Picking stocks with a "defense first, attack later" strategy

According to Mr. Hoang Huy, an analyst at Maybank Investment Bank, the Vietnamese stock market has had a positive start to the Year of the Dragon, indicating a prosperous year ahead for investors.

Accordingly, Mr. Huy expects two possibilities for the VN-Index in 2024: 1,250 points (11% in the absence of a market upgrade) and 1,420 points (26% if the upgrading process is more definite by the end of 2024).

In all scenarios, the expert predicts severe market volatility in the first half of 2024 due to divergent perspectives on the pace of recovery and dangers in the banking and real estate industries. The market is projected to pick up in the second half of 2024 as confidence in a stronger recovery emerges.

On February 15, the sixth day of the Lunar New Year, the VN-Index closed at 1,202 points, up about 4 points from the previous year's final session. This is the highest level since the end of September 2023, some five months earlier.

With prospects of an economic and stock market revival, there is optimism regarding cyclical sectors, particularly those associated to consumption. The base case scenario focuses on organizations that are likely to achieve strong and/or extraordinary profit growth. Defensive stocks with net cash positions and a track record of steady dividend payments should also be evaluated.

In the positive scenario, the expert recommends large-cap companies with greater betas, particularly those with room for overseas investors. Aside from the companies chosen for the base scenario, the focus portfolio will comprise retail, steel, real estate, finance, energy, and IT.

2024, unlike the uncertain outlook of 2023, has started with a clearer economic recovery path. This has placed most high-growth and attractively valued sectors in the profit-valuation matrix for 2024, compared to the dispersion in 2023. Specifically:

For retail, Mr. Huy expects rapid economic growth, especially in the second half of 2024, to boost consumer confidence, leading to a boost in consumption-related sectors. The retail sector's profit growth is forecasted at 113% with a PE ratio of 26.5 times for 2024. The retail sector once traded at a PE ratio of 40 times during the Covid-19 years due to strong profit growth, with an actual 3-year average PE of 28 times. Preferred stocks in this sector include MWG, PNJ, DGW, FRT, and MSN.

The Maybank expert has an optimistic prognosis for the IT industry (mostly represented by FPT), citing worldwide digital transformation tendencies. Profit growth is expected to be 24.5% year on year in 2024, and the stock is trading at a PE ratio of 15.0 times, compared to a three-year average of 20.0 times.

The energy industry remains favorable, with upstream firms continuing to gain from the revival of large domestic oil and gas projects such as Block B - O Mon. Profit growth is expected to be 9.7% year on year, and the stock is trading at a PE ratio of 12.2 times in 2024, compared to a three-year average of 19.3 times. PVD and PVS are among the selected equities.

The beverage industry is considered neutrally since input costs and profit cycles have returned to normal levels, while the maritime logistics sector is viewed positively because export recovery is expected to be mild this year.

The real estate sector's outlook has been raised from negative to neutral, with expectations of a clear recovery path. Profit growth is expected to be 11.5% year on year in 2024, and the stock is trading at a PE ratio of 8.0 times, compared to a 3-year average PE of 12.4. Stocks under consideration are KDH, NLG, PDR, and DXG.

The steel industry likewise has a neutral outlook. Although profit growth is likely to accelerate in 2024 (because to a low comparative base), values for many equities in the industry have already been reflected in their prices. Mr. Huy expects profit growth of 66% year on year in 2024, with a PE ratio of 15.0 times, compared to a three-year average PE of 8.8 times. HPG is the preferred stock for investment positions (which will gain greatly if the FTSE classifies Vietnam as an emerging market). HSG and NKG should also be evaluated as short-term trading chances.

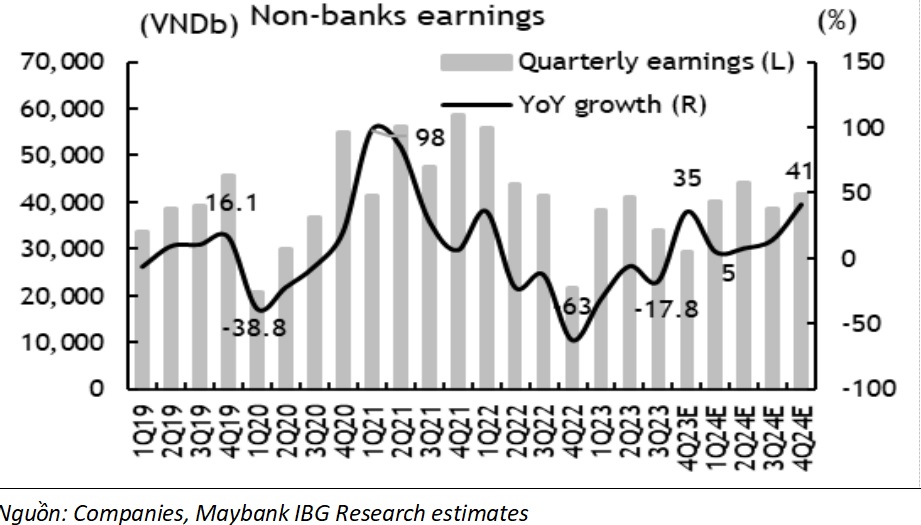

Finally, the financial industry is still expected to perform well. The banking sector's profit growth has been consistent throughout the Covid-19 period and the 2022 recession, allowing top banks to retain ROEs above 20% and industry ROEs above 17%. The 17 major listed banks all traded at a P/BV of 1.3 times in 2023 (around the lowest levels during the Covid period and the Q4/2022 crisis), with a P/BV of only 1.1 times in 2024.

However, the market's general mood and investor view of the sector are now negative. In our opinion, the average profit growth forecast is insufficient to drive significant price increases for the entire sector; concerns about the non-performing loan ratio caused by the economic downturn and real estate crisis must be addressed before the sector can record significant price increases.

As a result, the expert predicts that the banking industry would develop at a slower rate than other industries. Banks with long-term benefits (including leading positions, business models, high asset quality, and loan loss provisioning) and discounted values, such as TCB, VCB, and MBB (for investment positions) and STB, HDB, and CTG (for active trading), continue to be attractive.