Will SBV continue to raise policy rates in 2023?

Vietnam’s inflation is forecasted to reach 4.0% (previously: 3.7%) for 2023. This means the SBV will likely continue its tightening cycle, said HSBC.

The SBV will likely continue its tightening cycle in 2023

>> The SBV’s hiking cycle is still under way

Vietnam experienced a roaring rebound in 2022, solidifying its place as one of Asia's top performers going forward. Due to a healthy external sector and strong domestic demand, GDP increased 13.7% y-o-y in 3Q22 (albeit this was partially aided by a low base). However, the potential for growth is currently hampered by escalating trade barriers. After expanding by over 17% y-o-y in the first three quarters of 2022, export growth abruptly slowed down in October. The first significant y-o-y fall in two years occurred in November.

Domestic demand has come to a partial rescue, thanks to an ongoing recovery in its labour market. While the unemployment rate dropped to 2.3% as of 3Q22, there is still potential for a further decline, as many jobs are concentrated in tourism-related sectors. Although tourists have started to return, arrivals are still less than 20% of 2019’s level.

Given lingering re-opening tailwinds, HSBC raised its 2022 growth to 8.1% (previously: 7.6%). However, challenges will likely be more acute in 2023, particularly after the re-opening effect fades and the impact of high inflation starts to kick in with a lag. Therefore, it expect growths to moderate to 5.8% (previously: 6.0%).

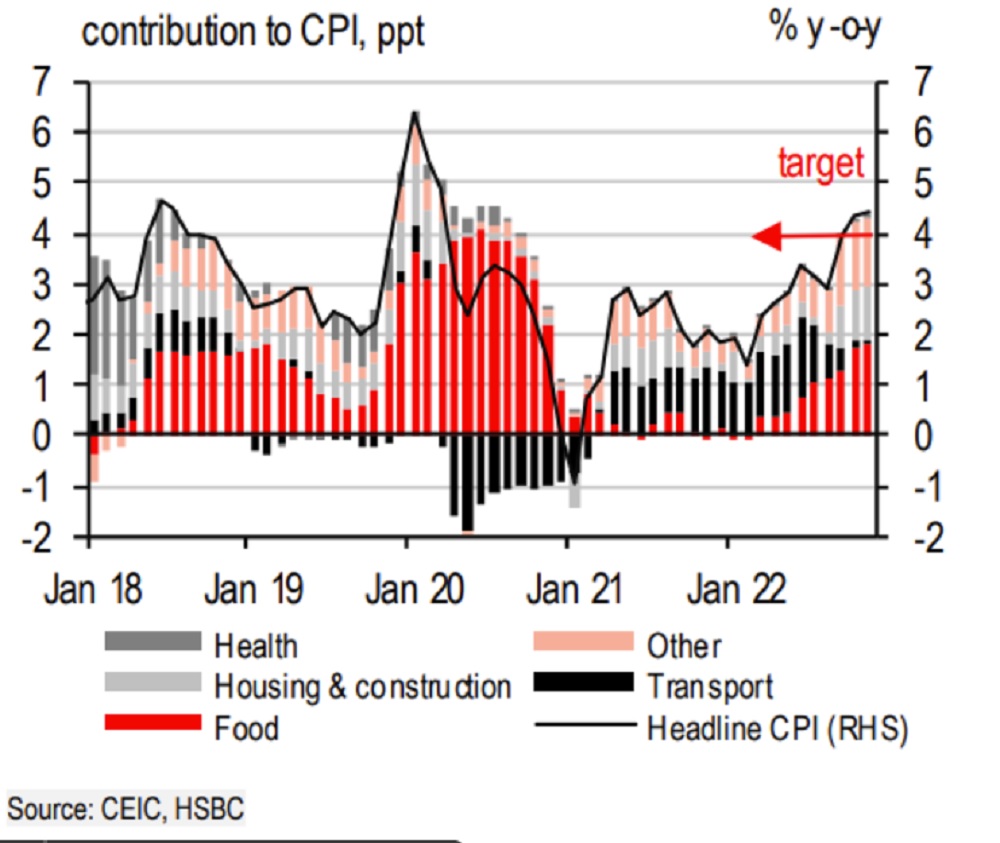

In addition, HSBC said Vietnam has started to see stronger inflation pressures, with the latest data exceeding the State Bank of Vietnam’s 4% “ceiling”. Not only has core inflation accelerated, but Vietnam has also seen a domestic energy shortage, keeping headline prices elevated. “While we recently trimmed our inflation forecast slightly to 3.2% (previously: 3.4%) for 2022, we raised our forecast to 4.0% (previously: 3.7%) for 2023. This means the SBV will likely continue its tightening cycle”, said HSBC.

As the last ASEAN central bank to move, the SBV has been actively “playing catch up” in the face of a weakening VND and rising imported inflation. Only starting in September, the SBV has delivered back-to-back rate hikes of 100bp each time, taking the refinancing rate to 6.0% by end- October 2022.

>> Policy rate hike unavoidable to curb exchange rate, inflation risks

For now, bolder rate hikes reflect more of a concern from external factors, such as the Fed’s rapid hiking cycle and FX volatility. Granted, external factors have turned more favourable in recent weeks, with the Fed likely slowing down its rate hikes and easing exchange rate pressure. However, rising core inflation increasingly suggests the SBV’s hiking cycle is still under way. HSBC expect the SBV to raise its refinancing rate by 50bp each in 1Q23 and 2Q23, taking the refinancing rate to 7.0% by mid- 2023.

Vietnam's CPI

Regarding the fiscal policy, unlike regional peers, such as Malaysia and Indonesia, Vietnam has limit ed fiscal room to introduce immediate relief measures to alleviate the impact of high energy prices. Since April, the authorities have been cutting various taxes, including fuel and environment taxes.

To combat rising inflation pressures, the Ministry of Finance is seeking to extend the current environment tax cuts on various fuels until end- 2023. This suggests that, while global oil prices may cool down in 2023, the authorities may opt to reinstate the environment tax as early as 2024. In addition, other energy prices may rise in 2023. Vietnam Electricity Group (EVN) has recently filed for a price hike in 2023, the first major price adjustment in almost four years, citing high energy import costs.