Crisis as catalyst: Expecting a rebound

Deloitte’s survey shows that the majority of respondents believed their companies would rebound from the COVID-19 crisis.

![]()

The still-uncertain operating environment is reflected in a slight decline in revenue growth expectations for the next 12 months. For instance, 11 percent of the business leaders asked in Deloitte’ recent survey now believed they wouldn’t have any revenue growth this year, up from just 5 percent two years ago.

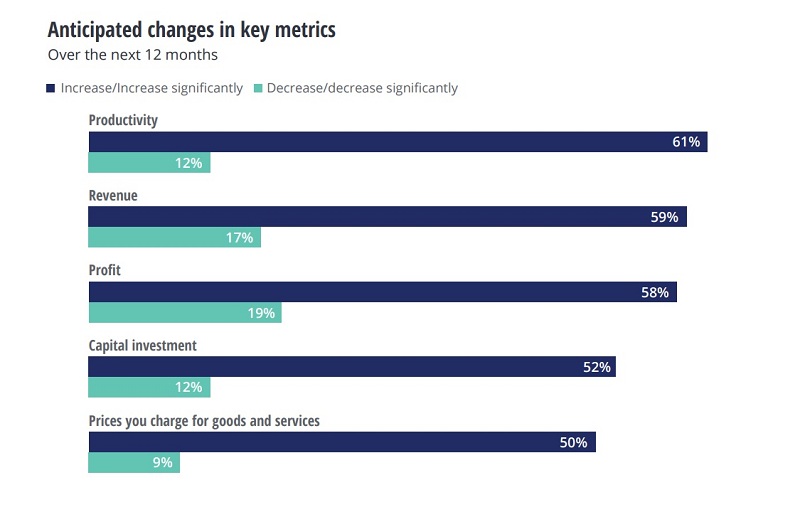

Despite this fact, the survey shows that the majority of respondents believed their companies would rebound from the crisis, with more than two-thirds expressing high confidence in their company’s success during the next 12 months. They also believed most key business metrics would improve.

Here, the most resilient organizations are also the most optimistic: three-quarters of those in the top tier for resilience expect their business metrics to improve, compared with less than half of those with low resilience scores. Highly resilient organizations are even more optimistic about their long-term growth potential, with 52 percent extremely confident in their outlook over the next three years, compared with just 20 percent of those in the bottom tier.

By and large, the executives are most confident about their ability to boost productivity, an objective that also shows up as their top growth strategy for the coming year. But digital transformation also rated as the second-highest growth priority overall, and as the number one priority among high-resilience respondents. The difference in how these companies view the importance of digital transformation to their growth versus those with low resilience was 18 percentage points, the widest gap in the survey.

While organic growth was prioritized by most respondents over mergers and acquisitions as a main growth strategy, many characterize their company as likely or very likely to be acquisitive over the next 12 months, up a full 10 percentage points from the 2019 survey. Highly resilient enterprises are likely to be more active than lower resilient organizations. Chief motivations for deals include entry into new global markets, expansion or diversification of their client base, and the increased availability of capital.

“As we captured in M&A and COVID-19: Charting new horizons, M&A is poised to have an outsized influence in shaping the post-COVID landscape, with companies adopting a combination of defensive and offensive strategies to safeguard existing markets, accelerate their recovery, and position themselves to capture market leadership. Sustainability is also likely to be a cornerstone of deal making in the new era, as it intertwines with corporate purpose to define commercial success”, Mr. Bui Tuan Minh, Deloitte Private Leader, Vietnam said.

Beyond M&A, the pandemic is prompting private companies to form new partnerships and alliances among 61 percent of the companies surveyed, and among 78 percent of highly resilient firms. As these ecosystems expand, family businesses in particular may struggle with the loss of control inherent in alliance structures. Interestingly, in a survey of global family businesses on this topic, Deloitte found that 63 percent said it was important that they retain ownership over intellectual property.