Catalysts for GAS stocks

Will the upward trend of GAS shares - Vietnam Gas Corporation improve if many more of its projects are actively implemented?

As of June 14, GAS shares were trading at 79,000 VND per share. This pricing range has stayed very steady for the previous six months. So, how does GAS perform?

.jpg)

High dividend payments this year will support the rise in GAS shares.

GAS's financial statement shows that in the first five months of 2024, it generated 41.5 trillion VND in revenue, with dry gas and LPG sales volumes of 3.1 billion m3 and 1.2 million tons, respectively. Accordingly, the pre-tax profit is anticipated to be 5.2 trillion VND. LNG sales are making an increasingly significant contribution. GAS bought around 320 million m3 of LNG valued at 3.5 trillion VND. GAS proposes to sign a gas sales agreement (GSA) with POW to sell LNG for the Nhơn Trạch 3&4 power plants, with an annual production of 980 million m3, corresponding to about 70% of the Thị Vải port's full capacity. The Nhơn Trạch 3 power plant is set to begin trial runs in September 2024.

GAS presently delivers LNG to Phú Mỹ 3 at a rate of 3 million m3/day, Phú Mỹ 2 with a total output of 140 million m3 until February 2025, when the BOT contract ends, and 1.85 billion m3 to GENCO 3. GAS will deliver LNG to the Nhơn Trạch 1 power plant as per the electricity mobilization agreement with EVN.

The Ministry of Industry and Trade approved energy prices for LNG power plants ranging from 0 to 2,591 VND/kWh. This legislation will serve as the foundation for EVN and power plants to negotiate official electricity rates that do not exceed the ceiling price, therefore allowing investment in LNG-powered power plants in the medium future.

By the end of 2024, GAS plans to execute a Gas Purchase Agreement (GSA) with owners of new fields such as Khánh Mỹ-Đầm Dơi, Nam Du-U Minh, and Thiên Nga-Hải Âu, totaling around 10.9 billion m3. With good commercial prospects, GAS paid a cash dividend rate of 6,000 VND/share in 2023, representing a 7.4% dividend yield at the current price and a 120% payout ratio.

The net cash per share ratio of GAS is now 16,060 VND/share, up from 15,200/share at the end of 2023. In addition, GAS plans to issue 2% bonus shares in 2023 and 3% the following year. Cash dividends are often given between June and August in recent years.

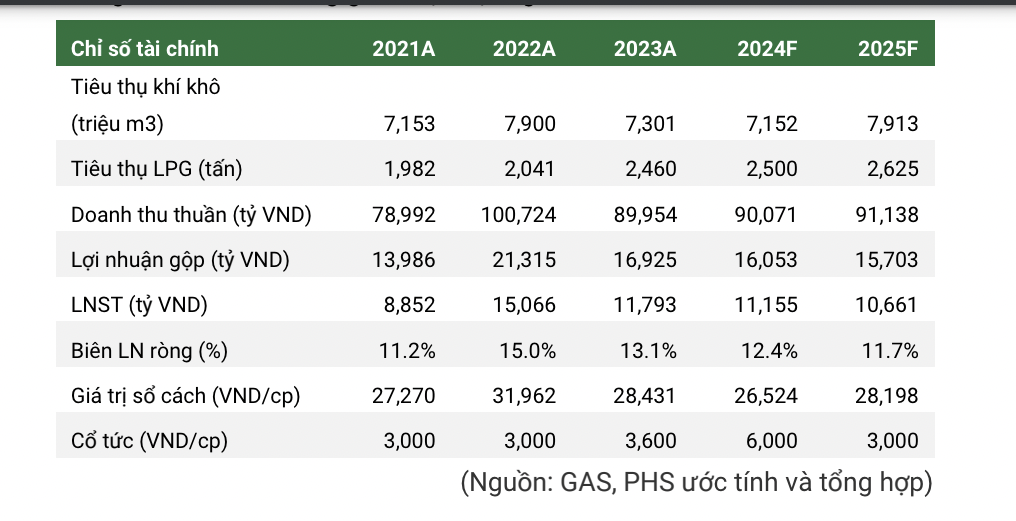

SSI Securities maintains its forecast for 2024 net profit at 11.1 trillion VND based on dry gas sales volume of 6.95 billion m3 and a 2% increase in average selling price, with the company's profit expected to remain stable in 2025 due to contributions from LNG and new fields offsetting the depletion of old fields.

Notably, GAS is now building infrastructure for importing and distributing LNG to fulfill rising domestic demand, particularly for gas-fired electricity. The first LNG complex, LNG Thị Vải, has started operations and is anticipated to produce 5 trillion VND in net income from 600 million cubic meters of LNG exported this year. GAS is participating in numerous large offshore projects, including Block B-Ô Môn, which promises to offer considerable growth in volume and revenue to the firm after completion in 2026. This strengthens long-term growth.

Block B-Ô Môn, the most critical catalyst for the national energy industry, is being hastened from upstream to downstream after directions from the Prime Minister. Legal challenges and disagreements among project participants, notably between upstream and downstream, have caused delays. The Prime Minister accepted the framework gas purchase deal for the Ô Môn II and Ô Môn IV Power Plants, providing a favorable signal.

The Block B project has recently advanced its timeline by granting EPCI#1 and EPCI#2 packages to PVS and partners to ensure timely completion, with the first gas flow expected in 2026.

GAS will build and operate a 264 km offshore and 152 km onshore pipeline network to transfer dry gas to the Ô Môn Gas Power Complex in Cần Thơ, which has a total capacity of over 4,000 MW. The overall capital cost for these infrastructure developments is around 1.2 billion USD, with GAS expecting to invest 0.61 billion USD (equal to 51% interest).

SSI advises holding onto GAS shares with an unchanged one-year target price of 84,000 VND/share, based on the 2024 EPS prediction and a one-year target P/E ratio of 180. In the immediate term, the cash dividend of 6,000 VND per share, which equates to a dividend yield of 7.4%, will support the stock price. Furthermore, the LNG industry and the advancement of the Block B project will provide long-term support for GAS stock values in the future years. As a result, investors should continue to own GAS shares for medium-term goals.