The SBV’s hiking cycle is still under way

The State Bank of Vietnam (SBV) has so far made bold moves in a short span of time, with reports of discussions on possibly widening the trading band again, indicating that the hiking cycle is still under way.

Many commcercial banks raised deposit rates after policy rate hike by the State Bank of Vietnam.

>> Lending rates could increase slightly by the end of 2022

Inflation breaches 4%

Headline inflation rose 4.3% y-o-y in October, breaching the SBV’s target of 4% and in line with HSBC expectations (HSBC: 4.3%, Bbg: 4.4%). Food prices continue to rise, increasing 5% y-o-y and partly reflecting the impact of the various typhoons and consequent poor harvests. Housing and construction also rose notably, rising 5.4% y-o-y and reflecting an increase in rent, repair services and housing material demand.

While transport costs have not contributed much to headline y-o-y growth, in part due to gasoline prices remaining at lower levels since earlier this year, recent high-frequency readings have indicated a slight pick up in price.

Some petrol stations have been encountering challenges in procuring gasoline, with the MoIT ordering the two domestic refineries, Dung Quat and Nghi Son, to increase production in response. The MoIT Minister has explained the situation is as a result of the fluctuation in the FX rate, challenging the operations of fuel traders.

Nevertheless, these events highlight the risks of upward price shocks, and HSBC expects inflation to continue to exceed 4% for the next few quarters.

>> Policy rate hike unavoidable to curb exchange rate, inflation risks

Back-to-back hikes by the SBV

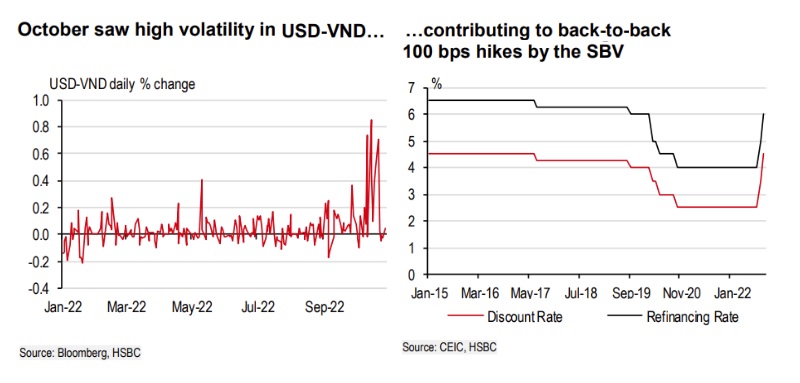

On the VND, it has depreciated roughly 8% year-to-date against the USD, with October seeing a substantial rise in realised volatility. In addition, mounting inflation pressures have spurred the SBV to act boldly once again. Effective October 25, the SBV raised its discount and refinancing rate by 100 bps to 4.5% and 6.0% respectively, in line with HSBC forecasts. Other rates were also increased: the overnight electronic interbank rate was raised by 100 bps to 7.0% and the cap on dong deposit rates at commercial banks by 50 bps to 1.0% depending on maturities.

In its statement, the SBV mentioned the US Fed’s hikes and the strength of the dollar, highlighting the continued pressures facing Asian central banks. Earlier in October, the SBV widened the trading band from ±3% to ±5%, reducing some pressure on the use of reserves, which as of August have fallen by 16% since the peak in January 2022. In light of the rising risks to the SBV’s mandate, the SBV has notably adopted a more proactive stance in maintaining macroeconomic stability and dampening imported inflation.

“The SBV has so far made bold moves in a short span of time, with reports of discussions on possibly widening the trading band again, indicating that the hiking cycle is still under way. We expect the SBV to raise the refinancing rate by 50 bps in both 1Q23 and 2Q23, taking the policy rate to 7.0% by mid-2023”, said HSBC.