NLG steps back to leap forward?

MBS expects Nam Long Group (HOSE: NLG)’s profit to grow by 45%/ 5% in 2025/2026, respectively, driven by gains from the transfer of shares in the Izumi project and handovers at new projects or sub-phases.

In 2Q25, NLG’s revenue improved significantly by 201% yoy from a low base, but net profit fell 31% yoy due to the absence of financial gains from the transfer of shares in the Paragon Đại Phước project, as recorded in the same period last year. For 6M/2025, NLG posted net revenue of VND 2,064 bn (352% yoy) and net profit of VND 208 bn (38.2% yoy), showing a strong recovery from last year’s low base, mainly driven by the handover of products at Akari Phase 2 and Nam Long Cần Thơ. Despite the improvement, NLG has only achieved 30% of its full-year 2025 profit target as no new projects were handed over.

NLG recorded strong presales growth in 1H25, driven primarily by the Southgate project, where the launch of the Park Village subdivision achieved positive results, and the Nam Long Cần Thơ project, which showed a healthy absorption rate. We believe that the handover of these projects will serve as a solid driver for the company’s profit in 2025, in addition to the divestment of its stake in Izumi project to Tokyu.

In 2H25, NLG plans to launch multiple new projects or subdivisions, as these projects have made positive progress in legal procedures. Notable examples include the CC5 subdivision of the Mizuki project, The Pearl subdivision of the Southgate project (Waterpoint Phase 1), the Izumi Canaria subdivision of the Izumi project, and the Paragon Đại Phước project. These will provide a solid buffer for the company’s profit in 2026, even in the absence of financial income as recorded in 2025. NLG’s profit is expected to grow by 45%/ 5% in 2025/ 2026, respectively.

MBS believes that NLG’s projects scheduled for implementation during 2025-2026 will benefit from the following factors: (1) most have already completed land use fee payments and are therefore unaffected by changes in the land price framework or related legal regulations; (2) selling prices at certain projects are expected to remain favorable as they are located in areas anticipated to benefit from provincial mergers; and (3) absorption rates are likely to remain strong as the projects cater to genuine end-user demand.

MBS continues to expect NLG’s profit to maintain solid growth in the coming period, supported by positive legal developments at its projects. We have revised our 2025- 2026 net profit forecasts upward by 39% and 20%, respectively, from our previous estimates, based on the following factors: (1) Inclusion of estimated financial gains from the divestment in the Izumi City project to Tokyu in 2025; (2) Accelerated assumptions for the launch and handover schedules of the Izumi City and Paragon Đại Phước projects, in line with the actual progress of legal procedures; (3) An 8% upward adjustment to the assumed selling price of the Izumi City project compared with our previous forecast. Following these revisions, NLG’s net profit attributable to parent company shareholders is projected to grow by 45% in 2025 and 5% in 2026.

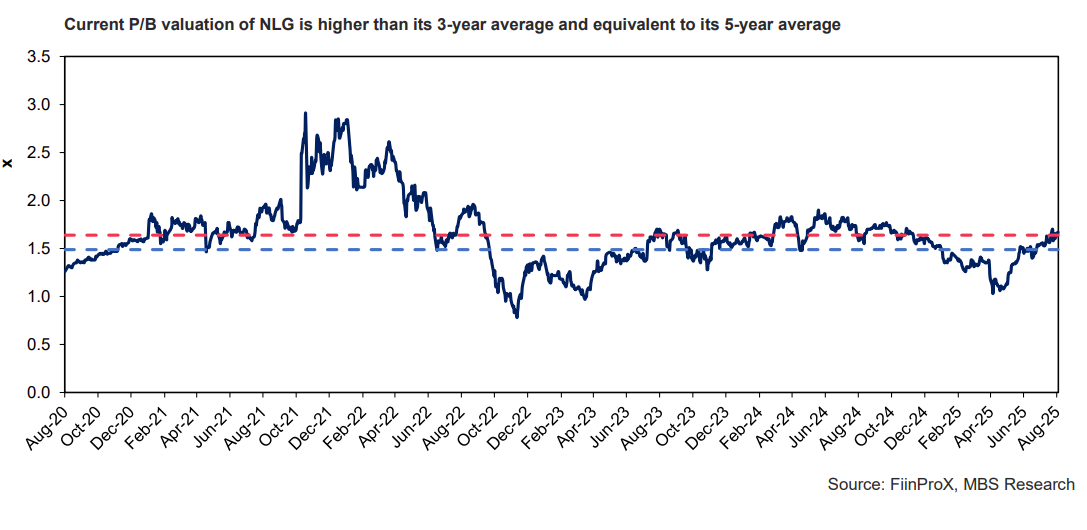

Although NLG's outlook remains positive, MBS downgrades its recommendation on NLG to Hold, as the stock price has already largely priced in the company’s potential and is currently trading above its 3- year average P/B multiple. We will continue to monitor and update our valuation should further positive developments from the company arise.

MBS applies the RNAV method to set a new target price for NLG at VND 45,600/share (up 7.3% from previous target price) based on the following changes: (1) Increasing Izumi’s selling price by 8% compared with our previous forecast to align with the company’s estimates; (2) Reducing NLG’s ownership stake in the Izumi project; (3) Accelerating assumed progress for certain projects and adding other projects into the valuation. Accordingly, while we raise our target price, we downgrade our recommendation to hold as the current share price has already partially reflected the company’s potential. Investors may consider new positions when the stock price corrects to a more attractive level.