ACB shifts its business strategy

Asia Commercial Bank (HoSE: ACB) is steering its investment strategy toward deepening engagement with large corporate clients.

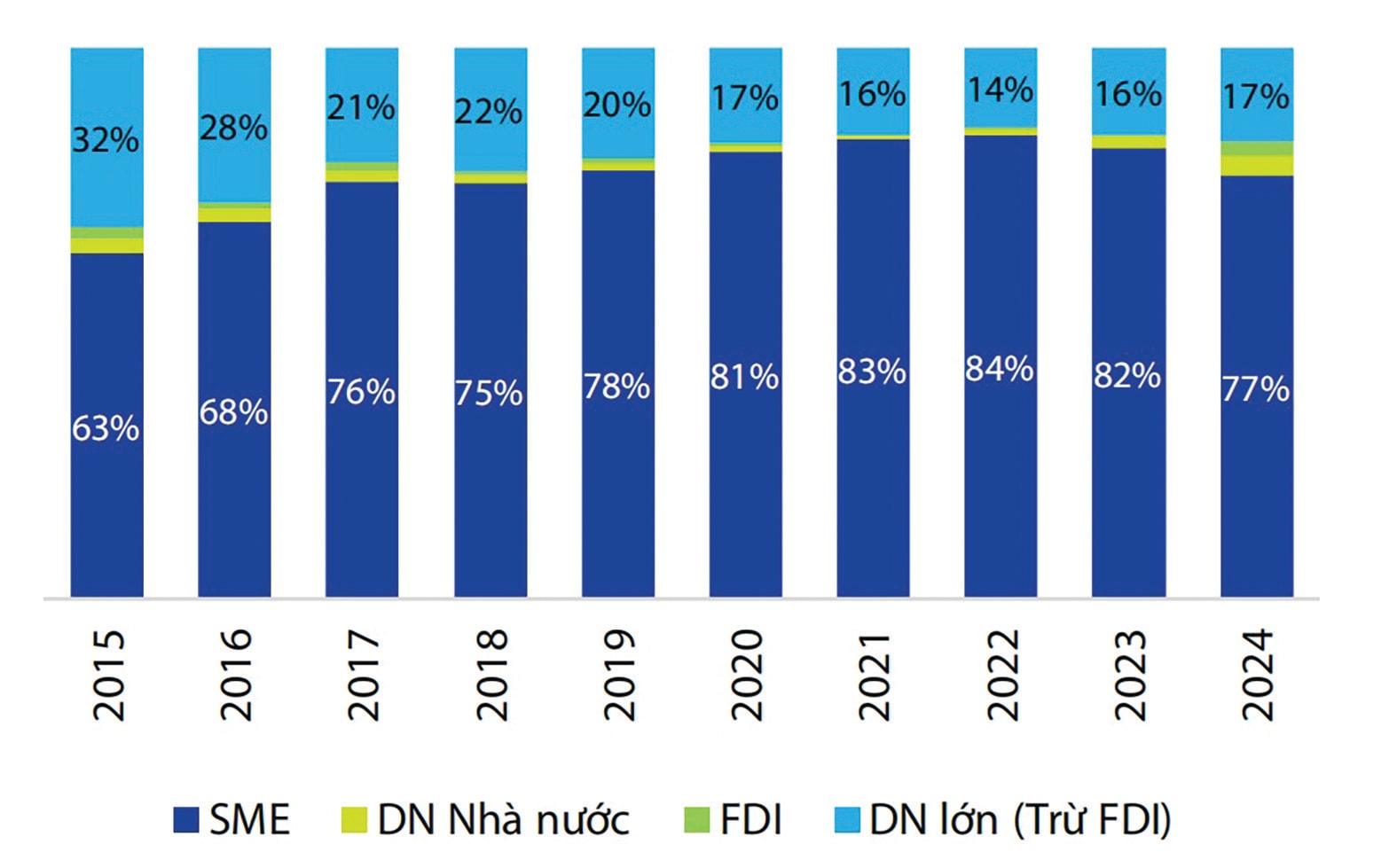

ACB’s corporate lending portfolio by client type

According to VDSC, under its 2025–2030 development strategy, ACB is focusing on expanding market share by strengthening its large corporate client segment, including leading domestic enterprises and foreign direct investment (FDI) companies.

Advantage of Quality Market Share

Thanks to its early focus on retail banking between 2014 and 2024, ACB has built a stable market share of around 3.7% by the end of 2024, mainly serving mass-affluent individual clients and SMEs. During this period, ACB consistently outperformed the industry average in credit growth, with a CAGR above 17%. Of this, personal lending contributed over 60%, with a CAGR exceeding 25%, according to VDSC.

However, as macroeconomic headwinds weigh on personal income and household consumption, ACB is increasingly shifting toward large corporate clients to sustain credit growth. In 2024, ACB’s lending to major and multinational large corporates (MMLC) reached more than VND 53 trillion, up 82% from 2023. This pushed overall credit growth to 18.4%, the highest in seven years.

In fact, ACB leadership has repeatedly emphasized lending and offering tailored products to exporters, FDI firms, and manufacturers since 2024. CEO Tu Tien Phat recently noted that for SMEs, ACB is redefining its role—not only as a financier but also as an active participant in shaping policy frameworks, with the aim of fostering private-sector growth in line with Resolution 68/NQ-TW.

Currently, the bank has rolled out a VND 40 trillion credit package for SMEs with lending rates up to 2% lower than the market average. Flexible financing solutions include cash-flow-based lending, overdraft facilities, and long-term unsecured loans. ACB also helps SMEs adopt digital solutions in sales management, invoicing, and payments, while connecting them with nearly 8 million retail clients and 300,000 corporate clients in ACB’s ecosystem to expand market reach.

Opportunities and Challenges

Financial data shows that lending to large corporates still accounts for a modest share—about 20% of ACB’s corporate loan book and only 8% of its total lending portfolio. Initially, ACB is prioritizing sectors with strong growth potential, such as international trade, industrial parks, and FDI enterprises. Indeed, this trend had already begun in 2023–2024, when large corporate and FDI lending was identified as a lever to offset the slowdown in retail lending.

A more balanced approach between retail and wholesale banking allows ACB to broaden and deepen its client base, while aligning with global supply chain shifts. This is also forward-looking, as Vietnam continues to attract a diversified and higher-quality stream of FDI, increasingly concentrated in high-tech and knowledge-intensive sectors.

That said, wholesale banking, particularly in manufacturing, export, and FDI-related lending, carries its own risks. For example, when the U.S. announced steep tariffs in April, banks promptly disclosed the proportion of loans to these client groups. For ACB, the corporate loan portfolio remains relatively conservative—short-term focused, low-risk appetite. But to fully capture large corporates, especially FDIs that often bank with global institutions or receive financial backing from parent companies, ACB must offer a distinctive value proposition to compete.

Growth Outlook

With this strategy of expanding its corporate banking pillar, VDSC forecasts ACB’s credit growth CAGR at about 18.5% during 2025–2030. Within this, personal lending is projected to grow at 17% CAGR, while corporate lending may reach 21%. Net interest margin (NIM) is expected to recover from its 2025 trough of 3.10% to 3.45% by the end of the forecast period.

Accordingly, ACB’s profits are forecast to rise 10% in 2025 and compound at 19% annually from 2026–2029. Based on VDSC’s valuation, ACB remains attractive given its asset quality outlook and efficient capital utilization.