Don't let interest rates catch firms off guard

Many experts advise the State Bank of Vietnam (SBV) to raise the policy rate gradually rather than dramatically in order to avoid shocking firms.

Many commercial banks hiked deposit rates after the SBV raised policy rates.

>> The SBV’s hiking cycle is still under way

To reduce the pressure on inflation and particularly the exchange rate, the SBV may need to raise the policy rate even higher.

Big pressures

Just recently, the FED decided to hike rates by 75 basis points, to 3.75–4%. This action raised the USD index to its highest point in 20 years, almost 110 points.

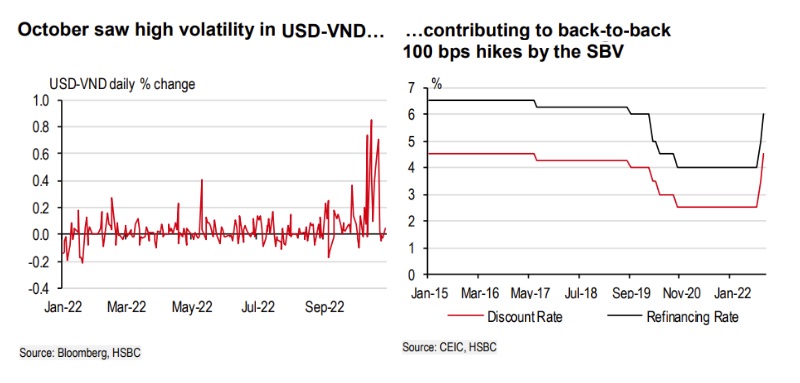

The foreign exchange market in Vietnam is also not immune. The selling price of USD by commercial banks has increased by 2,200 VND/USD (equivalent to 10%) since early 2022, while the central exchange rate has increased by about 540 VND/USD (equivalent to 2.35%).

The SBV has twice raised the policy rate, each time by 1% to scope with FED’s action. Even if the FED is expected to raise interest rates beyond 5%, the pressure on the exchange rate is still quite strong, mostly because of the USD's continued rise. Not to mention, Vietnam frequently experiences an increase in demand for foreign currency during the final months of this year.

The SBV may sell foreign exchange reserves to intervene in the FX market or hike policy rates to stop the depreciation of the VND. Vietnam's foreign exchange reserves are still fairly low, so the SBV will undoubtedly restrict the use of FX reserves. Therefore, raising policy rates is the most practical way to reduce inflation and release pressure on the exchange rate.

>> Policy rate hike unavoidable to curb exchange rate, inflation risks

Even though the SBV has loosened the trading band, Dr. Nguyen Tri Hieu, a financial expert, emphasized that "the upward pressure on policy rates is huge."

Reducing size of the rate hike

The SBV should have a suitable roadmap and scale back the size of the policy rate hike to avoid pressure on the financial costs of enterprises. Because the US CPI is in a downturn, the FED may decide to scale back the rate hike at subsequent meetings.

A leader of a consumer goods manufacturing company in Hanoi stated, "Our business has not fully recovered from COVID-19 and is now under additional strain on input costs and interest charges, making production and business activities very tough."

In light of the current pressures, Mr. Nguyen Minh Cuong, principal country economist of the Asian Development Bank (ADB) in Vietnam, suggested that monetary policy management ought to be extremely flexible. The SBV must balance the need to both alter the trading band and, if required, boost policy rates to a reasonable level.