HVN gears up for a strong business growth

Vietnam Airlines JSC (HoSE: HVN) is preparing to take off to become a top regional airline.

Naturally, these wide-open "runways" come with no small challenges for the airline.

Expanding the Aircraft Fleet

During the COVID-19 period, one of HVN’s key strategies was restructuring its fleet. In 2024, HVN entered into a strategic partnership with U.S.-based Air Lease Corporation to modernize its aircraft fleet. At the same time, the airline has been aggressively opening direct routes to major markets.

Now, broader opportunities are emerging for HVN as Vietnam seeks to accelerate and reduce its bilateral trade deficit with the U.S. The demand to modernize HVN’s fleet is being further elevated with plans to add narrow-body aircraft.

At the recent extraordinary general meeting of shareholders, HVN approved a resolution to invest in 50 narrow-body aircraft from 2030 to 2032. The investment involves purchasing 100% new aircraft, with an estimated total investment of USD 3.587 billion (approximately VND 92.4 trillion), including 10 spare engines. Of this, equity capital (PDP interest, aircraft and engine deliveries, and other costs) accounts for over USD 1.66 billion, while the remaining USD 1.92 billion will be financed through loans.

HVN’s leadership stated they are in talks with Airbus and Boeing to secure early delivery slots if other airlines adjust their fleet plans. If the new aircrafts are not delivered before 2030, HVN will opt for leasing.

Previously, HVN had plans for new borrowing during 2021–2025, primarily to implement two key projects: fleet investment and the Long Thanh project. PDP loans, which are medium-term (2–3 years), could be sourced from both domestic and international commercial banks.

HVN views this method of fleet investment financing as feasible and cost-competitive compared to other funding options (like bond issuance). In this current plan, HVN estimates a net present value (NPV) of VND 5.3 trillion, an internal rate of return (IRR) of 9.11%, and a discounted payback period of 12.8 years.

Share Purchase Rights Offering

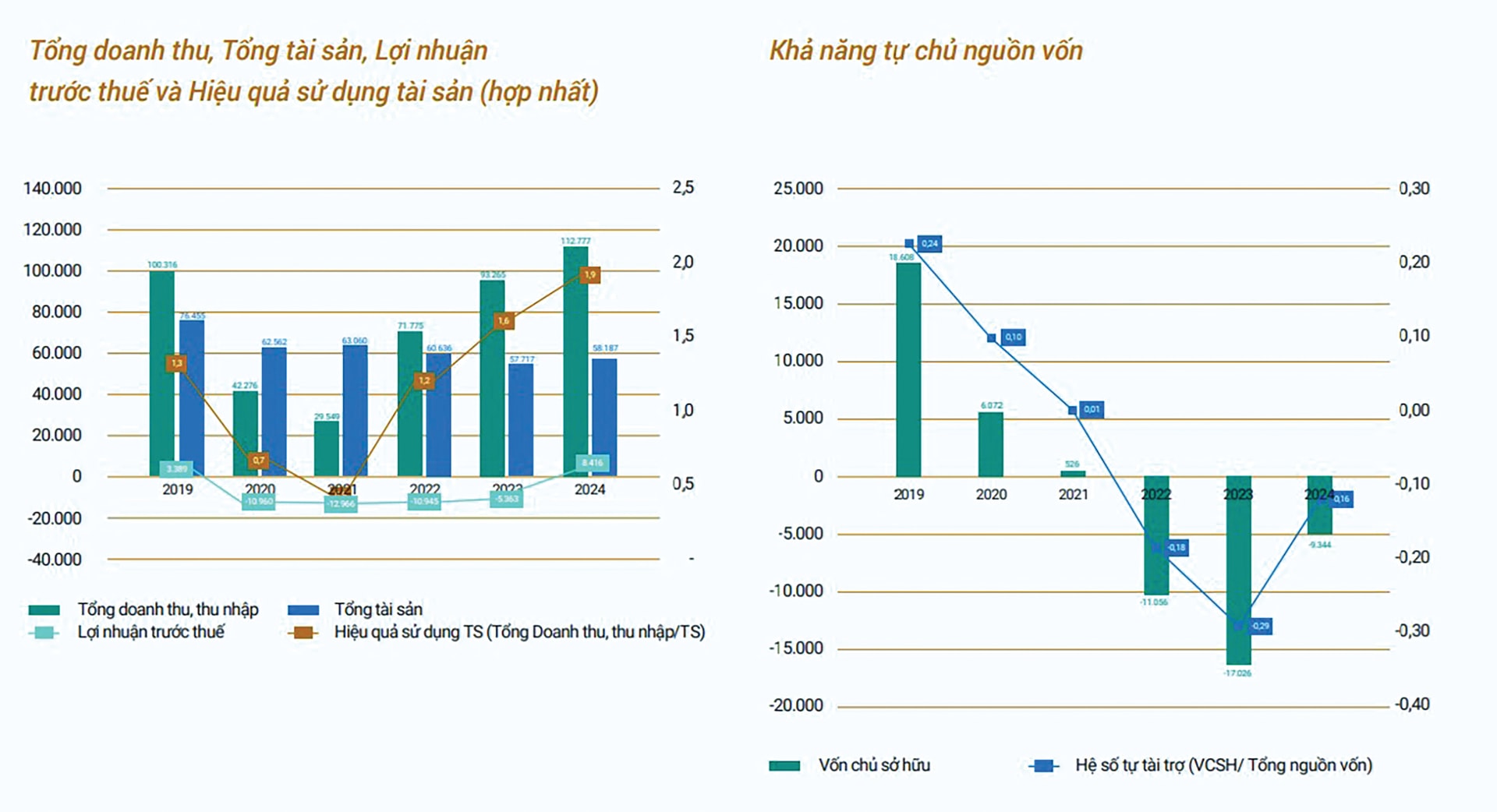

HVN plans to issue share purchase rights. Specifically, each shareholder owning 100 shares will be entitled to purchase 40.6 shares at a price of VND 10,000/share. The issuance is expected to take place in the second half of 2025. After this issuance, HVN’s charter capital will increase by 41% to VND 31.1 trillion from the current VND 22.1 trillion, and its equity capital will improve from negative VND 9.3 trillion to negative VND 344 billion.

Including retained earnings, Vietcap expects HVN's equity to turn positive in 2025. The VND 9 trillion raised will be allocated to settle due and overdue payables to suppliers, and to repay short- and long-term debts, including a portion of refinanced loans.

Currently, HVN’s greatest challenge remains its debt burden. As of Q1/2025, HVN had VND 6.3 trillion in overdue payables and VND 4.3 trillion in current payables to suppliers. Short-term loans, long-term loans, and refinancing loans stand at VND 2.8 trillion, VND 123 billion, and VND 3.9 trillion respectively. Repayment obligations for 2025 and 2026 are estimated at VND 2–3 trillion, VND 29 billion, and VND 1–2 trillion respectively. Hence, the debt restructuring plan will be prolonged and depends on approval by regulatory authorities.

Previously, in phase 1 under Resolution 110/NQ, HVN was authorized to issue additional shares to existing shareholders to increase charter capital; the government directed SCIC to purchase HVN shares via transfer of purchase rights, with a scale of VND 9 trillion, equivalent to 900 million shares. In 2020, SCIC also invested over VND 8 trillion to buy more than 6 million HVN shares.

It remains unclear in phase 2 whether SCIC or another entity receiving the purchase rights will continue to provide state support, helping improve HVN’s business efficiency and contributing to national goals—aligning with its ambition to scale up its fleet and become a top-three airline in Southeast Asia.

By the end of Q1/2025, HVN recorded revenue of VND 30.6 trillion, up 8%, while post-tax profit attributable to shareholders reached VND 3.4 trillion, down 22% year-on-year. HVN attributes the strong performance to multiple factors, including lower fuel costs and recovering market demand. For 2025, HVN targets 25.4 million passengers, parent company revenue of VND 95.6 trillion, and pre-tax profit of VND 2.176 trillion. HVN's management notes that engine issues and supply chain disruptions are industry-wide challenges.

Additionally, from a macroeconomic perspective, should trade war risks and global macro instability intensify—alongside the realization of stagflation in the U.S.—the impact would extend beyond economies to significantly curtail travel, investment, and tourism demand, affecting the entire aviation sector. Moreover, the market hasn’t forgotten that HVN avoided a credit risk in 2024 thanks to a VND 4 trillion refinancing extension. Hence, similar support mechanisms will be essential for HVN to gain the policy runway it needs to soar higher.