Will real estate firms revive bond investors’ confidence?

Many real estate companies have recently paid off outstanding corporate bonds, sending a positive signal to this market.

PDR's EverRich Infinity project

>> Corporate bond market stays quiet at year beginning

From late 2023 to early 2024, many real estate enterprises proactively purchased back many bond lots before they matured, restoring trust in the bond market after a rough year.

Good news in early 2024

Phat Dat Real Estate Development Joint Stock Company (HoSE: PDR) repurchased two lots of corporate bonds for 800 billion VND, and paid an additional 37.5 billion VND to buy back bond lot PDR12204 before maturity. As a result, this corporation has officially cleared outstanding corporate bonds by the end of 2023, as intended to be received.

Mr. Bui Quang Anh Vu, General Director of Phat Dat, indicated that his company had just had a "serious illness" and was beginning to recover.

"Our firm now has six projects that are most likely to enter the market, with a total projected revenue of more than 40,000 billion VND. The primary goods are apartments and land. There are also resort properties. In the future, Phat Dat will focus on developing projects that meet the real needs of consumers in order to reach the maximum degree of market absorption," stated Mr. Bui Quang Anh Vu.

Furthermore, some businesses, such as Dien Phat Land Company Limited, Hoa Kim Anh Company Limited, Vinh An Dien Company Limited, Dak Lak Urban Development and Investment Company Limited, Minh Khang Dien Company Limited, Sunrise Power Dak Psi Company Limited, City Garden Joint Stock Company, Hong Lim Land Joint Stock Company, Downtown Real Estate Joint Stock Company, Nam Bay Bay, CEO, HDG... announced that they had completed the repurchase of corporate bonds. They spent more than 5.1 trillion VND clearing all outstanding business bonds.

Bright business prospects are one of the reasons why real estate firms can mobilize cash flows. For example, Indochina Real Estate Investment Joint Stock Company made a "great" profit after the first half of 2023, paying down outstanding debts of VND 1,200 billion.

Similarly, Hateco Group ended last year with a solid profit of VND 421 billion, six times greater than the same period in 2022, allowing Hateco to settle the bond lot of VND 310 billion in March 2023.

This is a fresh signal that will boost confidence among companies and investors in 2024. This demonstrated that the Government's support efforts had begun to take effect.

Will bonding challenges persist?

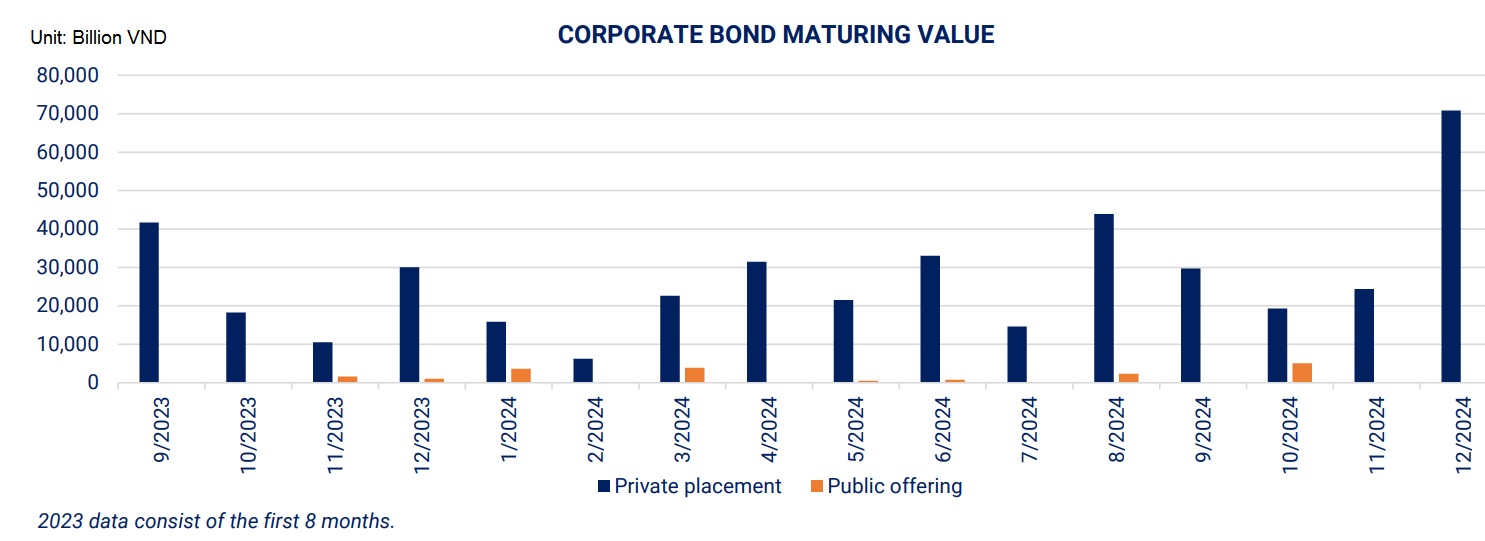

However, many analysts anticipate that real estate corporations will continue to struggle to raise cash on the bond market in the coming years. In 2024, the real estate industry alone will have a large number of bond maturities (about 134 trillion VND), which is equal to the total value issued in both 2022 and 2023. The strain is significant, but when legal obstacles are eliminated, investors' trust returns, allowing the real estate market to grow healthily and productively.

>> Unlock funding for real estate firms

FPTS believes that the operational status of real estate enterprises, as well as the duration of present support programs, will make fundraising on both main channels more challenging in 2024. Because banks are expected to tighten loans as the real estate industry's bad debt ratio rises to 2.9% by September 2023 (up 1.2 percentage points from the start of the year), despite the existence of a debt rescheduling mechanism and the maintenance of the same debt group under Circular 02/2023/TT-NHNN (valid until June 30, 2024).

Furthermore, the issuance of corporate bonds will be strictly controlled, with provisions of Decree 65/2022/ND-CP taking effect again on January 1, 2024, including tighter requirements to determine professional securities investor status, mandatory credit ratings, and shorter bond distribution times.

However, Deputy Minister of Finance Nguyen Duc Chi stated that investor trust in the corporate bond market is gradually recovering. As a result, the bond market will continue to rise after 2024. The bond market's quality will improve for issuers, investors, and service providers alike.

According to VIS Rating projections, the rebound in business activity will increase real estate enterprises' capacity to repay outstanding corporate bonds, resulting in fresh cash flow. This is projected to reduce the issuance of bad debt and new potentially risky bonds in 2024.