DPG thirsts for capital

After issuing nearly 37.8 million shares, Dat Phuong Group JSC (HoSE: DPG) now plans to offer an additional 17.8 million shares to professional securities investors.

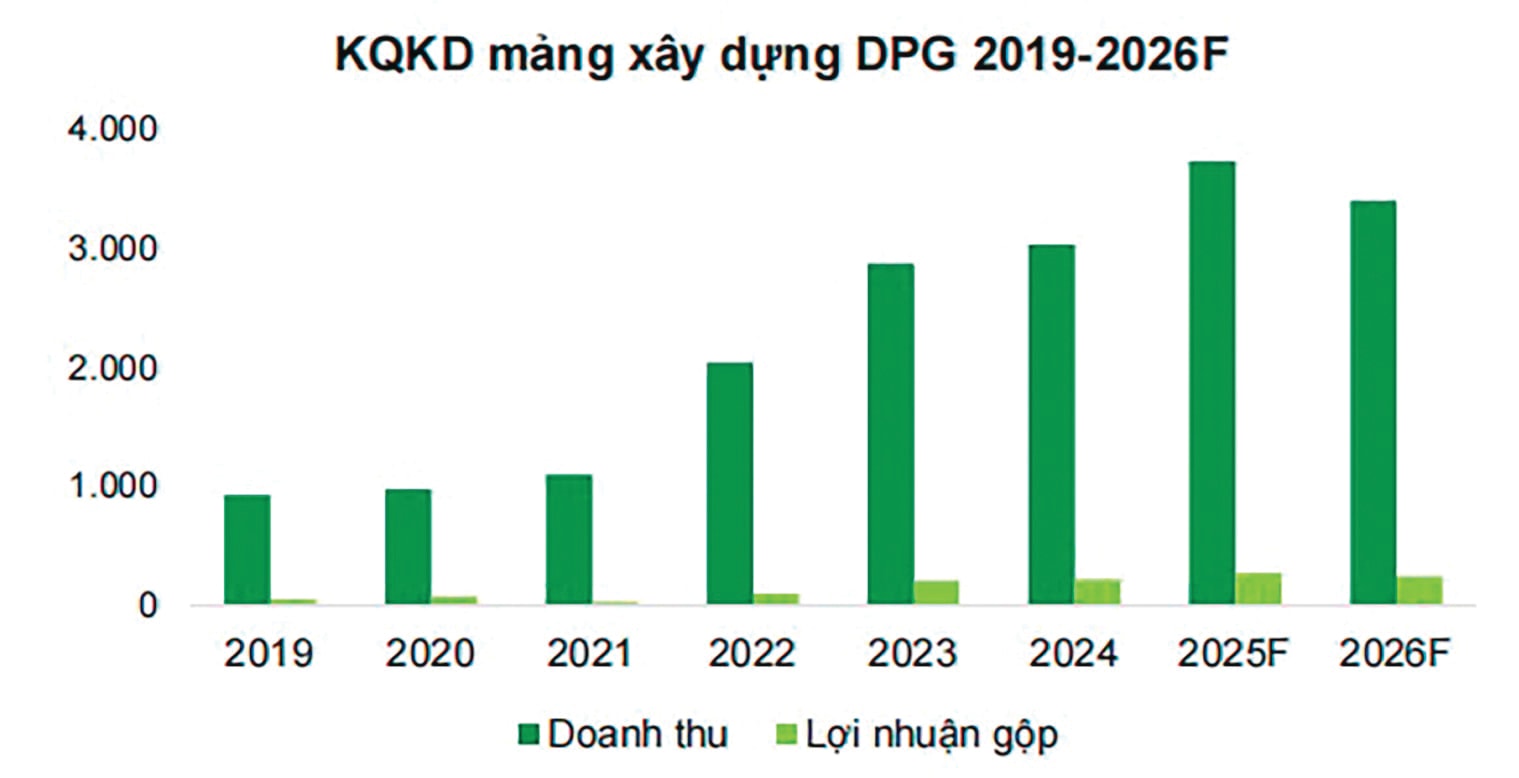

Revenue and profit of DPG over the years (Unit: billion VND)

The new capital raise will fund DPG’s ongoing projects, supplement working capital, and finance machinery and equipment purchases for the company’s construction segment.

Focusing on Core Business Segments

According to DPG’s report, consolidated revenue for the first nine months of 2025 is estimated at VND 2,832 billion — up nearly 33% year-on-year, achieving about 60% of the annual target.

To sustain its growth momentum, DPG continues to prioritize its core business areas. In the glass segment, the company has been actively engaging with solar panel manufacturers in several markets—including the U.S., Europe, Asia, and Viet Nam — to supply solar glass. DPG is also pursuing the construction of a super white patterned glass factory. Initially budgeted at VND 2,000 billion, the total investment is now expected to rise to VND 2,200 billion due to fluctuations in exchange rates and raw material prices.

In the real estate segment, in June 2025, the Quang Nam Provincial People’s Committee reinstated the investment approval for the Binh Duong Resort Complex project and reappointed DPG as the main investor. The project covers 178.1 hectares with an estimated investment of VND 3,000 billion, including a resort complex, an 18-hole golf course, and supporting facilities. DPG is currently completing revisions to the investment approval, expected within this year. The project is anticipated to make a significant contribution to DPG’s performance during 2027–2029.

Finally, in construction, with the government’s continued emphasis on public investment, DPG plans to accelerate and complete key national infrastructure projects, particularly expressways, targeting revenue and profit growth of 20–25%.

High Inventory in Real Estate Segment

One notable issue is DPG’s large inventory in its real estate segment, where the majority consists of ongoing project development costs. This reflects properties that are under construction but not yet eligible for revenue recognition.

At the recent annual shareholders’ meeting, DPG’s management explained that, although infrastructure for the Con Tien project has been completed and dozens of houses built, sales have stalled due to delays in land valuation procedures while costs continue to accrue. Management expects the necessary approvals for valuation and sales to be finalized soon. Revenue from the Con Tien project is projected to be recognized mainly during 2026–2027, after product handover. Accordingly, Dat Phuong Hoi An — the subsidiary in charge of real estate — still targets VND 619 billion in revenue and VND 53 billion in post-tax profit from this segment in 2025.

Given the heavy real estate inventory and the delayed revenue realization, DPG continues to rely primarily on its energy and construction segments to sustain revenue and profit growth this year.

Capital Raising Challenges

DPG’s Board of Directors has released materials for an upcoming extraordinary shareholders’ meeting in 2025, the main agenda being a plan for a private share offering to raise additional capital for investment and business operations.

Specifically, DPG intends to offer approximately 17.8 million shares to professional investors at a price no lower than 1.5 times the book value per share, based on the consolidated financial statement at the time of issuance. The proceeds from this offering will be allocated to three key purposes:

- Investment in the Dat Phuong super white patterned glass factory;

- Investment in the Binh Duong Resort Complex;

- Supplementing working capital and purchasing machinery and equipment for the construction segment — the company’s core business area.

Previously, DPG issued nearly 37.8 million bonus shares to existing shareholders at a 60% ratio, raising its charter capital from VND 630 billion to over VND 1,007 billion.

These two consecutive capital-raising moves indicate that DPG’s operational cash flow is tightening. As analyzed, one of the company’s biggest challenges lies in its real estate segment, which has yet to generate revenue. This has resulted in high inventory levels and forced the company to rely on other business lines such as energy and construction for liquidity.

However, raising capital through the stock market brings dilution risks. An increase in the number of outstanding shares reduces shareholders’ ownership ratios and can lower key financial indicators such as earnings per share (EPS) and book value, putting pressure on the stock price.

Furthermore, DPG’s repeated capital increases have raised concerns over its financial independence — particularly if operating cash flows cannot support its growth needs, forcing reliance on external fundraising. This underscores the need for a clear business strategy and efficient capital utilization plan, as overreliance on equity expansion could become a “double-edged sword.”