How will the NFP impact gold prices next week?

The September US nonfarm payrolls (NFP) report might have a big influence on Fed rate cuts and gold prices next week.

In the Vietnamese gold market, the price of SJC gold bars has risen from VND133 million/tael to VND135.1 million/tael.

This week, after beginning at $3,683/oz, gold prices rose to $3,791/oz on reports that NATO troops intercepted three Russian MiG-31 fighter planes for violating Estonian airspace, raising concerns of a growing NATO-Russia war. However, Fed Chairman Jerome Powell's cautious tone toward further interest rate decreases, combined with US Q2 GDP rising to 3.8%, pulled gold prices down to $3,717/oz. Gold prices improved, closing the week at USD 3,760/oz.

In the Vietnamese gold market, the price of SJC gold bars listed by the DOJI group has risen from VND133 million/tael to VND135.1 million/tael.

Notably, core personal consumption expenditures (PCE), which exclude volatile food and energy costs and are the Fed's preferred measure of inflation, stayed steady at 2.9% year on year. Although inflation is over the Fed's 2% objective, experts believe the situation is under control because the US economy is still growing steadily.

Next week, the US will disclose the September NFP), which is estimated to be 51,000 jobs, up from 22,000 in August. The increase in NFP over August is also expected, as the US economy maintains its growing trend.

However, many analysts believe that the September NFP will be around the projected level, and it is unlikely to reach 51,000 jobs, as US firms continue to struggle as a result of US tariffs and have not increased hiring operations this month. If NFP falls below 51,000 jobs, the Fed will be forced to contemplate more interest rate reduction, encouraging gold prices next week to approach, if not exceed, $3,800 per ounce.

Barbara Lambrecht, an analyst at Commerzbank, stated that if the US NFP report disappoints for the third time in a row and shows a significant deterioration, gold prices could break above $3,800/oz, as the market would then reflect the expectation that the Fed will cut interest rates faster. However, Commerzbank's economic specialists foresee a minor improvement in the US labor market over the previous quarter.

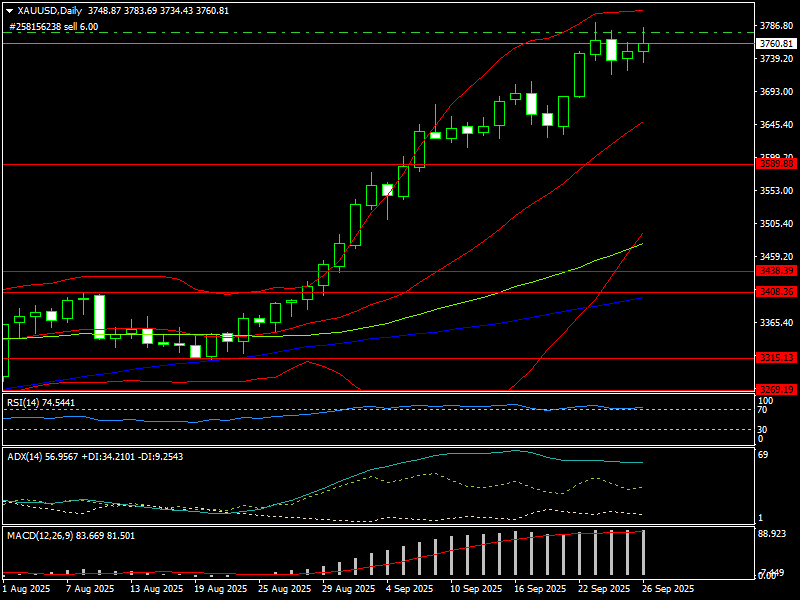

Gold price is still in an uptrend.

If the September NFP is 75,000 or higher, it will be deemed favorable information, lowering prospects for a Fed rate cut and placing downward pressure on gold prices next week, pushing them closer to $3,700/oz.

Many analysts say that if the NFP is far lower than predicted, the price of gold would swiftly fall below $3,800/oz after exceeding this level, as gold prices are already overbought and investors are wary.

According to David Morrison, Senior Market Analyst at Trade Nation, strong economic news from the last week has put the Federal Reserve in a difficult position, perhaps slowing gold's rise.

"The Fed is in a tough situation, and President Trump is certain to continue his personal assaults on Chair Powell and his colleagues as we approach the next two monetary policy meetings. Despite this, I believe the Fed will opt to stress its independence by making only one more cut this year, which it can readily explain given the strength of the US economy," he said, adding that Gold was on the verge of breaching above $3,800 earlier this week, and it has resumed its advance following a brief dip. However, the daily MACD remains extremely overbought, and I can't help but believe that it will need to reset lower, either through a deeper correction or a period of consolidation, before gold can get enough momentum to reach new highs. Gold is expected to reach new highs before eventually peaking. However, it is likely that it will require a big adjustment initially.