Edible oil producers: Downward pressure from input costs

Due to decreasing input prices, edible oil companies' prospects may appear more promising in 2023.

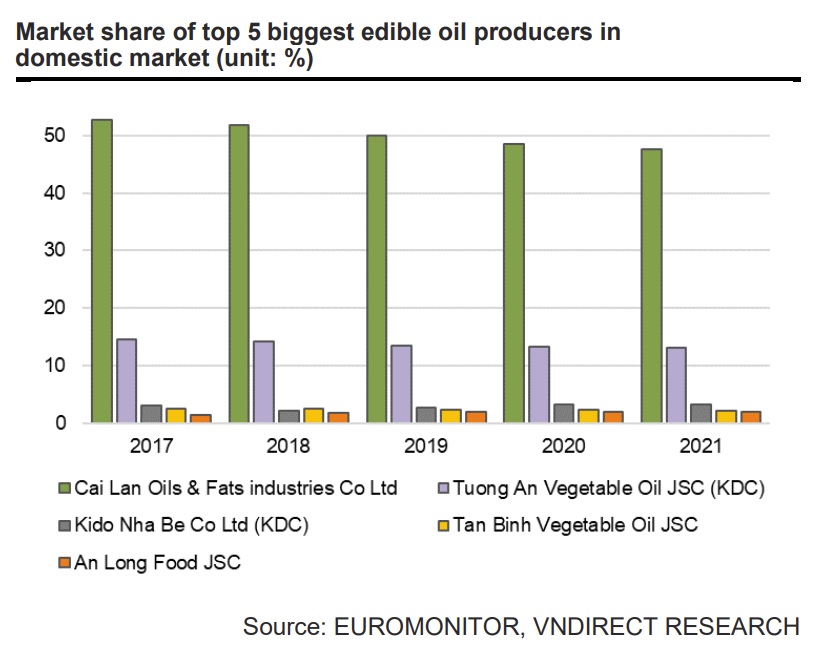

KDC holds the second-largest market share in the edible oil industry and controls more than 30% of the market in Vietnam

>> Headwinds could lessen for meat producers

Since the beginning of the global financial crisis in February 2022, the price of palm oil has significantly increased, reaching between 6,000 and 7,000 Myr/tonne in the months of March to early June 2022 (44% to 70% compared to the 2021 average price). Palm oil accounts for about 90% of Vietnam's imported raw edible oil. The material costs of edible oil producers, primarily KDC, increased dramatically as a result. However, according to VNDirect's assessment, KDC increased the selling price of cooking oil by 40% year over year in 1H22, leading to a 1.6% point increase in gross margin from 9M22.

Due to decreasing input costs, Ms. Ha Thu Hien, analyst at VNDirect, anticipates that 2023 will be a better year for manufacturers of edible oils. The price of raw palm oil, which the Indonesian government controlled, fell rapidly to around 4,000–4,200 Myr/tonne in the middle of June–August 2022, or around 43% less than the peak price in April 2022 and on par with the 2021 average price. Furthermore, the US Department of Agriculture predicts that global palm oil output would increase by 8% over 2022–2023F, following a flat 2021 that will support the continuation of the downward trend in palm oil prices in 2023. Thus, the average price of raw palm oil in 2022–23F might be 4,800–4,400 Myr/tonne, or 17%/8% YoY, respectively.

The forecast term is expected to see the global market for cooking oil grow at a CAGR of 5.6%. (2022-2027). Numerous things contributed to this, including the COVID-19 epidemic that caused total blackouts in Western Europe and the United Kingdom. Cooking oil sales were consequently down at restaurants, lodging establishments, and roadside food vendors; however, due to the necessity of the product, online sales remained unaffected.

Vegetable oil, a significant source of cooking oil, has its largest market in Asia. In addition to being utilized as a dietary supplement, vegetable oils are employed in the preparation of meals. Due to the high concentration of the aquaculture industry in China, India, Vietnam, and Indonesia, the region has seen a rapid increase in the consumption of fish oil. In developed nations like Japan and Australia, consumers are increasingly using fish oil as a nutritional supplement due to growing consumer health concerns. Due to its health advantages, olive oil in particular is growing at the fastest rate.

China is the region with the highest usage of vegetable oil in the Asia-Pacific. Even though production is high, consumption outpaces it, leading to higher edible oil import volumes than export levels. This tendency has been fueled by the existence of significant palm oil-producing countries in the area as well as rising food industry demand, which is a result of changing living standards and an expanding population base. The rise in edible oil use has also been significantly influenced by the rising demand for processed meals.

Ms. Ha Thu Hien predicts that the price of retail edible oil in the Vietnam market will move in the same direction as the price of raw palm oil. Because KDC holds the second-largest market share in the edible oil industry and controls more than 30% of the market in Vietnam, the price of KDC's edible oil may fall at a slower rate in this scenario. KDC can maintain their retail prices for edible oil because they have strong pricing power. KDC's revenue in FY22F may increase by 24.3% yoy; however, due to lower selling prices in FY23F, it may also soften by 2.4% yoy, with GM increasing to 15.2%.

However, there are potential threats to Vietnam's edible oil industry, such as political unrest or lower-than-expected palm oil production, which would raise palm oil prices globally and raise the cost of inputs for the production of edible oils.