Will the gold price's headwinds reverse?

Inflation fell to its lowest annual rate in more than two years in June, prompting the Federal Reserve to halt hiking interest rates after its July meeting, boosting the gold price.

SJC gold prices in Vietnam went from VND 67,1 million per teal to VND 67,35 million.

>> Will the US dollar move by the end of the FED’s tightening cycle?

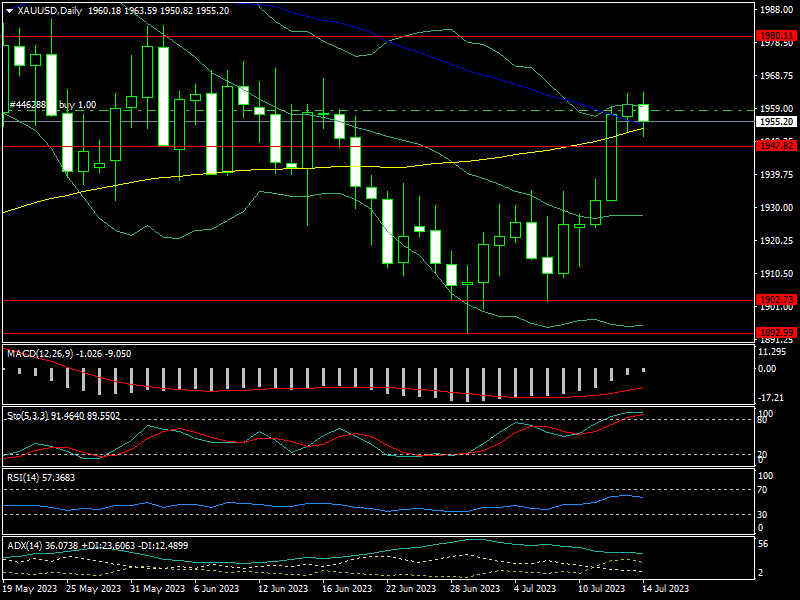

This week, the price of gold increased from $1,912 to $1,963 before closing at $1,955. SJC gold prices in Vietnam went from VND 67,1 million per teal to VND 67,35 million.

The jump in gold prices was caused by the fact that US inflation fell to its lowest annual rate in more than two years in June 2023.

The consumer price index, which measures inflation, rose 3% over the previous year, the lowest amount since March 2021.

Without volatile food and energy costs, the core CPI increased 4.8% year on year and 0.2% month on month. Consensus forecasts predicted 5% and 0.3% growth, respectively. Since October 2021, the yearly rate has been at its lowest.

"There has been significant progress made on the inflation front, and today's report confirmed that while most of the country is dealing with hotter temperatures outside, inflation is finally cooling," said Colin, FX analyst, adding that the Fed could embrace this report as validation that their policies are having the desired effect - inflation has fallen while growth has not yet stalled.

However, FED policymakers are more concerned with core inflation, which is still considerably above the Fed's 2% annual objective. As a result, the June CPI report is unlikely to prevent the Fed from hiking interest rates again later this month.

>> Will the FED leave rates unchanged?

Traders continue to price in a significant likelihood that the Fed will raise interest rates by a quarter percentage point when it meets on July 25-26. However, market pricing indicates that this will be the final rise as policymakers take a break to enable the series of hikes to work their way through the economy.

The price of gold may fluctuate in the coming week.

Mr. Colin stated that the essential question for the gold market is not how much the Fed has yet to increase, but how long rates will remain high until the Fed begins to reduce.

"If the Fed reverses course and cuts rates at the end of this year or the beginning of next year, the gold market will react strongly, pushing gold prices to $2,000/oz," Colin said.

Mr. Colin stated that the gold price may continue to rise next week, but the upswing is not long-term, especially because we are still in the low season for physical gold consumption. The strong resistance level for gold next week will be around $1,966-1,980/oz, while the main support level will be around $1,900-$1,930/oz, followed by $1,892/oz.

Except for retail sales, industrial output, and house sales, there won't be much meaningful economic data reported next week. These indicators may have little effect on gold prices next week.