Oil and gas sector: Rising tide lifts all boats

There are similarities in the global economy between the 2020-2021 period and the 2009-2010 period when oil prices significantly hiked after the 2008 financial crisis.

FED and other central banks remain in the low interest rate environment and provide QE stimulus to support the economic recovery after the crisis.

The commodity prices significantly increase from the trough caused by Covid-19. Bloomberg Commodity Index surged over 77% from April 2020, showing a significant increase in commodity price, similarly to the upward revision in 2010 after the 2008 crisis.

Thanks to production expansion, the PMI index also shows the same signal between the two periods, said VNDirect.

In fact, oil demand is on track to recovery. By July 22, 2021, Brent crude futures rose $2.88, or 4.2%, to settle at $72.23 a barrel. U.S. West Texas Intermediate (WTI) crude futures rose $3.1, or 4.6%, to settle at $70.30 a barrel. The International Energy Agency (IEA) said in its monthly report (May 2021) oil demand has outstripped supply and the shortfall is expected to grow even as Iran ramps up exports.

OPEC ministers agreed on July 18, 2021 to boost oil supply from August to cool prices which have climbed to 2-1/2 year highs as the global economy recovers from the coronavirus pandemic.

Besides, President Joe Biden has put the U.S. shale oil industry on edge with his plans to reform O&G permitting and leasing practices on federal land and federal water (aiming to deal with climate change). This could affect U.S oil production in the long term. For 2021F, EIA forecasts the U.S. oil production to be 10% lower than the pre-Covid level. While the total capital spending in E&P activities has also decreased since 2014, partially due to the green energy transmission.

However, VNDirect expects that supplies would not rise fast enough to keep pace with the predicted demand recovery, creating the shortage gap that could support the oil price stability in the price band around US$70/bbl in the coming period (similar to the stable trend in 2011-13 period due to some similarities between two periods).

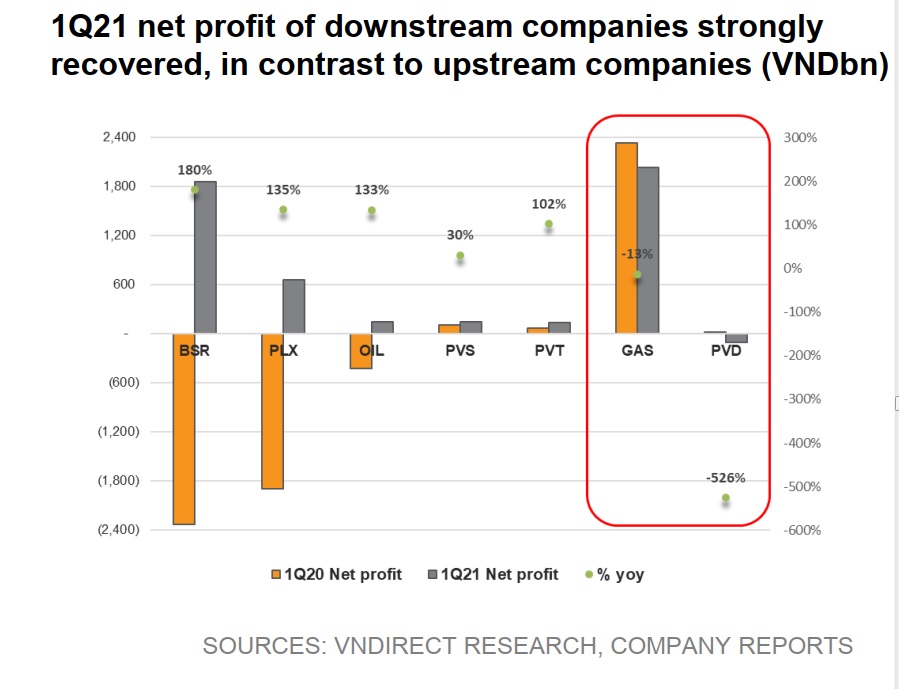

The strong oil price rally could promote Exploration & Production (E&P) activities in Vietnam, providing potential jobs for upstream companies, such as PVD and PVS. Besides, some midstream companies can gain benefits from higher oil prices like GAS, as its product selling prices are benchmarked to global oil prices.

For downstream companies, the impact depends on (1) the company-specific operation, (2) the proportion of O&G input in total production expenses, and (3) the ability to translate higher input prices to selling prices.

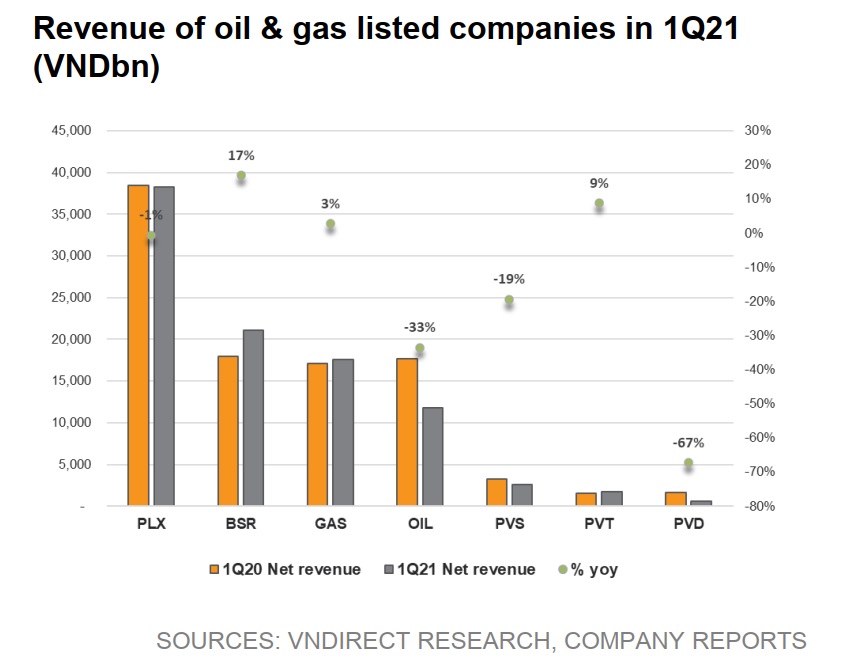

While Southern Asia average Jack-up day rate and utilization rate have the signals of recovery in later-1Q21. The regional drilling market in 1Q21 was still quite gloomy compared to 1Q20 due to the complicated pandemic. VNDirect sees the recovery signals in later-1Q21 when the steady oil price rally seems to heat E&P activities.

For PVD, the sluggish market negatively affected the company results until 1Q21. VNDirect expects that the warming regional drilling market and pandemic under control thanks to vaccination help PVD’s jack-up utilization recover from 2H21F onwards, especially from 2022F when PVD’s fleet could operate abroad like 2019.

Meanwhile, PVPower (POW) announced the opening of the EPC bid for Nhon Trach 3&4 LNG-based power plants in July 2021. VNDirect expects Nhon Trach 3 to be soon constructed and go online in 2023F to meet the LNG supply from Thi Vai terminal phase 1.

GAS and PVT will be the biggest beneficiaries as (1) GAS could raise its gas sales volume through distributing LNG to power plants, and (2) PVT would likely participate in transporting imported LNG.

Due to the high correlation with the Brent oil price movement, VNDirect supposes that the expected steady oil price in the coming period would be the key driver for stocks in the oil & gas value chain, such as GAS, BSR, PVT, PVS, etc.

PVS’s P/E has risen at a quicker pace than the oil price rally to the highest level since 2017, absolutely outperforming in comparison to Brent oil price and other stocks’ P/E movements. Meanwhile, GAS and PVT still have a potential upside compared to their history amid the same oil price level, said VNDirect.