Bank liquidity is not ominous

For a variety of reasons, the liquidity of the Vietnamese banking system is not ominous, particularly because Circular 26/2022/TT-NHNN will significantly increase the liquidity.

The loan growth as of March 28 climbed by 2.06% compared to the end of 2022

>> Solving the challenge of capital for businesses

Several banks have received loan quotas from the State Bank of Vietnam (SBV). Banks like VCB, ACB, HDB, and MSB that participate in handling weak financial institutions, have a benign credit mix (reduced exposure to hazardous categories like property loans), and have strong asset quality and liquidity positions... Due to its relatively low LDR (abundant liquidity) compared to other banks, MSB earned the highest quota.

The loan growth as of March 28 climbed by 2.06% compared to the end of 2022, a rise of more than 11% compared to the same period last year, according to SBV Deputy Governor Dao Minh Tu at a news conference on March 31. He noted that this growth was not very significant compared to the end of 2022. Weak corporate demand was to blame for this.

"The current business challenge is an issue. The demand for credit has slowed in some locations”, said Mr. Tu.

According to Mr. Tu, SBV leaders have spoken with numerous associations and companies to get updates and discuss challenges. They don't have orders, so the production is sluggish.

As a result, the SBV suggested a policy of extending loan terms for a number of struggling industries. The SBV will swiftly release a circular once the Government issues a resolution regarding this policy.

>> Inadequate regulations hinder green credit growth

In 2023, VNDirect anticipates that the system credit growth may slow to 12% as a result of the weak real estate market, subpar export activity, and increased lending rates. In addition, given a 21% increase in the minimum wage (starting in July 2023) and an increase in the cost of several government-controlled services (retail energy tariff, health care...), inflation will continue to be significant. Finally, even though the liquidity situation has improved, banks' LDR are still quite high, which is limit ing this year's credit growth.

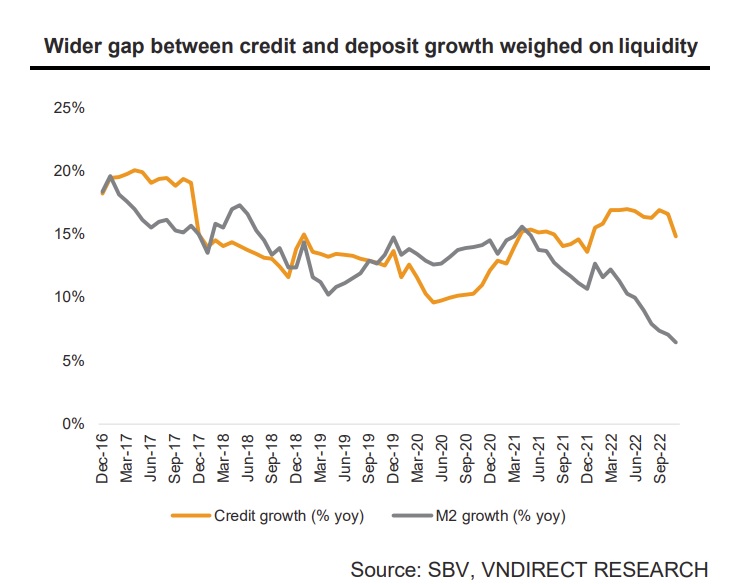

A widening disparity between credit and deposit growth pressured on liquidity and caused M2 to improve by 3.6% ytd and 6.4% yoy at the end of November 2022, significantly less than system credit growth (14.8% yoy). Because of this, the majority of banks' LDR ratios increased by the end of 2022 compared to the levels at the end of 2021 (75–80%, with the exception of MSB and TPB). Notably, the LDR of certain banks came very close to meeting the 85% regulation required threshold.

However, since the start of 2023, things have improved. In order to help enterprises and the economy, the SBV has been able to stabilize interest rates thanks to the cooling of exchange rates (VNDirect estimates that the SBV has purchased around US$3.6 billion since the start of 2023).

The interbank rates have significantly decreased since their peak in early October 2022 as a result of this liquidity support. The range of overnight rates was between 5 and 6% (as opposed to the peak of 8.4% in early October). While this was happening, 1-week interest rates varied between 5% and 6.5% (as opposed to a peak of 9.5% in early October). Additionally, the deposit rate began to ease and ranged between 8 and 8.5% (down from its peak of c.9%).

On the other hand, Circular 26/2022/TT-NHNN will be an effective contributor to this liquidity improvement. As LDR formula has changed i.e. 50% of state treasury is allowed to release to use for lending activities (total amount of c.VND150tr, according to banks’ 4Q22 financial statement), it will partially solve the liquidity constraints in this year.