Catalyst for the Vietnam stock market: Awaiting IPO deals

A wave of IPOs, kickstarted by TCBS and soon to be followed by VPBank Securities along with several high-profile companies, is emerging as a catalyst for Vietnam’s capital market.

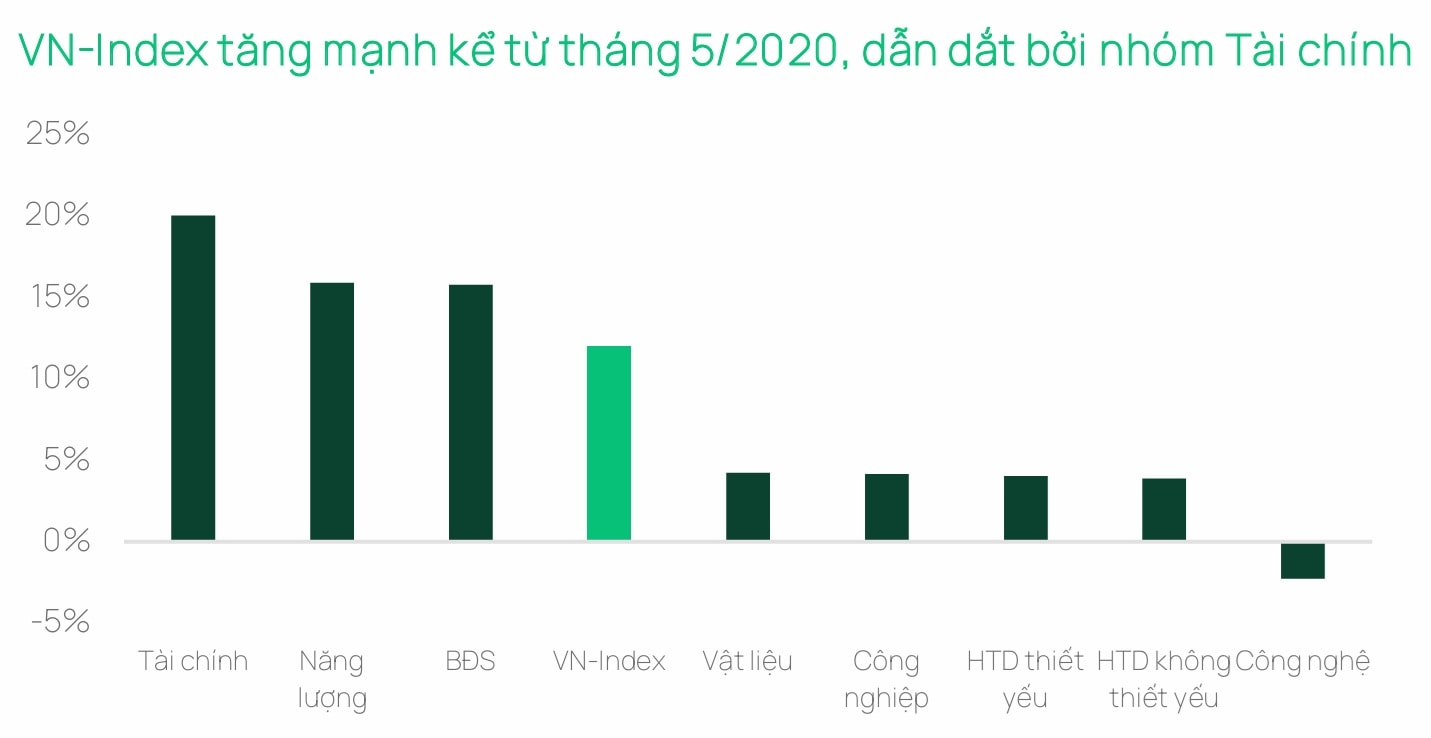

According to Ms. Đặng Nguyệt Minh, Head of Research at Dragon Capital, Vietnam’s stock market maintained a positive momentum in August as the VN-Index continuously set new records, at one point nearing 1,700 points before facing profit-taking pressure at the end of the month. In USD terms, the VN-Index rose 11.5% — the strongest gain since May 2020. Market liquidity reached record highs, with average daily trading value of about USD 1.9 billion and peaking at USD 3.3 billion (on August 5).

“The main driver came from domestic investors, with more than 250,000 new accounts opened during the month — a 13.8% increase from the previous month. This partly offset net selling pressure from foreign investors, which mainly targeted block trades in Vingroup stocks as well as the banking, steel, and technology sectors. The current rally is being led by domestic retail investors, while foreign capital remains cautious,” Ms. Minh said, adding that although market momentum and liquidity remain strong, short-term corrections are still possible due to profit-taking, trade volatility, geopolitical tensions, or exchange rate risks.

Notably, according to Dragon Capital, the IPO market has restarted with many positive signals. Techcom Securities (TCBS) is in the process of completing procedures to list this year. With an expected market capitalization of over USD 4 billion, TCBS could become the largest listed securities firm in Vietnam.

For its IPO, from August 19 to September 8, 2025, TCBS opened registration and deposit payments. Investors subscribed for more than 575.16 million shares, 2.5 times higher than the 231.15 million shares offered. TCBS said the total subscription value reached VND 27 trillion (over USD 1 billion), reflecting strong interest from international investment funds across continents. This indicates the appeal of TCBS and its pioneering Wealthtech model in Vietnam, while also building positive expectations for liquidity and valuation once the shares are officially listed, expected in Q4/2025. The company announced a pro rata allocation ratio of 40.18% for investors.

“This news triggered a revaluation wave of securities firms in mid-August, reflecting the sector’s sensitivity to large listings and suggesting that upcoming IPOs could become catalysts for the market,” noted Ms. Đặng Nguyệt Anh.

Following TCBS, VPBank Securities is also preparing for an IPO, aiming to raise about USD 170 million, equivalent to a 25% stake, in the coming quarters. Additionally, several other companies in infrastructure and retail — including Gelex Infrastructure, C.P. Vietnam, Highlands Coffee, and spin-offs from Mobile World’s retail chain — are also highly anticipated by the market.

Looking ahead, many companies have mid- to long-term IPO plans, with Long Châu, Viettel IDC, Meey Group, and EST Vietnam among those on the list. The expected revival of the real estate sector may also accelerate IPO prospects for corporations and ecosystem-linked businesses seeking capital, listings, improved governance, greater transparency, and opportunities to expand in scale and value.

On September 11, the Government issued Decree No. 245/2025/ND-CP, amending Decree 155/2020/ND-CP guiding the implementation of the Securities Law, adding Article 111a on simultaneous IPO registration and listing. Under the new rules, shares can be listed immediately after the IPO, protecting investors’ rights and improving capital-raising efficiency. The process is shortened, with listing applications reviewed in parallel with IPO applications. Once the offering is completed, companies only need to provide updated information to obtain listing approval.

The Decree also shortens the time to bring securities into trading from 90 days to 30 days after approval, meaning shares can reach investors 3–6 months earlier than before. This change is expected to increase the supply of quality stocks, expand investor choices, and attract both domestic and international capital.

Assessing the macro environment, Ms. Đặng Nguyệt Anh said that both macroeconomic and sector indicators reinforce a positive outlook. Public investment disbursement in August rose 34.5% year-on-year, while realized FDI grew 12.5%, pushing total registered FDI in the first eight months to USD 26.1 billion, up 27.3% year-on-year. This shows robust capital support from both public and private sectors.

Trade also maintained double-digit growth, with exports in August rising 14.5% and imports up 17.7% year-on-year, resulting in a trade surplus of around USD 3.7 billion. Inflation remains under control, with CPI in August up 3.2% year-on-year and core inflation stable at around 3.2%, slightly lower than July. Industrial production grew 8.9% year-on-year, while PMI eased slightly to 50.4 as orders normalized after a surge the previous month.

On monetary policy, the banking sector recorded strong credit growth of 11.1% year-to-date by end-August. The State Bank of Vietnam cut reserve requirements by half for banks undergoing restructuring and deployed cancelable forward contracts to stabilize the exchange rate, after the dong depreciated about 3.3% since the start of the year — a signal of the central bank’s readiness to intervene decisively to support liquidity and exchange rate stability.

In particular, Ms. Đặng Nguyệt Anh highlighted that the Government issued Resolution 05/2025/NQ-CP, officially launching a five-year pilot framework for the issuance and trading of digital assets. Licensed platforms must have a minimum charter capital of VND 10 trillion, with dominant participation from institutional investors and foreign ownership capped at 49%. All transactions must be settled in VND, and only domestic firms are permitted to issue new digital assets.

“In the context of Vietnam ranking fifth globally in cryptocurrency adoption, with holdings estimated at around USD 100 billion, Resolution 05/2025 marks a key step toward rapid and orderly market development. We believe this framework will mitigate speculative risks by restricting unregulated platforms, while positioning Vietnam to become one of Asia’s regulated digital asset hubs in the near future,” said Dragon Capital.

Previously, the fund manager had proposed a pilot project for tokenized ETFs. According to Dragon Capital, Vietnam’s consistent ranking in the top five of Chainalysis’ Global Crypto Adoption Index for four consecutive years — including two years at the top — reflects strong retail investor participation, despite limited regulatory support. This trend creates opportunities for capital market development and financial inclusion, in line with the global rise of retail investors. However, insufficient infrastructure and regulation for digital assets have left a large portion of trading unregulated, resulting in weak investor protection.

The company also noted that the Government’s requirement to establish a dedicated exchange for digital assets is a milestone in the nation’s digital economy strategy. Launching a regulated exchange creates a strategic opportunity for tokenized ETFs to become the first assets listed on this platform, primarily issued by asset management companies.