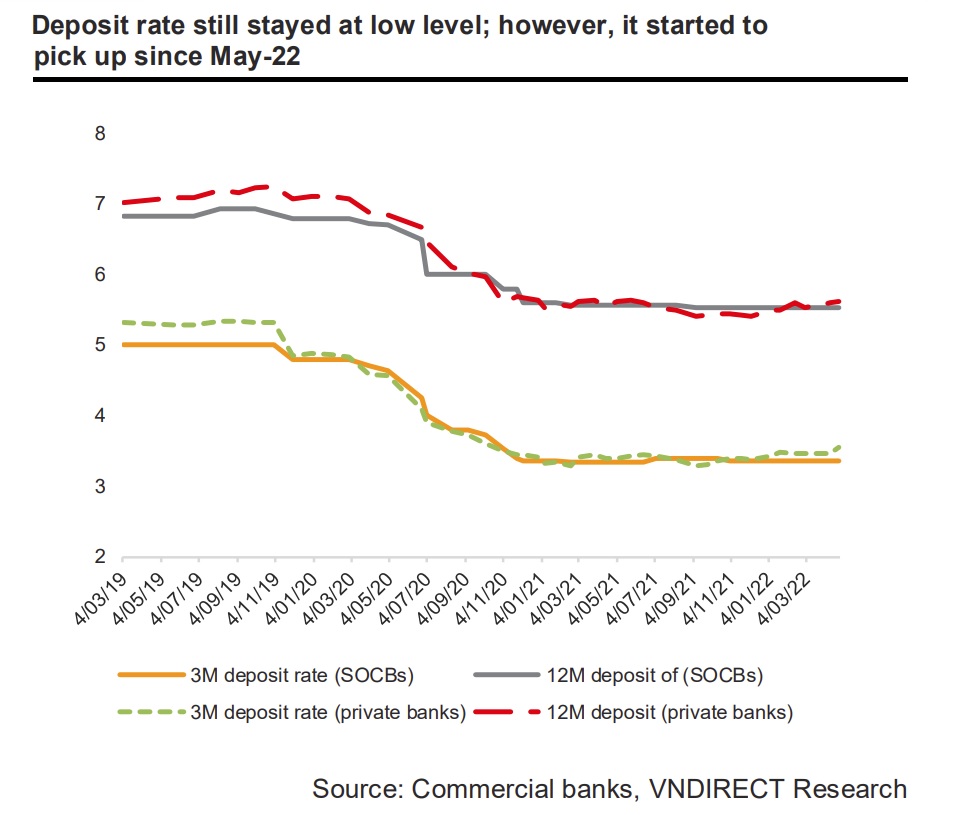

From May 2022, deposit rates appear to be picking up

In comparison to the levels at the end of 2020 and 2021, the 3-month and 12-month term deposit rates were steady at the end of 1Q22. However, from May 2022, they appear to be picking up.

The average deposit rates for both 6-month and 12-month terms increased marginally in May, according to the Bao Viet Securities Company (BVSC), rising by 0.02 and 0.03 percentage points to 4.92 percent and 5.69 percent, respectively. Both of these average deposit rates grew by 0.05 and 0.10 percentage points, respectively, as compared to the same period in 2021.

The only categories with deposit rates increasing by 0.10 percentage points to 5.61 percent /year (6 months) and 6.23 percent /year is small-scaled joint stock commercial banks (chartered capital below VND 5,000 billion) (12 months).

In contrast, a group of large-scaled joint stock commercial banks (with a charter capital of over VND 5,000 billion) offered deposit rates that were reduced by 0.02 percentage points for the 6-month tenor to 4.68 percent per year and by 0.01 percentage point for the 12-month tenor to 5.45 percent per year.

Interbank interest rates, meanwhile, have risen from historic lows in late-2021, but remain extremely low in comparison to pre-pandemic levels.

Regarding lending rates, the SBV has implemented an interest rate compensation package with a scale of VND3,000bn. It offered lending rates of 3–4% per year for businesses strongly affected by the COVID-19 pandemic. More importantly, the government has another plan this year of interest rate compensation for businesses of VND40,000bn with 2% lending rates until the end of 2023. This is the first policy on interest rate support to be implemented on a large scale through commercial banks, with the goal of assisting enterprises, cooperatives, and business households in accessing lower-cost bank loans in order to overcome difficulties, stabilize, and expand business activities.Thanks to these supportive policies, VNDirect expects lending rates to decrease by 10–30 bps in 2022F, on average.

Deposit interest rates are unlikely to remain at historic lows for the following reasons: (1) increased demand for fund raising as credit expands; (2) higher inflation; and (3) increased competition with other investment channels to attract capital inflows.As a result, VNDirect expects that deposit rates will slightly increase by 30-50bp in 2022F. It forecasted the 12-month deposit rates of commercial banks could climb to 5.9-6.1%/year at the end of FY22, which is still lower compared to the pre-pandemic level of 6.8%/year.

In the event that Circular 08/2021/TT-NHNN is not extended for one more year as proposed at the present time, the bank shall maintain a maximum ratio of short- term capital for the provision of medium-term and long-term loans from 34% to 30% in Oct-22. Banks reduce the ratio by lowering short-term capital or increasing medium and long-term loans.

In the meantime, the NIM improvement trend will likely be rather uneven across individual banks, as their sensitivity to competition for deposits and their need for funding mobilization vary widely. Banks with the following advantages have more opportunities to improve their NIM:

First, any bank that has a high CASA ratio or lower loan-to-deposit ratio can lower funding costs while facilitating lending rate reduction.

Second, banks that have the ability to borrow in foreign currency can lower funding costs by taking advantage of the stable exchange rate.

Third, banks with opportunities to increase their exposures to individual lending will enjoy better asset yields.