Lending rates are under upward pressure

Vietnam’s deposit and lending rates could rise further in 2H22 for many reasons.

Transactions at SeaBank

>> Banks continue savings interest rates “race”

According to a State Bank of Vietnam (SBV) representative, as of August 26, credit had expanded by 9.9% year to date, which is substantially higher than the increase of 7.9% in 8M21 and the greatest increase in the previous five years. The SBV stated that a number of commercial banks received additional credit expansion quotas. In particular, around 15 banks have received additional loan growth quotas as a result of this revision, with increases ranging from 0.7 to 4.0%. According to Mr. Dinh Xuan Hinh, an economist at VNDirect, the economy will add around VND279 trillion in new loans over the next four months, which is comparable to an additional 2.7% expansion in credit.

Interbank interest rates increased further during August and early September, continuing the upward trend that began in July. In particular, the overnight interest rate rose by 270 basis points from the end of July to 6.9% on September 7 (the highest level since September 2012). During that time, interbank interest rates rose by 56 to 208 basis points for longer terms (from one week to nine months).

The SBV wants to keep the VND interest rate higher than the USD interest rate in the interbank market to reduce pressure on the USD/VND exchange rate in the context that the USD continues to strengthen as the Fed maintains the roadmap to increase interest rates. As a result, the net withdrawal of dong from the banking system increased significantly as a result of the SBV's increased net withdrawal in August through bills and foreign currency sales.

Mr. Dinh Xuan Hinh expects interbank rates to cool down in the coming weeks but hover at a high level of 4–5% for the overnight term. The USD could level off or even fall after the Fed’s meeting on Sept. 20-21, as the recent USD rally may over-reflect the Fed rate hike news. Lower exchange rate pressure along with the supportive actions of the SBV such as the net injection of liquidity into the market in the early sessions of September, may contribute to cooling down interest rates in the interbank market.

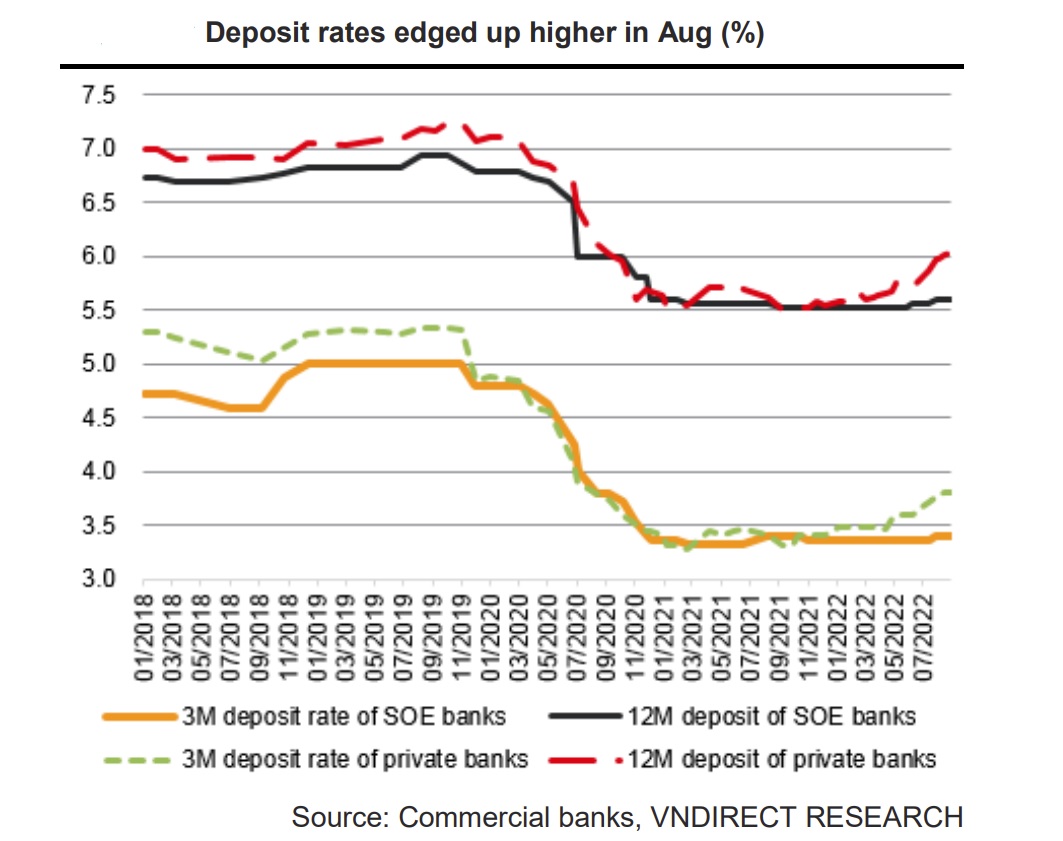

Deposit interest rates continued to increase in August, but at a slower pace than in the previous month. As of August 29, 2022, the 3-month term deposit rates and the 12-month term deposit rates of private banks edged up by 4bps (vs. the increase of 16bps in July) and 6bps (vs. the increase of 20bps in July), respectively, compared to the level at the end of last month. Thus, since the beginning of 2022, the 3-month term deposit rates and the 12-month term deposit rates of private banks have increased significantly by 40 and 48 basis points, respectively.

>> The pressure to increase deposit interest rates will happen at the end of the year

Meanwhile, the 3-month term deposit rates and the 12-month term deposit rates of state-owned banks stayed flat in August. It is noted that the 3-month term deposit rates and the 12-month term deposit rates of state-owned banks inched up by 3 and 7 basis points, respectively, in July. Since the beginning of this year, the 3-month term deposit rates and the 12-month term deposit rates of private banks have increased by 3 and 7 basis points, respectively.

The SBV raised two of its policy rates by one percentage point each after the local currency slumped to a record low. Therefore, the refinance rate was increased to 5% while the discount rate was raised to 3.5% starting Sept. 23. In addition, the interbank overnight lending rate and the DNG deposit rate cap rise.

The deposit and lending rates could increase further in the coming months due to: (1) the SBV has officially granted additional credit growth limit s to a number of commercial banks since early September, resulting in an increase in the capital demand of commercial banks, (2) deposit growth was slow in 7M22 (4.2% ytd, 9.9% yoy) due to less attractive deposit rates compared to other investment channels, (3) FED is expected to raise the policy rate to around 4-4.25% by the end of 2022, (4) strong USD put pressure on Vietnam’s exchange rates and interest rates, (5) the SBV raised policy rates by one percentage point each.

"We keep our view that deposit rates could increase by 30-50 basis points in 2H22F. We see the 12-month deposit rates of commercial banks climbing to 6.0-6.2%/year (on average) at the year-end of 2022, which is still lower compared to the pre-pandemic level of 7.0%/year,", said Mr. Dinh Xuan Hinh.