A new cycle for the Vietnam’s residential property

A new cycle for Vietnam’s residential property could be situmulated by low interest rate, infrustructure development, amended property laws.

The new residential property cycle

Three primary reasons that also laid the groundwork for the preceding cycle led many analysts to predict that there will be a residential property cycle soon:

First, after a period of persistently high interest rates, they have now dropped to a low level. The State Bank of Vietnam (SBV) has lowered its major interest rates four times since the start of 2023. The current refinance rate is 4.5%, which is lower than it was during the COVID era in 2020. Consequently, the rates for medium- to long-term loans are currently between 6.7% and 9.1% (falling from 9.3% to 11.4% in mid-2023).

In order to attract liquidity, deposit rates are gradually rising (from 0.1% to 0.7% annually in the first half of November 2024), which could put some slight upward pressure on lending rates in the future. However, given expectations that interest rates have bottomed out and investors' sentiment to take advantage of relatively favorable borrowing costs to invest, Le Hai Thanh, analyst at MBS, thought that even a moderate increase in lending rates would encourage capital inflows into residential property, meaning that even a short-term increase in interest rates would not have a significant negative impact on the residential property market.

Second, the emphasis on improving infrastructure reduces traffic in metropolitan areas and forges closer ties between the city core, suburban areas, and outlying provinces.

The substantial infrastructure investment will benefit the suburban urban areas, according to MBS's estimate. Compared to the 2016–2020 timeframe, Hanoi's total public investment is anticipated to rise by 36% to 340,153 billion VND in 2021–2025. Important transportation projects like Ring Road 4 and Ring Road 3.5, which connect the core region to Eastern and Western Hanoi as well as adjacent provinces, have made a substantial contribution to this year's public investment.

By cutting down on travel time between various regions, Thanh believed infrastructure development will contribute to enhancing the benefits of the expansive suburban urban areas in comparison to the central districts.

Third, barriers in the current real estate market have been eliminated by the application of updated property laws.

Positive signs in the South real estate

While HCM city residents have a greater GRDP per capita, at 187 VNDmn/capita (as opposed to 158 VNDmn/capita in Hanoi), apartment costs in HCM city are cheaper than those in Hanoi. In the upcoming years, this residential property market may draw more cash because investors can now afford a home in HCM city in fewer years than in Hanoi.

In 2025, the supply in Ho Chi Minh City is anticipated to reach 9,500 newly launched units (90% year over year), according to CBRE. With the opening of complexes like Vinhomes Grand Park, The Global City (future stages), Lotte Eco Smart City, and East Valley, new projects in HCM City will primarily target the high-end market.

According to plans for infrastructure development, new supply tends to concentrate in places like the Eastern and Western regions, particularly in Thu Duc city, as well as the city's periphery and surrounding provinces, while land in the inner city districts becomes more and more scarce. In the future, the market will continue to be dominated by these areas.

It is anticipated that HCM City's low-rise new supply will reach 1,100 units by 2025, an increase of 100% year over year. The majority of these units will come from recently constructed complexes that were created by respectable developers and had legal standing. The high-end market will be the primary focus of recently announced projects.

Brigh outlook in the North

According to CBRE, Hanoi's supply of newly constructed high-rise residential units is expected to exceed 30,100 units in 2025, a modest increase over 2024 and a new five-year record high. The high-end market is predicted to account for a sizable amount of this projected supply, driven by well-known developers like Masterise Homes, MIK Group, and Mitsubishi & Vinhomes. In the meantime, according to OMRE data, Eastern Vietnam will lead the new supply distribution by region, making up 48% of the total, followed by Western Vietnam at 29% and Northern Vietnam at 19%.

The supply of low-rise homes is focused in suburban areas rather than central metropolitan areas, as was the case with the apartment segment. Large-scale urban communities in suburban areas, like Vinhomes Ocean Park and Vinhomes Vu Yen, provide the majority of the contribution. According to MBS, the high-end category will mostly contribute to the new launched supply in 2025, which is anticipated to reach 7,800 units (-8.2% YoY). The new low-rise supply is mostly from developments of Vinhomes and Sunshine Group in the Western and Eastern Hanoi.

Boom in property project M&A

In order to restructure debt, satisfy land-related financial responsibilities to the government, and deal with growing project development expenses, Thanh thought that one of the highlights for residential property developers in 2025 would be fundraising through issue. Furthermore, she anticipates that residential real estate M&A activity will be a significant trend in 2025 for the following reasons:

First, as we have already examined, project development expenses will continue to increase, and many residential property developers still have poor financial standing and limited access to cash.

Second, there has been a notable reduction in interest rate volatility, which will facilitate future financing arrangements for buyers.

Third, MBS’s analysis indicates that projects with a clear legal status, excellent quality, and substantial development potential will continue to be the focus of M&A transaction targets.

Investment strategy

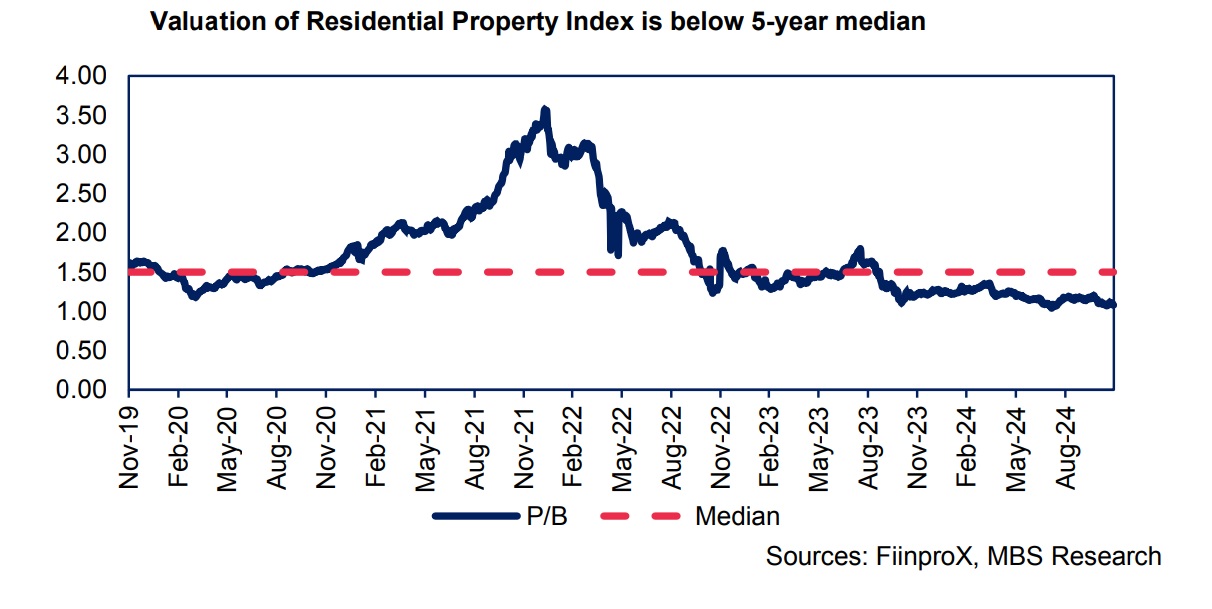

In Thanh’s view, a re-rating would likely occur soon in the near future. The residential real estate market has so far trailed the VN-Index by a considerable margin, with YTD advances of 9.8% and -1.4%, respectively. Compared to the 5-year median of 1.50 times, the residential property group's current P/B is 1.08 times.

“We think that the market will soon look for leading sectors with interesting stories and suitable risk-reward ratios because the residential real estate market is now trading at relatively cheap values and the industry outlook is indicating more favorable signals. To bring the group to more reasonable valuations, we do not rule out the possibility of re-rating the residential property stocks," Thanh stated.