Headwinds could lessen for meat producers

In 2023, the challenges faced by the meat industry are anticipated to lessen as a result of rising swine prices, a rebound in restaurant demand, and a shortage of supply.

The total gross profit of meat producers weakened by 31.0% year over year in 9M22

>> What meat producers' stocks should be on your watchlist?

According to VNDirect, aggregated revenue of listed meat producers fell 31.0% year on year in 9M22, while net profit fell 6.2% year on year. BAF Viet Nam Agriculture Joint Stock Company (HoSE: BAF) has excluded their non-core businesses, dragging down the sector's revenue.

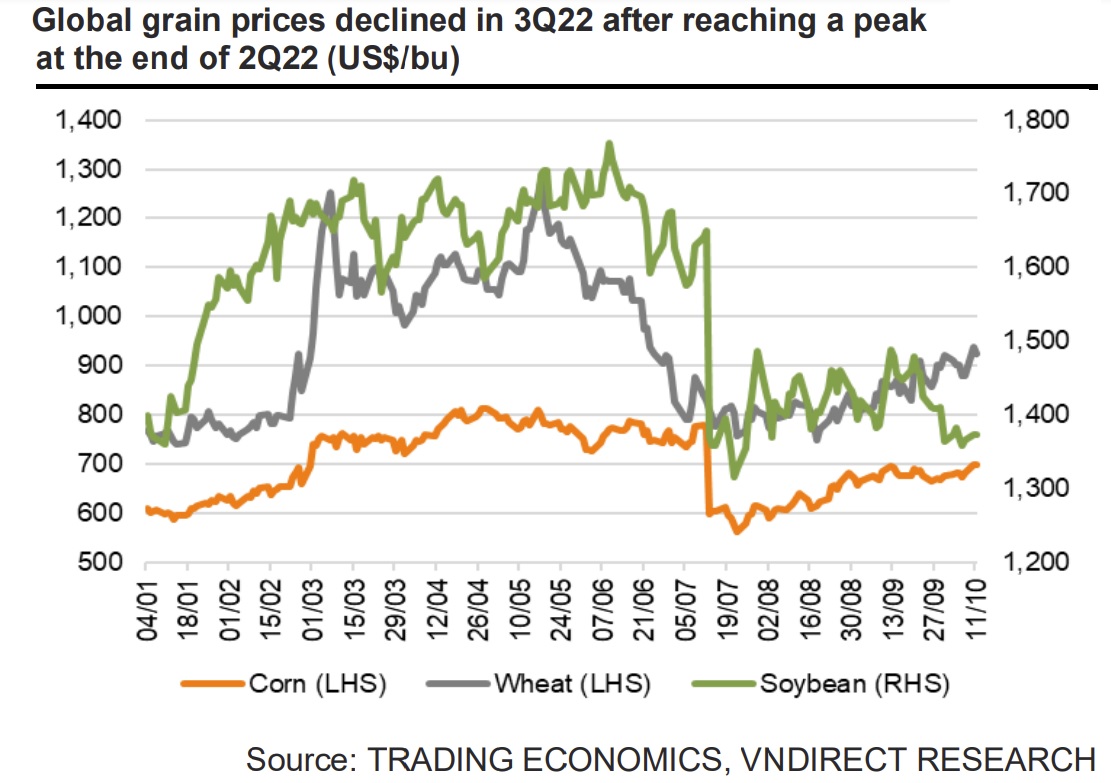

Meanwhile, the total gross profit of meat producers weakened by 31.0% year over year in 9M22 due to higher input material prices for animal feed and lower output prices. Based on VNDirect’s estimates, wheat, corn, and soybean meal prices increased strongly by 37.9%, 19.8%, and 10.7% yoy, respectively, in 9M22.

Ms. Ha Thu Hien, analyst at VNDirect, believes headwinds for meat producers will subside in 2023 as swine prices are expected to increase 5.0% yoy in 2023F thanks to 1) the recovery of eat-out demand and 2) a supply shortage as farmers still hesitate in re-herding due to the recent drop in swine prices while feed prices are still high. Currently, farming households account for 60% of the total pork supply in Vietnam.

Grain prices are likely to decline in 2023F thanks to some factors: 1) initial fears of grain shortages due to the crisis have gradually subsided as other producers have stepped in to increase supply; 2) Ukraine grain shipments have resumed following an agreement to end the blockade of Ukrainian ports; and 3) fertilizer prices have also fallen and could boost grain harvests by increasing crop yields. As domestic feed prices have increased more slowly than global agricultural prices. Ms. Ha Thu Hien anticipates that animal feed prices will gradually fall in 2023F.

Ms. Ha Thu Hien expects meat consumption to increase by 10-15% yoy in 4Q22F, as this is the peak consumption season when the Lunar New Year approaches. For 2023F, she believes meat demand will remain unabated thanks to 1) real income growth thanks to the government's plan to increase basic wages to around 20.8% in 2023F; and 2) international tourist volume is expected to recover to 84% in 2Q23F and 100% in 4Q23F, leading to a strong recovery in entertainment, accommodation, and catering services. Thus, she believes meat producers recorded positive revenue growth in FY23F. Therefore, DBC and BAF’s net revenue could increase by 3.5% yoy and 18.0% yoy, respectively, in FY23F.

Amid a lower input animal feed price and a slight increase in selling price, Ms. Ha Thu Hien expects meat producers' gross margins to improve in FY23F, such as DBC, MML, HAG, and BAF. However, they will face some risks.

>> Vietnam’s meat industry: Challenges lie ahead

First, prolonged tensions between Russia and Ukraine affecting shipping in the Black Sea may put upward pressure on global grain prices.

Second, as about 80% of input materials for animal feed production are imported, the increase in the USD/VND rate will lead to higher raw material prices for animal feed production.

Third, the African swine fever disease has the potential to disrupt the meat supply in 2023F. According to the Departments of Agriculture and Rural Development, the whole country currently has 53 outbreaks in 53 districts. The total number of infected pigs was 3,164, while the total number of dead was 3,259 heads. Amid the fact that the vaccine has not given specific positive results yet, the ASF still has the risk of reducing the pig supply.