What will happen to gold prices after the Fed Chair’s testimonies?

Aside from the Israel-Iran conflict, the Federal Reserve Chair's testimony to the Senate Committee on Banking, Housing, and Urban Affairs next week could have a big impact on gold prices.

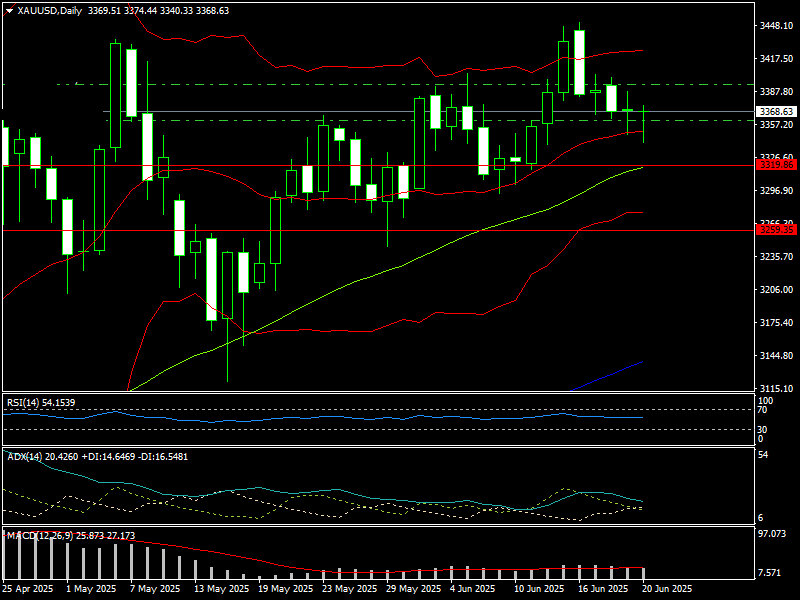

This week, after opening at 3,369 USD/oz, gold prices moved within a narrow range of 3,340-3,374 USD/oz, closing at 3,368.6 USD/oz. The fact that gold prices ended this week near their opening price suggests that investors remain worried in the current situation.

In the Vietnamese gold market, SJC gold bar prices fell from 120.5 million VND per tael to 119.6 million VND per tael before rising again to 120 million VND per tael.

Gold prices have remained in a limited range this week as US President Donald Trump has given Iran a two-week deadline to consider discussing an end to the war with Israel, despite the ongoing violent Israel-Iran confrontation.

Furthermore, on June 12, the Federal Reserve maintained its benchmark interest rate at 4.25 to 4.5 percent while adjusting its GDP prediction downward and upping its near-term inflation estimate. Fed Chair Jerome Powell admitted that tariffs "will push up prices and weigh on economic activity." Despite forecasting two rate cuts by the end of the year, Powell said the Fed can afford to "wait for clarity," citing mixed signals in the data.

The preceding reality demonstrated that the FED is quite careful about monetary policy. Because if the Federal Reserve decreases interest rates while the trade war escalates following the 90-day negotiation period between the United States and its trading partners, inflation will skyrocket. That rules out the chance that the Israel-Iran confrontation will linger, attracting the US and many other countries, complicating the Middle Eastern conflict, leading to Iran closing the Strait of Hormuz, causing oil prices to skyrocket and inflation to rise even higher.

The Fed Chairman will have two semi-annual monetary policy testimonies before the committees of the United States House of Representatives and Senate next Tuesday and Wednesday. If Fed Chairman Powell hints at a rate decrease at the FOMC's September meeting, the US dollar may fall against other major currencies, causing gold prices to jump next week. Conversely, if the FED Chairman emphasises that they will continue to prioritise controlling inflation and are not in a hurry to decrease interest rates, the USD will gain, sending gold prices lower next week.

However, the increase/decrease in gold prices next week owing to the influence of the FED Chairman's two testimonies may not be significant, as investors are still waiting to see whether the US will engage in combat with Iran.

According to technical analysis, gold prices may remain sideways next week. Notably, the RSI index has stabilised, implying that gold prices may continue to trade sideways next week. As a result, if gold prices fall below 3,340 USD/oz next week, they could drop as low as 3,308 USD/oz. Below 3,308 USD/oz, there will be a significant support zone ranging from 3,245 to 3,293 USD. Meanwhile, $3,452 USD/oz remains a solid resistance level.

Although gold prices remain sideways in the near term, they are maintained in the long run by strong demand from central banks. According to the World Gold Council, central banks purchased 290 tonnes in Q1 2025, the greatest amount ever. This follows record gold purchases in 2022, 2023, and 2024, with robust purchases from China, India, and other emerging nations looking to reduce their reliance on the dollar.