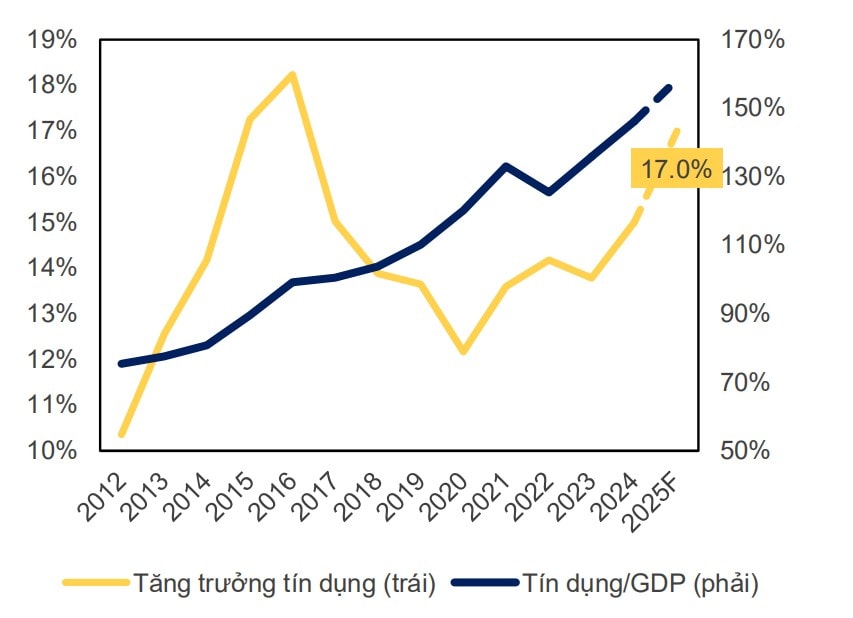

Could credit growth reach 17-18% in 2025?

The State Bank of Vietnam (SBV) has set a credit growth target of 16% for the banking system in 2025. However, under favorable conditions, this figure could rise to 17-18%.

Credit growth has shown improvement right from the beginning of 2025 compared to previous years. Illustration: Quoc Tuan

As of February 13, 2025, total credit growth in the banking system stood at VND 15.6 trillion (-0.08% YTD, -0.88% YoY). Specifically, VND-denominated loans decreased by 0.21% YTD, while foreign currency loans increased by 3.22% YTD. These figures indicate a strong recovery in credit demand, providing a solid foundation for achieving SBV’s 16% credit growth target for 2025.

Analyzing credit growth by region reveals positive early-year signs. For example, in Ho Chi Minh City, Nguyen Duc Lenh, Deputy Director of SBV’s District 2 branch, reported that as of the end of January 2025, total outstanding credit in the city reached VND 3,944.5 trillion, marking a 0.04% increase from the end of 2024 and a 12.43% rise year-on-year. Although the growth rate is modest, it still indicates an upward trend, in contrast to the previous two years.

Furthermore, in February 2025, loan disbursements surged by 14% compared to the previous month, demonstrating that credit is effectively meeting the capital needs of businesses and households.

"With the banking sector targeting 16% credit growth in 2025, Ho Chi Minh City’s banking sector will continue implementing the Bank-Business Connection Program. The key principle of this program is ‘real lending and disbursement.’ Particularly, with lower lending rates compared to previous years, this presents an excellent opportunity for businesses to access credit and reduce financial costs," emphasized Nguyen Duc Lenh.

According to MBS Securities, credit growth could exceed the SBV’s target and reach 17-18%, assuming GDP grows by 7-8%. Several key drivers are expected to support this expansion:

Vietnam’s manufacturing and consumption sectors are anticipated to rebound significantly in 2025. The second trade war could once again benefit countries in the "China " group, such as India and Southeast Asia, by attracting supply chain diversification and foreign investment.

Consumer spending had yet to fully recover in 2024, as indicated by the slow growth of retail sales at only 9.3% YoY. This suggests considerable room for expansion, with retail credit expected to play a larger role in total banking system credit due to increased demand and a low base from the previous year.

Public spending has remained a key growth driver, with public investment disbursement reaching 86.4% of the annual plan in 2024, increasing by 5.7% YoY.

MBS forecasts that if GDP grows by 8% in 2025, the government will accelerate infrastructure investments, with public investment disbursement expected to reach 90% of the annual plan. This is anticipated to boost corporate credit growth and enhance household purchasing power.

MBS Research has identified groups of banks that are expected to achieve higher-than-average credit growth in 2025:

- Banks with high credit limit utilization in 2024: Those that fully utilized their credit limits last year will have a competitive advantage in securing credit quotas for 2025.

- Banks with increased provisioning and improved asset quality: Rising provisioning costs in 2024, combined with better asset quality, will help mitigate bad debt risks as retail banking credit expands in 2025.

- Banks benefiting from a strong Net Interest Margin (NIM) recovery in 2024: A rebound in NIM last year will allow banks to lower lending rates, providing a crucial competitive advantage in credit expansion.

- Based on these factors, banks expected to experience high credit growth in 2025 include: HDBank (HDB), VPBank (VPB), VIB, ACB, VietinBank (CTG), Vietcombank (VCB), Sacombank (STB), OCB, Eximbank (EIB), BIDV (BID), and MBBank (MBB).

Meanwhile, Techcombank (TCB), LPBank (LPB), and TPBank (TPB) may see slightly lower credit growth than in 2024 but will still maintain strong growth relative to their market share (particularly for TCB).

High credit growth has been a key driver of market expectations for continued banking sector profitability in 2025. This, in turn, supports corporate earnings and stock market performance.

Additionally, expanding credit availability benefits the real estate market and stock market liquidity, both of which have shown signs of revival. If credit growth exceeds 17%, the credit-to-GDP ratio could surpass 130%, reflecting a credit-driven economic expansion.

Credit growth exceeding 17% will push the credit-to-GDP ratio beyond 130%. Source: MBS

Despite the optimistic outlook, credit growth must be managed carefully to maintain credit quality. Dr. Tran Du Lich, a leading economist, emphasizes that Vietnam’s 2025 economic growth will heavily rely on credit expansion, with the SBV planning to increase total outstanding loans by VND 2.5 quadrillion.

However, he warns that excessive credit allocation to speculative markets, such as real estate and stocks, instead of business and production sectors, could lead to financial bubbles, similar to those seen in 2016.

To prevent this, Vietnam must diversify growth drivers beyond credit, focusing on efficient capital allocation and preventing speculative excesses. PGS, Dr. Tran Hoang Ngan, a National Assembly delegate and economic advisor, stresses the need for flexible credit policies that balance growth and inflation control.

Managing interest rates based on core inflation is essential to maintaining credit quality and preventing a resurgence of bad debt.

Experts caution against excessive credit expansion, drawing lessons from 2000-2010, when credit growth averaged 30% per year, GDP grew 7.3%, but inflation surged to 23% in 2008 and 18.6% in 2011, destabilizing the economy.

A tight fiscal policy, reduced recurrent expenditures, and strategic public investment are crucial to preventing economic overheating.

SBV Governor Nguyen Thi Hong reaffirmed the 16% credit growth target for 2025, with the flexibility to adjust based on economic conditions.

If inflation remains low, the SBV may increase credit expansion to stimulate growth. However, if financial risks emerge, credit policies will be tightened to ensure macroeconomic stability.

With a strong focus on small and medium-sized enterprises (SMEs)—which contribute significantly to employment and GDP growth—as well as consumer credit expansion, experts believe that balancing credit growth and quality will be vital in ensuring private sector dynamism, reinforcing its role as "the most critical engine of economic growth."