Will gold price go sideways after Jackson Hole Symposium?

According to many analysts, the gold price is unlikely to rise sharply next week after the Jackson Hole Symposium because investors remain cautious.

In the Vietnamese gold market, the price of SJC gold bars listed by DOJI also increased sharply from VND 124.7 million/tael to VND 126.6 million/tael.

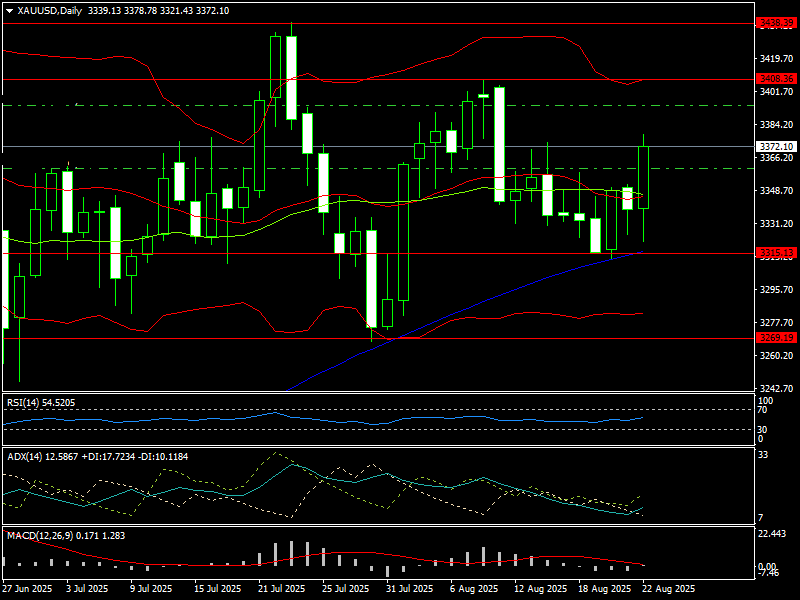

This week, after opening at USD 3,336/oz, the price of gold briefly fell to USD 3,311/oz, but then gradually recovered and surged to USD 3,378/oz after FED Chairman Powell's speech at the Jackson Hole Symposium.

In the Vietnamese gold market, the price of SJC gold bars listed by DOJI also increased sharply from VND 124.7 million/tael to VND 126.6 million/tael.

The dovish tone that markets had been anticipating was delivered by Federal Reserve Chairman Jerome Powell in his much awaited speech at the Jackson Hole Economic Symposium, which caused notable swings in the currency and commodities markets. Powell's well-chosen wording gave traders the security they needed about the direction of the Fed's monetary policy, especially indicating that interest rate decreases are probably going to start next month.

The market reacted sharply at first, and when investors adjusted their expectations, the US dollar saw significant declines. As expected monetary easing and currency strength are inversely correlated, the dollar index lost 0.90% of its value, falling to 97.73. Because gold prices usually rise when the dollar declines, this currency weakening produced good conditions for gold prices.

Powell pointed out that there is still opportunity to lower interest rates, but he also emphasized the mounting economic concerns of slowing economy and rising inflation. "The baseline outlook and the changing balance of risks may warrant adjusting our policy stance, as policy is in restrictive territory," he stated.

Gold prices may go sideways next week

Powell's remarks obviously favor easing in September, according to economists, but it doesn't indicate the central bank will be ready to lower rates significantly through the end of the year, despite what the market anticipates. Markets are pricing in the possibility of two more rate cuts before the year ends, according to the CME FedWatch Tool.

Powell stated that it was time to prioritize employment above inflation, even if their mandate was at danger from both increased unemployment and inflation. Chris Zaccarelli, Chief Investment Officer for Northlight Asset Management, acknowledged that the present level of interest rates is a bit too high, but he was clear that one rate decrease did not guarantee the Fed would follow that with a series of future rate cuts on a predetermined trajectory.

The market is still stuck in its wider range, even if Powell's dovish outlook has given gold some fresh upward momentum. Philip Streible, Chief Market Strategist at Blue Line Futures, stated in an interview with Kitco News that he believes there is still room for increased gold prices the next week, but there are dangers involved. Because a lot more economic data still has to be disclosed before the FOMC's September meeting. Furthermore, gold prices have already substantially factored in predictions of a rate decrease by the Fed in September. Additionally, gold demand is low throughout the summer.

As a result, it is doubtful that the price of gold will rise much the following week. Unless there is an unexpected geopolitical incident, there is a chance that the price of gold may drop below the $3,400/oz mark next week as it approaches that level due to profit-taking pressure.

Economic data to watch next week:

Monday: US New Home Sales

Tuesday: US Durable Goods Orders, US Consumer Confidence

Thursday: US Preliminary Q2 GDP, US weekly jobless claims, US Pending Home Sales

Friday: US PCE Index, personal income and spending