Drive bank lending to certain industries

Commercial banks in Vietnam must continue to direct credit toward priority areas such as production, business, and government-identified priority areas after receiving a credit room.

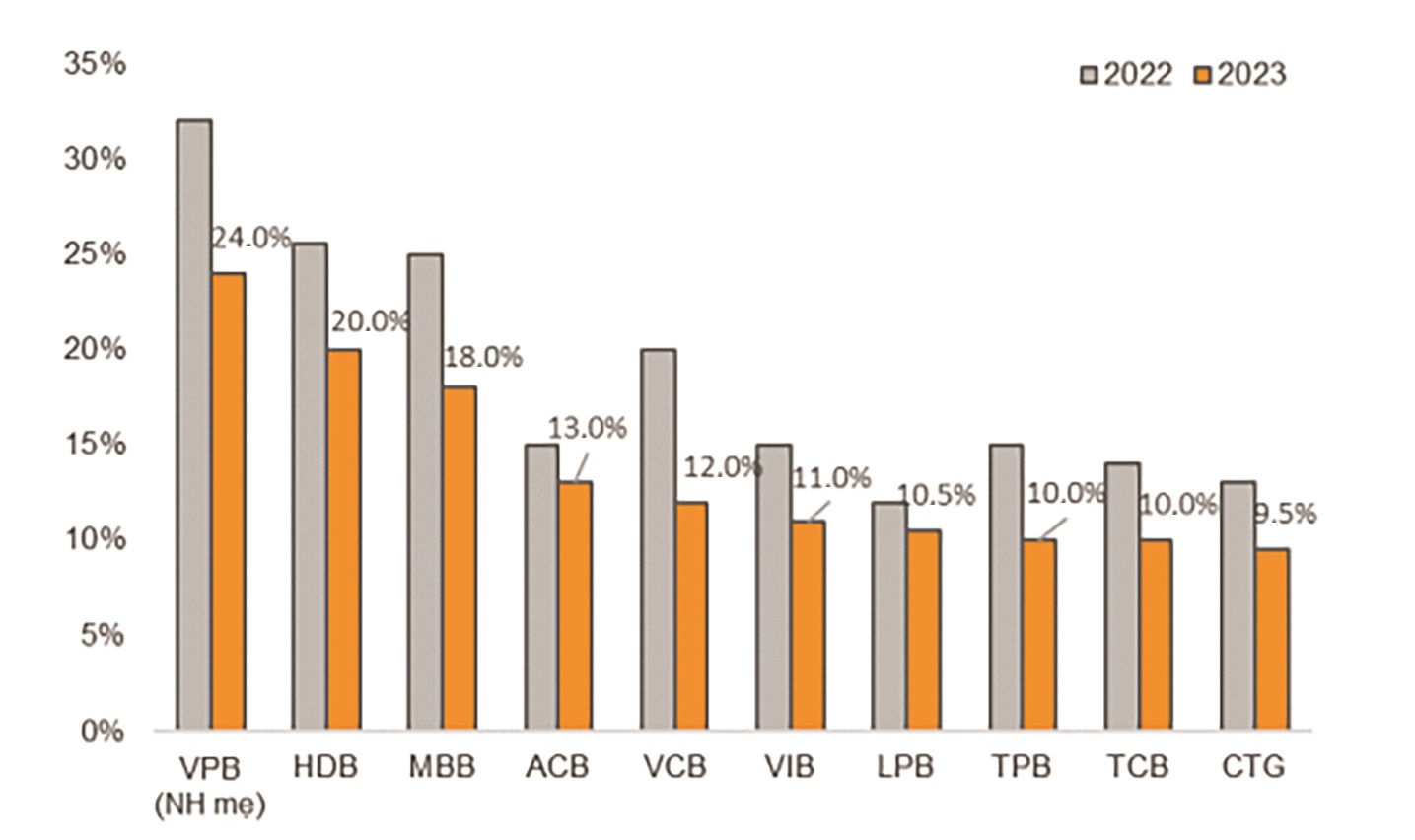

The State Bank of Vietnam fixed loan growth between 14 and 15% in 2023.

>> Expansion of credit limit good for market

The State Bank of Vietnam (SBV) fixed loan growth between 14 and 15% in 2023, with modifications made in accordance with the actual scenario.

Check credit “room”

As of today, the SBV has given a number of banks the first credit growth cap in 2023. In particular, MSB received the credit room with the greatest percentage, 13.5%. The remaining banks are given lower initial credit growth allowances, such as HDBank, which is given a room of 11%, as opposed to 15% in 2022; ACB is given a room of 9.8% as opposed to 2022's 10%; VIB is given a room of 9.5% as opposed to 2022's 10%; and TPBank is given a room of 9.1% as opposed to 11.5% last year.

The most recent credit rating results, the percentage of outstanding loans for 100 clients with significant outstanding loans, interest rates, participation in the management of poor credit institutions, and other fundamental factors are used to determine the credit growth targets.

>> Banks push "cheap" capital for loans at the end of the year

Effective credit orientation

According to MSc. Ha Thu Giang, Director of the Credit Department for Economic Sectors at SBV, the banking system should prioritize the following activities to direct loan activity into high-efficiency industries:

Credit growth of some commercial banks

According to the directives of the Government and the Prime Minister, the SBV continues to promote credit to production, business, and priority areas. It also controls credit risk for investments in corporate bonds and other potentially risky areas like securities trading, real estate, and BOT projects. Finally, it strengthens risk management for consumer lending.

Second, the SBV closely monitors the credit granted to industries, particularly vital ones like petroleum and important agricultural export products; housing real estate projects that are about to be finished and turned over, have the capacity to repay loans in full and on time, ensure legality, have good liquidity, particularly social housing projects, worker housing projects, commercial housing projects with reasonable prices...

Finally, credit institutions must create diverse banking credit products that are appropriate for every sort of production and business demand of individuals and businesses, especially SMEs and cooperatives; this will help to restrict "black credit" by establishing favorable conditions for loan access.