FED’s impacts on Vietnam’s economy

The FED suggested that, after two rate hikes this year, it would continue to raise rates in the coming months to keep inflation under control.

The market expects the Fed to raise the policy rate by 175-200 basis points to a target level of 2.5 percent to 3.0 percent for the rest of 2022.

>> How will FED deal with risk of recession?

Fight against high inflation

The Federal Open Market Committee (FOMC) voted to raise the fed funds rate by 50 basis points to 0.75–1.0 percent during its most recent meeting on May 3–4, 2022. Since May 2000, this was the most aggressive increase made in a single meeting. In order to keep inflation under control, central bank officials advised hiking rates again this year. According to a CME Group survey, the market expects the Fed to raise the policy rate by 175-200 basis points to a target level of 2.5 percent to 3.0 percent for the rest of 2022.

The Fed also agreed to start reducing its balance sheet in June 2022, initially by US$47.5 billion per month ($30 billion in US Treasuries and $17.5 billion in mortgage-backed securities), then by US$95 billion per month after three months ($60 billion in US Treasuries and US$35 billion in mortgage-backed securities). The Fed's balance sheet could shrink by around US$427.5 billion under the aforementioned scenario in the second half of 2022. Because the magnitude is so small (approximately 5% of the Fed's existing balance sheet), the impact on global financial market liquidity will be minimal.

Impacts on Vietnam's economy

Tighter global financial circumstances may reduce global growth prospects, resulting in lower demand for Vietnamese goods. The Fed's policy tightening will raise borrowing rates (in USD), lowering consumer demand and weakening the need for firms to grow their investment.

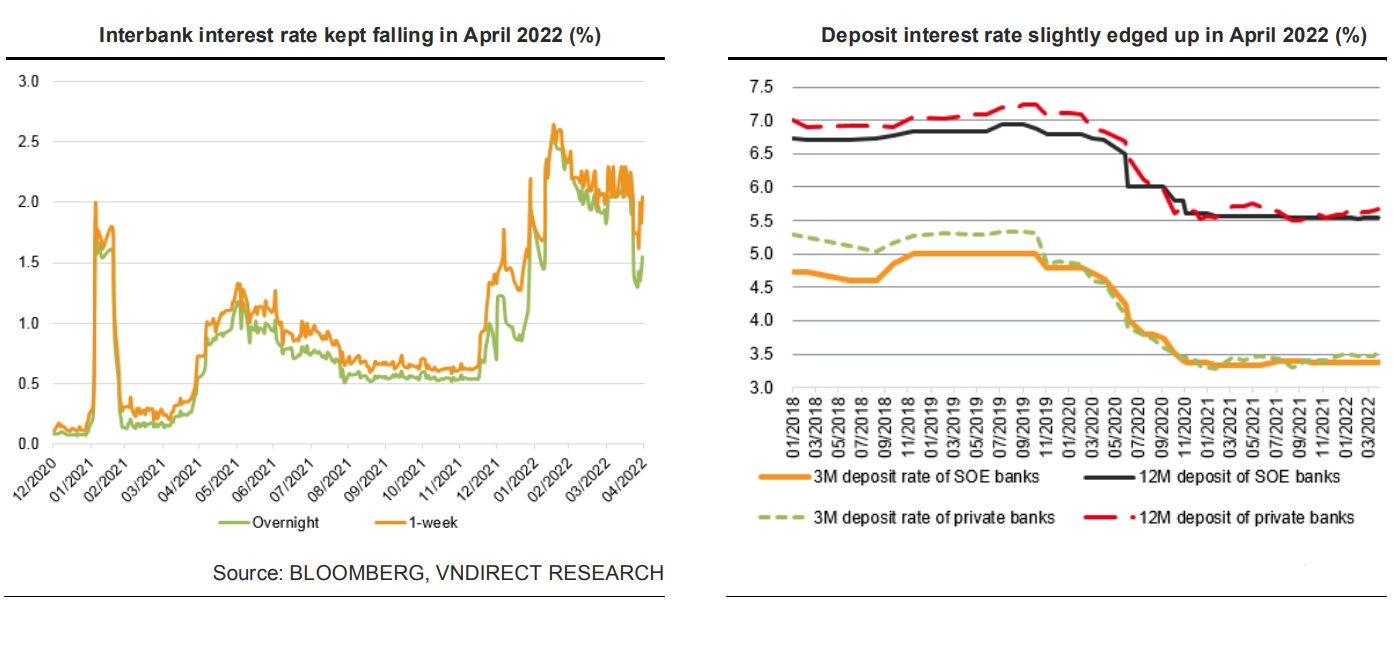

In the second half of 2022, deposit interest rates (in VND) are expected to rise. State-owned banks' 3-month term deposit rates and 12-month term deposit rates remained unchanged as of April 26, 2022, compared to the end of 2021, while private banks' 3-month term deposit rates and 12-month term deposit rates increased 14 basis points and 13 basis points, respectively, compared to the end of 2021.

Deposit interest rates (in VND) are predicted to grow in the second half of 2022. In comparison to the end of 2021, state-owned banks' 3-month term deposit rates and 12-month term deposit rates stayed steady as of April 26, 2022, while private banks' 3-month term deposit rates and 12-month term deposit rates increased 14 basis points and 13 basis points, respectively.

Furthermore, rising US interest rates put pressure on the Vietnamese government's and businesses' international debt repayment commitments. Vietnam's external debt will account for 39 percent of GDP by the end of 2021, according to VNDirect. Due to tighter liquidity in international financial markets, raising funds in the international market and at higher interest rates will be more challenging for Vietnam's government and businesses.

Due to the impact of the taper tantrum on the financial market, foreign indirect investment (FII) may continue to be net withdrawn in the coming months. However, because foreign investors have been net sellers on the Vietnamese stock market for the past two years, the impact of foreign net selling will be limit ed because the market has already prepared. Meanwhile, FDI flows into Vietnam will be barely impacted, as Vietnam continues to be a desirable investment location in the global supply chain diversification trend.

Furthermore, a strong dollar exerts downward pressure on the Vietnamese currency. The dollar index (which measures the strength of the US dollar against a basket of currencies) reached 103 points on April 31, 2022, the highest level in 20 years. In the first four months of 2022, a strong USD pushed the USD/VND exchange rate higher by around 0.6 percent. The Vietnamese dong, on the other hand, remains one of the most stable currencies in Asia-Pacific. The underlying reasons that have kept the Vietnamese dong steady in recent years, such as the current account surplus and greater foreign exchange reserves, are still present (FX reserves).

From a projected deficit of 1.0 percent GDP in 2021, VNDirect predicts a current account surplus of 1.9 percent GDP in 2022F. It also anticipates Vietnam's foreign exchange reserves to rise from US$105 billion to US$122.5 billion by the end of 2022 (equal to 4.0 months of imports). As a result, the US$/VND is expected to remain stable between 22,600 and 23,050 in 2022F, with the Vietnamese Dong moving in a very tight range (/-1 percent) against the US$.