Is there any brake on the US tariffs?

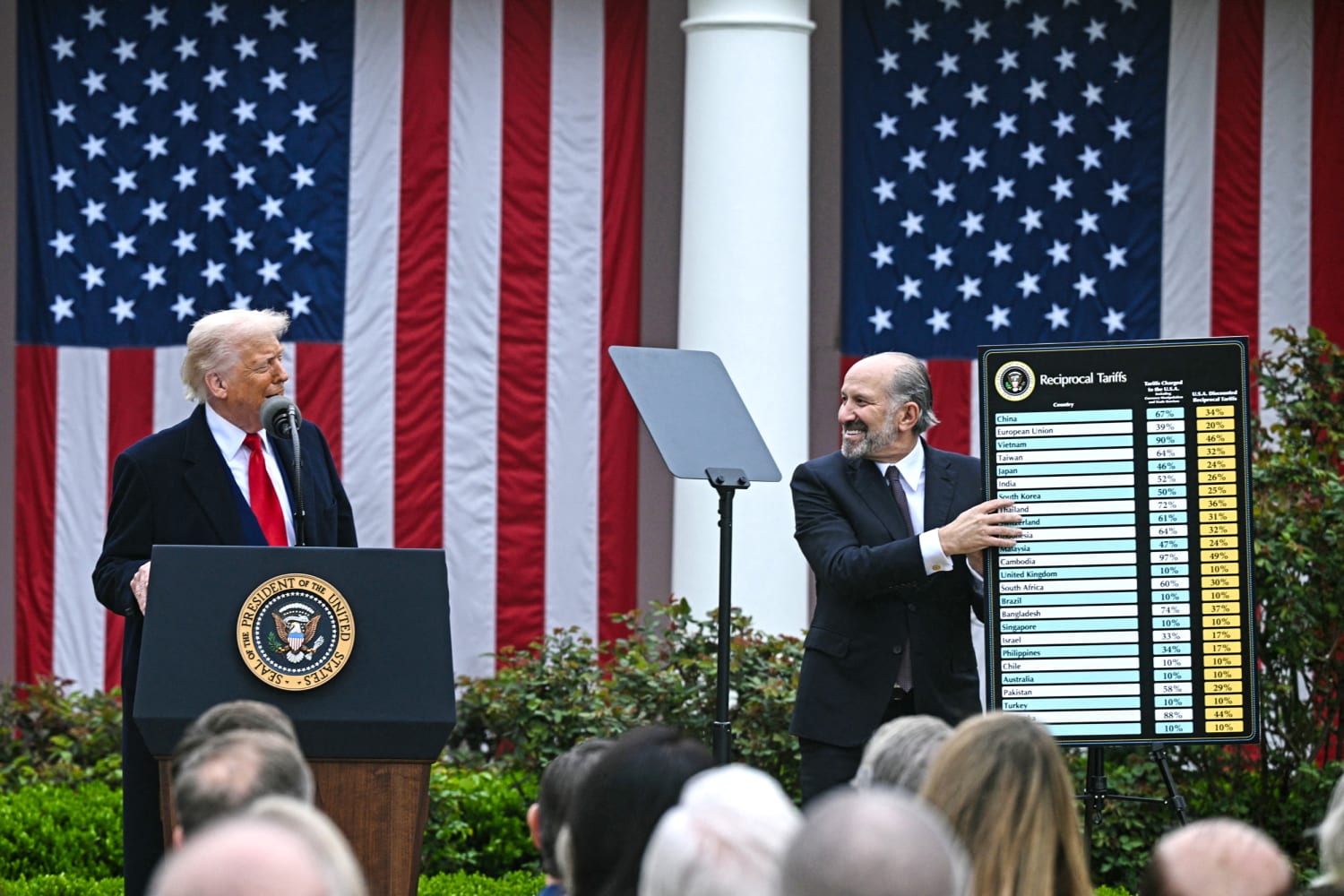

The Trump Administration has moved at breakneck speed this year with tariffs, tax cuts, deportations and more. Are there any brakes on the pace of and extent of US tariffs policy changes?

The new US Administration has been pretty unconstrained in its policy implementation this year, with the exception being the 90-day pause period for higher-rate tariffs. Congress has not reigned in the president with Republican dissents few and far between when it came to the one big, beautiful bill, even though it’s estimated that this could increase the budget deficit by USD3.4tr over the next decade; something that Republican’s usually balk at.

What’s more, Congress has not been allowed its usual checks-and-balances role on the president because Trump has used a huge number of executive orders to ram through his policies, especially on tariffs. The courts have fared little better. The International Court for Trade ruled that country-specific tariffs were illegal, but it seems that nobody thinks this will stick, as President Trump looks like the favourite to have it overturned at the Supreme Court if necessary.

The Federal Reserve has not proved much of a brake either, in spite of tariff-related inflation risks and the worrying easing of fiscal policy at a time of full employment. For although rates have not been cut this year, Fed officials still say that they will likely come down and, if they don’t, there’s the spectre of cuts being pushed through from next June as Trump appoints his preferred Fed leader.

Financial markets have had some limited success in braking, or pausing the Trump agenda. The treasury market’s protest after the April 2nd liberation day tariff reveal was enough to prompt a 90-day pause in the introduction of the highest tariff rates. Of course, stocks and the dollar sold off heavily as well, but it was the treasury market that was key, as Trump is particularly sensitive to the interest costs of the budget given relatively high policy rates and bond yields.

In fact, it can be argued that in the case of the dollar, the President would like to see a lower greenback anyway, as long as it is not rapid and does not undermine the dollar’s special status. But while the treasury market effectively paused tariff policy for a while, all the signs are that the lion-like roar of the bond vigilantes in April has turned to the miaow of a pussycat today. For as things stand, it looks as if tariffs are going right back to where they were on April 2nd and, in some cases, even higher. In addition, still more tariffs are being threatened, such as copper and pharmaceuticals.

In short, it looks as if Trump has faced down the treasury market and won. There is no sense at all that the president feels sufficiently chastened by the surge in treasury yields to back down over tariffs now. Of course, trade deals could still be made that lower tariff rates but, the 90 deals in 90 days suggested by White House trade advisor Peter Navarro during the April pause has actually meant three and, of these, the UK ‘deal’ has not seen any reduction at all in the overall 10% tariff. It seems that everything the treasury market seemed to fear shortly after liberation day will come to pass.

Steven Barrow, Head of Standard Bank G10 Strategy argues that it is worse than this because the president managed to push his one big, beautiful bill through Congress (at a cost of USD3.4tr in extra deficits) when it was not entirely obvious back in April that he would be able to get the bill passed. So, the treasury market has rolled over and had its tummy tickled like a pussycat by the Administration.

But will it continue to lie down? In Steven Barrow’s opinion, perhaps not if ratings agencies flex their muscles. Moody’s fell into line with the other major agencies by taking the US’s long-term rating down a notch below AAA in May. All have stable outlooks, but these outlooks must be in serious question. If that proves the case, it might be the rating agencies that are the ones that control the brake.