Lending rates could increase slightly by the end of 2022

By the end of 2022, lending rates may have somewhat increased due to the potential increase in deposit rates in the upcoming months.

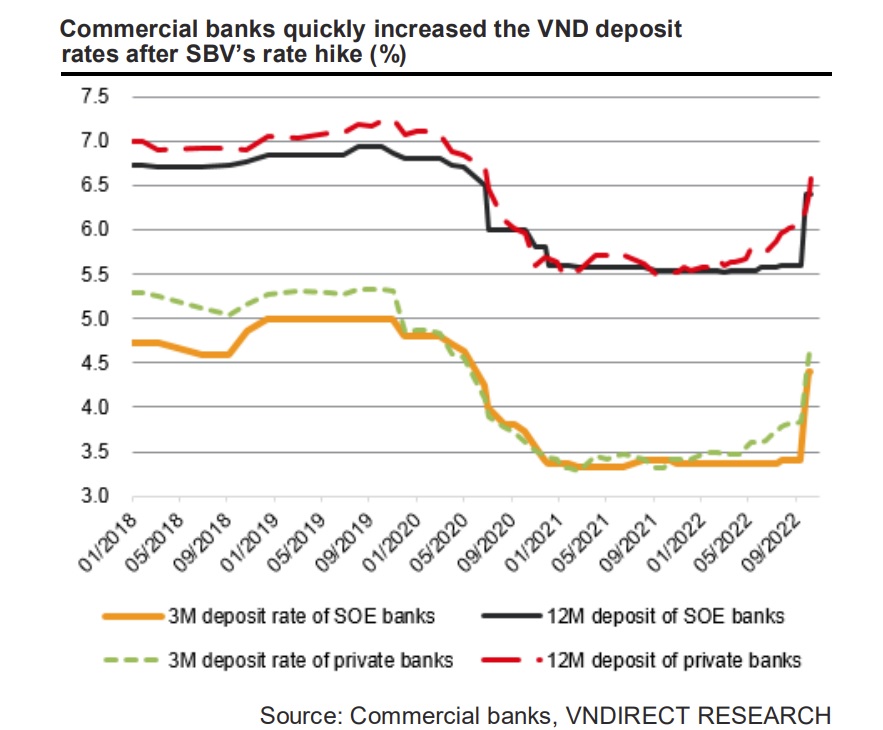

Many commercial banks quickly increased their VND deposit rates.

>> Lending rates are under upward pressure

The Federal Open Market Committee (FOMC) increased the fund rate by 75 basis points at its most recent meeting on September 20-21, and this week there may be another rate increase of 75 basis points to 3.75–4%. By the end of 2022 and 2023, the Fed plans to increase interest rates to 4.25–4.5% and 4.5–4.75%, respectively.

As a result, the Fed reduced its earlier prediction of 1.7% US economic growth to 1.2% in 2023 and stated that "the probability of a soft landing is increasingly difficult to achieve." The Fed also predicted that from its present level of 3.7%, the unemployment rate might increase to 3.8% by the end of 2022 and 4.4% by the end of 2023. The FED still firmly expressed the opinion that price stability and inflation control are the top priority targets at the moment, while anticipating negative effects on the economy brought on by restrictive monetary policy.

Following the last Fed rate hike, the State Bank of Vietnam (SBV) decided to raise its policy rates by 100 basis points, effective on October 25, 2022. Specifically, the refinancing rate will be raised to 6.0% from 5.0% previously and the rediscount rate to 4.5% from 3.5% previously, as announced by the SBV. In addition, the interbank overnight lending rate cap will be raised to 7.0% from 6.0% previously, and the ceiling interest rates for deposits with terms from 1 month to less than 6 months will be raised to 6.0%.

"We believe that this SBV’s rate hike is aimed at supporting the VND exchange rate and curbing the rise of domestic inflation", said Mr. Dinh Quang Hinh, Senior Analyst at VNDirect.

After SBV lifted its policy rates by 100 basis points on October 25, many commercial banks quickly increased their VND deposit rates. Many commercial banks have lifted the 3M deposit rate to 6% (1.03pts ytd) and 12M deposit rate to 8.6%.

>> Lending rates expected to be stable thanks to State support package

Mr. Dinh Quang Hinh expects deposit rates to increase further in the coming months due to (1) the impact of the SBV’s rate hikes, (2) the SBV has officially granted additional credit growth limit s to a number of commercial banks since early September, resulting in an increase in the capital demand of commercial banks, (3) deposit growth was slow in 7M22 (4.2% ytd, 9.9% yoy) due to less attractive deposit rates compared to other investment channels, (4) FED is expected to raise the policy rate to around 4.5% by the end of 2022, (5) strong USD put pressure on Vietnam’s exchange rates and interest rates.

The 2% interest rate compensation package is part of the economic stimulus package under Resolution 43 of the National Assembly and Decree 31/2022 of the Government. The scale of support is up to VND40,000bn, for businesses, cooperatives, and business households. There are about 10 main industry groups that will be supported, including aviation; tourism; transportation and warehousing; agriculture, forestry and fishery; and manufacturing.

According to the SBV, by the end of August, this package had only disbursed VND13.5 billion, or less than 0.1% of the disbursement plan for 2022.The implementation of the interest compensation package is slower than we expected and we think that it is very difficult to achieve the initial goal of disbursing VND16,000bn on the scale of VND40,000bn in 2022. Therefore, this program has little impact on the lending interest rate this year.

Mr. Dinh Quang Hinh believes that the 2% interest rate compensation package needs to be implemented faster to help curb the increase in lending rates to support businesses. This is absolutely necessary in the context that policy interest rates and deposit rates could climb higher in the coming quarter, putting great pressure on lending interest rates. If implemented well, the 2% interest rate compensation package can help reduce lending rates by an average of 20–40 basis points and partially offset the increase in lending rates due to pressure from increasing deposit rates.

"We forecast lending interest rates could increase slightly in the last months of 2022 before rising deposit rates pull lending interest rates up 60-80 basis points (on average) in 2023", said Mr. Dinh Quang Hinh.