Wood industry overwhelmed by escalating costs

Many firms report feeling overwhelmed by rising costs. Global volatility has caused a rise in both raw material and transportation costs.

Mr. Ngo Sy Hoai, Vice Chairman and General Secretary of the Vietnam Timber and Forest Product Association (VIFOREST), stated that input costs are growing and legal compliance expenses are exorbitant, prompting Government's decisions to invigorate and encourage firms.

According to Mr. Hoai, the wood businesses exported $3.6 billion USD in the first quarter of this year, which is still much below than forecasts.

Sir, despite some positive signals, has the wood industry overcome its difficulties?

The global economy is sending more optimistic signs, with consumer confidence rising and inventories falling in important markets such as the United States, Japan, South Korea, and the European Union. However, the recovery is sluggish and poor. Businesses are still wary to import and store raw materials in large quantities.

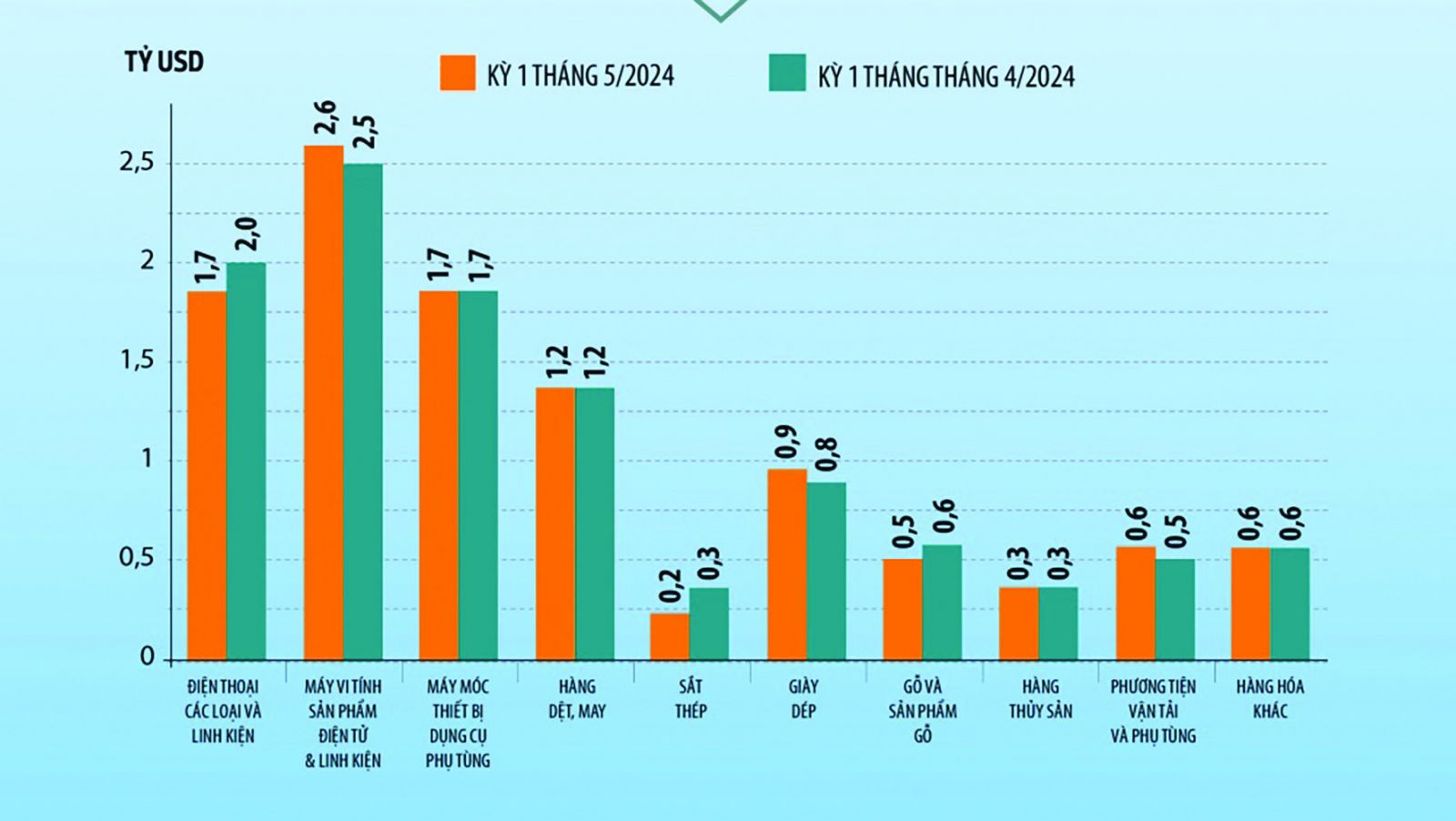

Export value of some major product groups. Source: Customs

Aside from market constraints, wood and forestry enterprises confront ongoing challenges, such as tax refunds, which remain extremely onerous, prompting many businesses to transfer to places with more favorable tax refund procedures than Hanoi or Ho Chi Minh City.

Specifically, many firms report being overwhelmed by rising costs. Global volatility has caused a rise in both raw material and transportation prices. Domestically, firms face exorbitant legal compliance expenditures. Many wood processing industries constructed 20-30 years ago on huge plots of 2-3 hectares or more require an expenditure of around 15-20 billion VND to fulfill fire safety standards. Businesses are eager to invest but unsure about local migration plans, but non-investment implies they cannot function. The issue is really hard.\

How are wood companies entering new markets, sir?

Today, competition is fiercer, and organizations require much better management. Input components and expenses are growing, yet selling prices must stay competitive and are frequently under pressure. As a result, both domestic and foreign-direct investment firms require greater coordination and cooperation. Previously, it was everyone to their own, with individual enterprises accessing foreign markets rather than sectors or countries, which often resulted in disadvantages such as underpricing and a lack of ability to execute huge orders. As a result, we recommend that firms collaborate more, including "joining hands," to better coordinate their supply chains.

Based on our observations, businesses are considering leveraging the "friend shoring" trend, which entails establishing friendly supply sources linked with EU and North, Central American partners to produce and export wood products into the EU and USA, saving time and transportation costs while avoiding supply chain risks and disruptions.

So, do you have any solutions to help firms overcome these challenges?

Every sector requires both pushing and pulling forces. The regulatory and policy framework drives the process. Fiscal and monetary policy instruments should help businesses run more smoothly.

Furthermore, the pull factor is the business sector itself. The Forestry Law recognizes forestry as an economically and ecologically sound business that plays an important role in economic growth. Businesses that process and export wood products are at the beginning of the supply chain, which includes additional linkages such as forest farmers, logging transport, and furniture manufacture for export... We urge that the government establish conditions that foster more collaboration among these stakeholders. For example, connecting processing enterprises with forest farmers requires a "catalyst" for collaboration in order to readily identify raw material sources and comply with legislation. Improved connection also makes detecting VAT refunds less expensive and easier for businesses.

Compliance costs are exceedingly high, necessitating pivotal government decisions to energize businesses amid increasingly fierce global competition, with Vietnamese exports being scrutinized more intensely.

Due to export hurdles and delayed market recovery, many enterprises have returned to the domestic market. What about forestry enterprises, sir?

Indeed, all of our main forestry firms have concentrated on export processing, which has been a huge driver for the forestry sector, for forest farmers, for employment creation, and for the country's export revenue. Regarding the home market, it is mostly owing to craft villages; we have over 340 craft villages, which include many very tiny and micro companies. The wood business frequently follows real estate, thus when real estate has remained static, even "frozen," domestic demand for wooden furniture has also decreased. We also encourage that these craft communities utilize legally procured wood.

At the same time, big firms are collaborating with artisan communities to keep up with emerging trends. Beyond the export market, firms are particularly concerned about the domestic market, which has over 100 million people and has the potential for high demand to rebound in the future.

Thank you very much, sir!