What meat producers' stocks should be on your watchlist?

Feed prices are expected to continue rising in 2022F, while average live hog prices are expected to fall 5.8% year on year.

Analyst at VNDirect advised holding both DBC and MML.

>> Vietnam’s meat industry: Challenges lie ahead

According to Ms. Ha Thu Hien, an analyst at VNDirect, DBC's meat sales would increase by 9.8% in FY22F, but the company's gross margin will drop by 6.6 percent year over year as a result of higher feed costs. DBC's net profit is therefore expected to decline 29.6% year over year in FY22F. The deconsolidation of animal feed is predicted to result in an uncommon profit for MML, which will result in a considerable fall in net profit of 66.2 percent yoy.

DBC and MML set their respective NPAT goals at VND918 billion and VND500-670 billion, or 156 and 147 percent of VNDirect's prediction, respectively. According to their analysis, hog prices are not expected to increase significantly in 2022F, despite the fact that raw material prices are unpredictable owing to disputes and meat manufacturers' business forecasts are relatively optimistic (10% yoy net profit growth).

Because of a 6.0 percent yoy increase in animal feed revenue and an 11.0 percent yoy increase in farm and food revenue, Ms. Ha Thu Hien anticipates DBC to report 7.0 percent yoy growth in FY22F revenue for meat producers. In which, while the average selling price (ASP) fell by 5.8 percent year over year, pork income increased by 10.3 percent, largely as a result of a 17.2 percent year over year increase in sales volume. She also forecasts that MML's pork sales will generate VND3,490bn (16.4 percent yoy) in FY22F, helped by a 22.5 percent growth in sales volume despite a 5.0 percent yoy decline in its average selling price. Masan Meatlife has a revenue target for FY22F of VND5,000-6,500bn, or 105.6 percent of VNDirect's prediction.

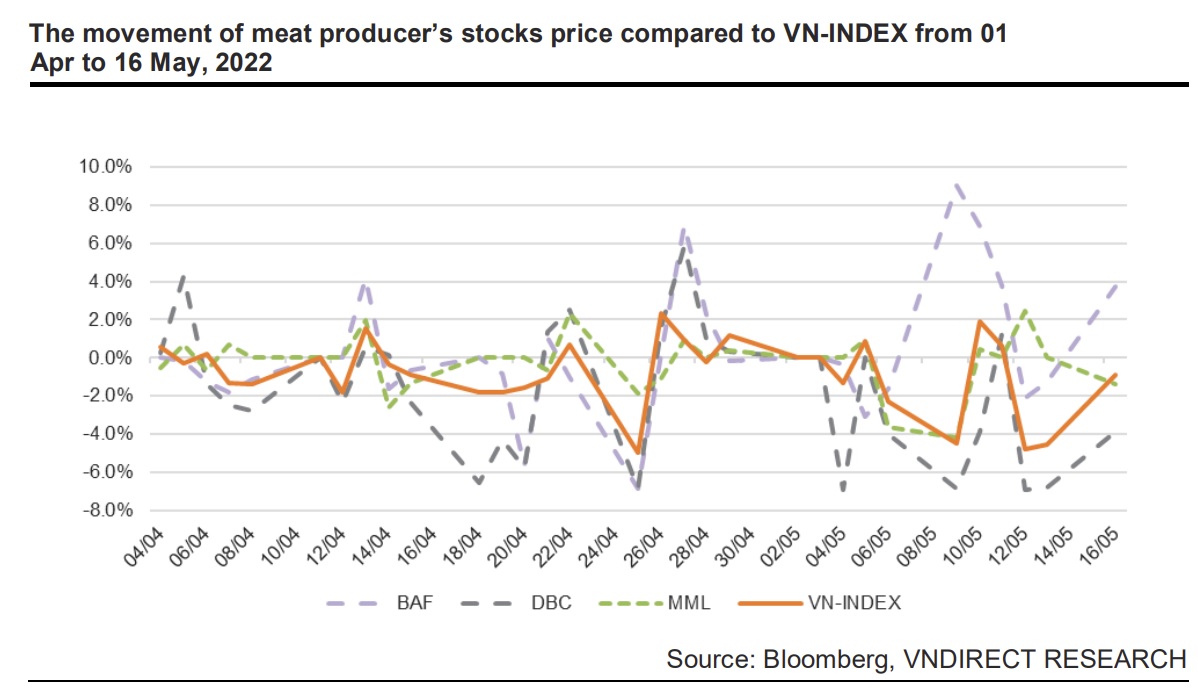

From April 1 to May 16, the stocks of meat production decreased by 13.3 percent, which is less than the 22.7 percent decline in the VN-Index. BAF had the best performance among the stocks (7.1%), while DBC saw the biggest decline (43.7%). According to Ms. Ha Thu Hien, the recent price decline of DBC is mostly the result of investors' worries about how rising cereal prices globally will effect the company's business as well as poor performance in 1Q22 business results.

Because she thinks that the expectations for net profit growth have already been factored in and because these firms are anticipated to have negative net profit growth in FY22F, Ms. Ha Thu Hien advises holding both DBC and MML.

>> Meat producers recorded a mixed performance

However, the stock of meat producers would face many risks. The conflict in Ukraine has been a major shock to commodity markets, coming on top of pandemic-related supply chain disruptions as well as production shortfalls. The war has led to significant disruptions to the production and trade of commodities for which Russia and Ukraine are key exporters. According to the World Bank, a continuation of the war beyond this year could reverse the expected easing of food commodity prices in 2023.

The impact of the conflict between Russia and Ukraine in February 2022 has caused raw material prices for the manufacture of animal feed to rise by 14 to 30 percent annually. Currently, 65 to 70 percent of the price of producing pork goes toward the cost of animal feed. While 80–85 percent of the total cost of production goes toward the cost of raw materials used to produce animal feed, the high cost of raw materials will result in higher livestock prices in 2022. Due to a high base in 1H21, hog prices are predicted to fall by 5.8 percent yoy, which would result in a loss in the gross margin of meat producers in 2022.

In addition, the possibility of the ASF epidemic affecting the meat supply in 2022F. Several thousand heads of pigs each locality were infected and suspected of having ASF in the first quarter of 2012, according to the Departments of Agriculture and Rural Development in An Giang, Tra Vinh, Soc Trang, and Tien Giang. But according to Ms. Ha Thu Hien, the majority of meat producers today use the 3F (Feed - Farm - Food) approach, which lessens the risk of disease more than farming does. Additionally, three businesses are currently independently researching ASF vaccines and seeing promising results. According to her, the vaccine might be commercially produced by 4Q22F–1Q23F, and the ASF outbreak could be contained by the end of 2023F.