Gold price needs new catalysts for breakthroughs

Short-term gold prices lack significant support. As a result, gold prices may struggle to break through in the coming week unless there are new, strong "catalysts."

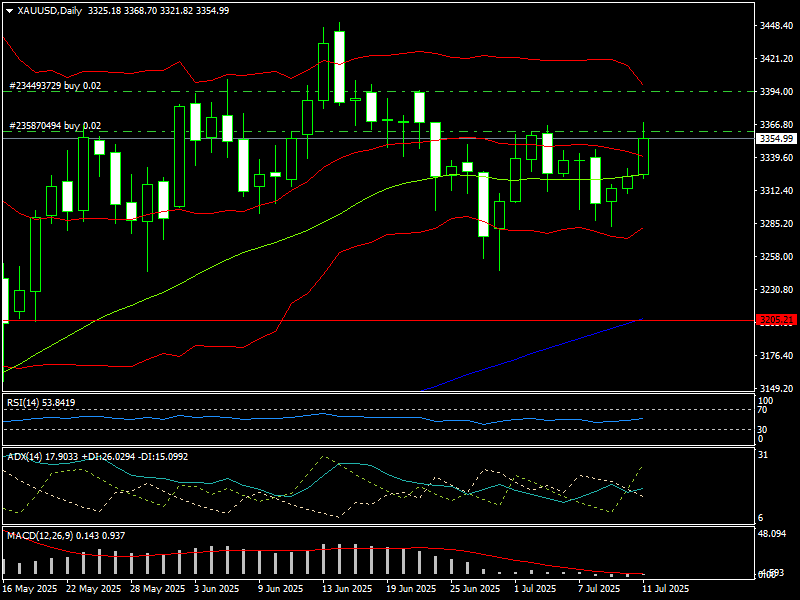

This week, after opening, gold prices on the global market fell from $3,342/oz to $3,282/oz. Following that, the gold price immediately recovered to $3,368/oz, closing at $3,354/oz.

In the Vietnamese gold market, the SJC gold bar price as quoted by DOJI group rose from VND120.5 million to VND121.5 million per tael.

Gold prices rose following President Trump's announcement of a 35% tax on Canadian goods, which would go into force on August 1, as well as intentions for 15% to 20% duties on most other trading partners. The measures rekindled concerns about global trade disruptions and their potential economic effects, driving investors to seek sanctuary in conventional sources of value.

The tariff decision is especially significant given Canada's prominence as one of America's top trading partners, indicating the possibility of significant economic damage. Markets saw the action as an indication of a more aggressive trade policy approach, raising concerns about the viability of current trade agreements and global supply networks.

Aside from trade concerns, continued Middle East tensions added to the risk-off mentality. The war between Israel and Hamas showed no signs of easing, with military activity continuing throughout the Gaza Strip. Despite vigorous US diplomatic attempts to broker a truce, progress has been slow, keeping regional tensions high and contributing uncertainty to global markets.

However, many experts feel that gold prices lack the necessary support to break through in the foreseeable future. Because the Trump administration's tariff pronouncements are primarily intended to intimidate partners into compromises, rather than increasing the global trade conflict.

Furthermore, the labour market is improving, inflation is rising, and the Trump administration's tariff policy continues to pose risks, prompting the FED to maintain a neutral monetary policy, which means keeping interest rates at current levels, with little impact on the short-term gold price trend.

Meanwhile, since Israel and Iran agreed to a cease-fire, geopolitical concerns no longer have a significant impact on gold prices, despite the fact that the Russia-Ukraine conflict and the Israel-Hamas battle continue.

Ole Hansen, Head of Commodity Strategy at Saxo Bank, believes gold lacks a near-term catalyst to drive prices back to their all-time high of $3,500 per ounce set in April. "Concerns about inflation and Mr. Trump's increasing pressure on the Fed to cut interest rates are not strong enough to push gold prices higher, especially as exchanges reduce risk during the summer holidays," said Ole Hansen, a broker.

Next week, the United States will release many key economic statistics, including the Consumer Price Index (CPI), Producer Price Index (PPI), and retail sales. Among these, if the core CPI for June rises considerably, by 0.4% or more, the market may reconsider the prospect of an interest rate cut by the FED in September. In this scenario, the USD is expected to recover, lowering gold prices next week. Conversely, if the CPI and PPI fall much, the FED is more likely to slash interest rates in September, causing gold prices to rise next week.

According to technical analysis, gold prices next week may continue to go sideways. Accordingly, if it surpasses $3,370/oz, gold prices next week will challenge the $3,400-3,450/oz range. Conversely, gold prices next week will adjust down to $3,285/oz, and even $3,205/oz.