Global core inflation remains elevated

Global core inflation remains elevated. Projections suggest inflation will continue to be above its pre-pandemic level beyond 2024, said World Bank (WB).

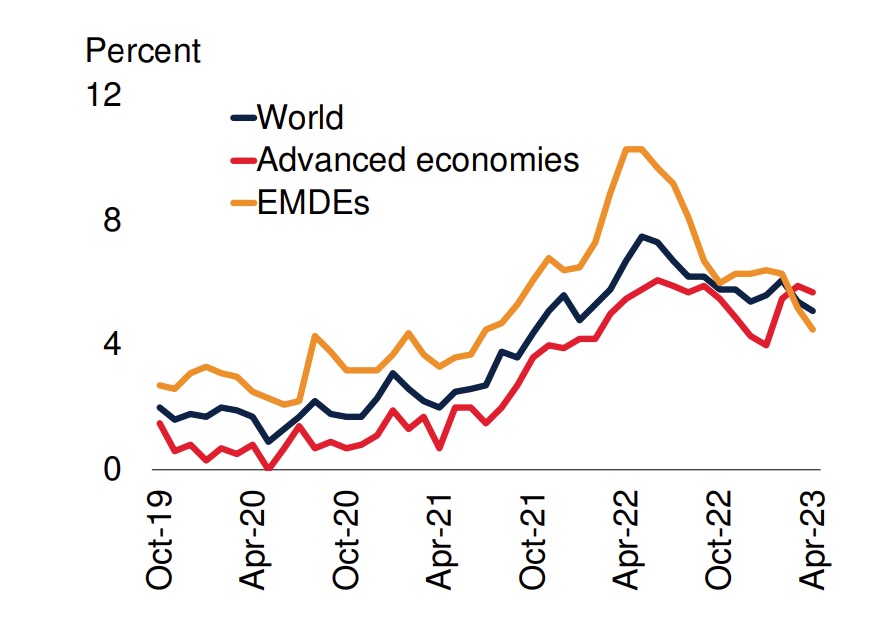

Median headline global inflation stood at 7.2 percent year-on-year in April, down from a peak of 9.4 percent in July 2022.

>> Global inflation could ease in 2023

Inflation remains above target in almost all inflation-targeting economies. Median headline global inflation stood at 7.2 percent year-on-year in April, down from a peak of 9.4 percent in July 2022. In WB’s view, this deceleration largely reflects favorable base effects from commodity prices falling below their 2022 peaks, along with abating supply chain pressures. Moderating energy prices help explain global inflation being somewhat softer in the first quarter of 2023 than previously anticipated.

However, recent core inflation measures suggest the disinflation that started last year has made only halting progress. Across EMDEs, three-month median core inflation has decelerated somewhat in recent months, while it has picked up in advanced economies. Amid these developments, global inflation is envisaged to remain further above its 2015-19 average than was expected in January, and for a longer period.

With supply chain pressures easing and energy prices declining, excess demand appears to be a key driver of continuing high inflation in advanced economies, though lingering impairments to supply capacity may also still play a role.

In Europe, the role of energy prices is particularly important—the pass-through of energy costs into broader prices may be adding to inflation persistence, which could be further exacerbated by the sunsetting of fiscal programs that have attenuated price spikes for end-users. The absence of economic slack may also be increasing the ability of firms and workers to exercise pricing power, such that inflation has become more responsive to economic activity.

In some advanced economies, particularly the eurozone, market-derived measures of long-term inflation compensation have moved up since last year, despite a decline in oil prices, with which they have been correlated in the past. This could signal greater risks of inflation remaining above target, but may also reflect increased inflation risk aversion among market participants. Consumer surveys indicate that medium-term inflation expectations in the United States and the euro area have been fairly stable in 2023.

>> Picture of inflation control in 2023

In many EMDEs, inflation is either accelerating once again or has stabilized at high levels. Some common responses to recent shocks, including indexation of wages to inflation and increases in untargeted fossil fuel subsidies, may have added to generalized inflation pressures.

The global inflation is in reduction.

WB said a protracted period of high inflation would be especially challenging for EMDEs, where inflation expectations are generally less stable than in advanced economies and more influenced by current inflation rates. Consensus-derived expectations for EMDE inflation one-year-ahead moved up substantially as inflation initially picked up, but declined more slowly as inflation decelerated last year.

The distribution of short-term inflation forecasts across EMDEs has also widened markedly, with double-digit inflation expected in more than a quarter of EMDEs. Long-term forecasts suggest that EMDEs with inflationtargeting central banks may have an advantage in durably bringing inflation down. Five years ahead, only one-in-twenty inflation-targeting EMDEs is projected to have inflation more than 1 percentage point above 2010-19 average levels, compared with about one-in-six non-inflation-targeting EMDEs.

“The reopening of China’s economy is not expected to have a material impact on global inflation. While strengthening activity will put upward pressure on domestic inflation, this will likely be limit ed by slack in China’s economy, including in the labor market. In addition, the recovery in China is projected to be less commodity-intensive than in past episodes of growth accelerations, and therefore less likely to boost global prices”, said WB.