Are open-ended funds a good investment option for investors?

A question is raising for many investors: should they still invest in open-end equity funds?

Investors may consider allocating part of their portfolio to open-end funds for stability while investing directly in selected stocks to enhance returns.

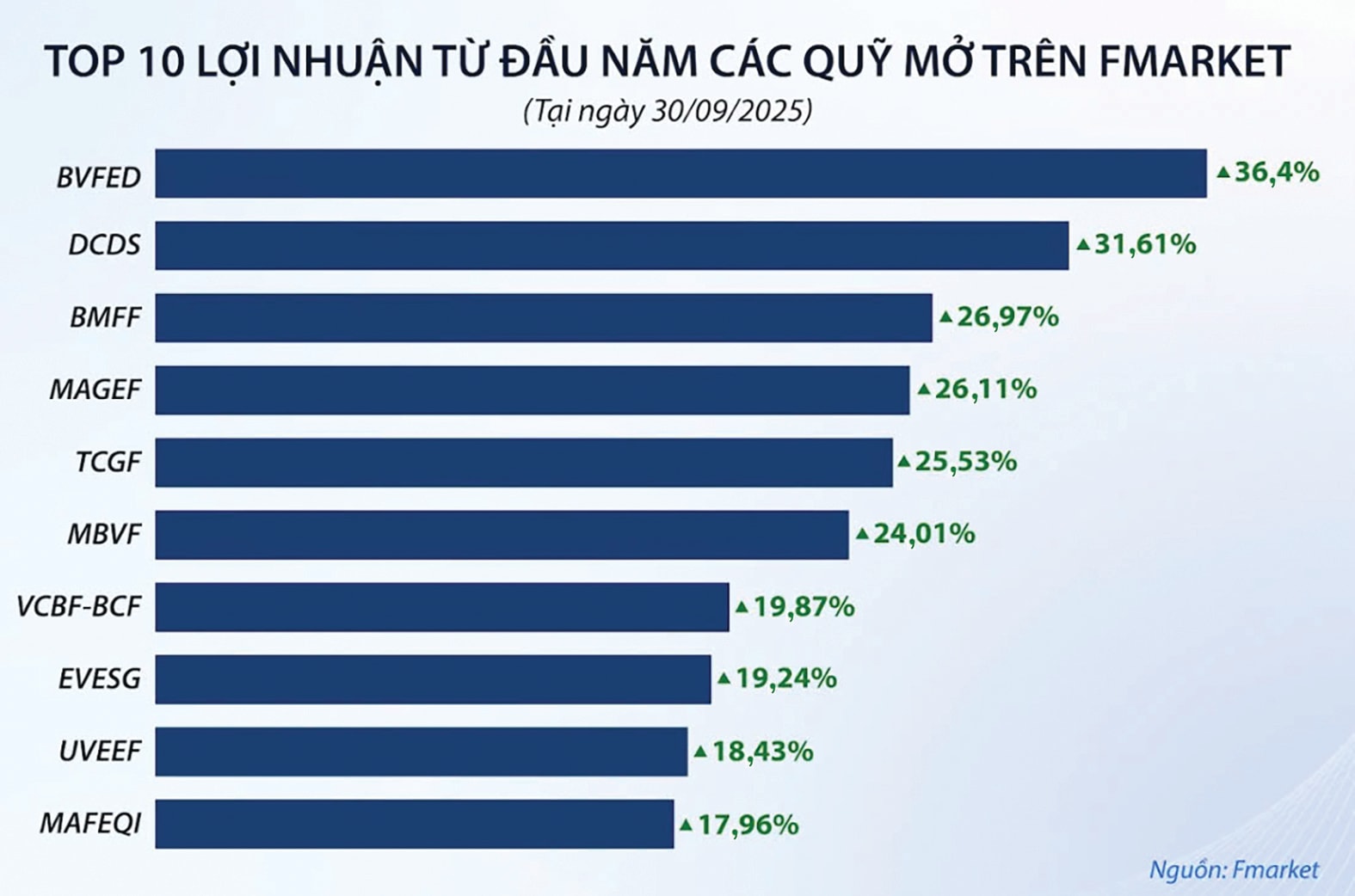

According to Huynh Hoang Phuong, Investment and Financial Analyst, statistics as of the end of September 2025 show that most equity open-end funds in Viet Nam have underperformed both the VN-Index and VN30-Index.

Short-Term Performance Is Not the True Measure

Historical data and fund strategies indicate that short-term performance does not fully reflect the capabilities of funds that are structured for medium- to long-term horizons. Investment decisions should therefore not be based solely on short-term results.

The essence of investing in open-end funds lies in a medium- to long-term asset allocation plan that yields results over three years or more—ideally beyond one full economic cycle. Hence, these funds are not designed for short-term speculation. Most funds even apply higher redemption fees during the first year to encourage long-term holding.

In fact, even the legendary Fidelity Magellan Fund managed by Peter Lynch saw many individual investors lose money despite the fund achieving an average annual return of more than 29% for over a decade. The losses came from emotional buy-sell decisions driven by short-term market swings. Acting on short-term performance metrics can therefore lead to poor decisions and diminish the long-term compounding advantage that these investment vehicles are designed to provide.

"Outperformance or underperformance over short periods is perfectly normal—even for the world’s most famous investors. No individual or institution can consistently outperform the market. What truly matters is long-term efficiency and the level of risk taken per unit of return", said Phuong.

Looking back over the past five years (2020–2024), most Vietnamese equity open-end funds have outperformed the VN-Index more than 50% of the time, though none exceeded 70%.

For example, VinaCapital’s VESAF Fund outperformed the index 60% of the time but delivered total returns 3.6 times higher than the VN-Index over that period, while also being 4.4% less volatile on a monthly basis. This demonstrates that consistency and a clear strategy are what drive sustainable outcomes.

Staying True to Strategy

A fund designed for moderate-risk investors cannot simply chase high-risk stocks just because they are surging. In 2025, Viet Nam’s stock market has been led by speculative segments, so it is natural for open-end funds to adopt a more defensive stance.

Moreover, funds are bound by regulatory limits and internal risk management rules on position sizes. Even when certain sectors rally sharply, funds cannot abruptly shift their portfolios to mirror the index.

In Phuong's opinion, if they were to chase short-term momentum, funds would distort their risk profiles and investment mandates—undermining the very reason investors chose them. From an asset allocation standpoint, this would also reduce the fund’s role as a reliable diversification tool across calibrated risk levels.

Although many open-end funds have underperformed the VN-Index recently, most individual investors have also struggled to beat the market. Few could fully capture gains from speculative rallies—and many even lost money by mistiming trades or failing to control emotions.

Meanwhile, funds have still generated double-digit returns with significantly lower risk than self-directed trading. Those with strong analytical skills and higher risk tolerance can adopt a hybrid approach: allocate part of their portfolio to open-end funds for stability, and invest the rest in individual stocks to pursue higher returns. This balances risk and opportunity.

"The surge of speculative capital in recent months has distorted short-term fund performance, which does not accurately reflect their long-term management quality. However, when the market corrects—as every overheated market eventually does—capital tends to flow back into fundamentally strong companies", emphasized Phuong.

At that stage, funds focused on value and sustainable growth are likely to rebound more sharply. Historical experience over the past five years shows that after periods of excessive speculation, funds that successfully restructure portfolios during corrections tend to generate the strongest “alpha” — risk-adjusted returns exceeding the market benchmark — in the following phases.