POM in Turmoil

Pomina Steel Joint Stock Company (HoSE: POM) has been plunging deeper into difficulties, reporting its 11th consecutive quarterly loss.

Amid this bleak reality, POM has been stepping up efforts to restructure its operations but continues to face numerous challenges and obstacles.

11 Consecutive Loss-Making Quarters

According to its Q4/2024 financial report, POM’s revenue surged by 125% year-on-year to VND 751 billion. However, the cost of goods sold increased sharply, dragging gross profit down to just VND 9.6 billion—a 56% decrease compared to the same period in 2023. Meanwhile, financial expenses alone reached over VND 146 billion. As a result, POM recorded a post-tax loss of more than VND 199 billion.

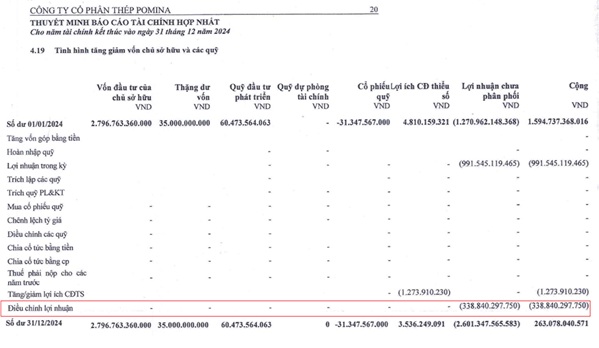

This marks the 11th consecutive quarter of losses for POM. For the full year 2024, the company posted a loss of VND 991 billion—its third straight year of post-tax losses. Since 2022, POM has incurred massive losses amounting to trillions of dong annually. In 2023 alone, the company lost VND 960 billion. To date, its accumulated losses have reached VND 2.601 trillion.

POM explained that the continued losses in early 2024 were due to the Pomina 3 and Pomina 1 steel plants remaining idle while still incurring management and interest expenses. Interest payments made up the largest portion, driving the company further into the red.

In an attempt to reverse the situation, the company is actively seeking investors to restructure its operations and resume production and business as soon as possible.

The Burden of Debt

As of the end of 2024, POM's total assets stood at VND 9.903 trillion, with short-term assets accounting for VND 2.519 trillion. However, short-term liabilities made up VND 8.921 trillion. The company’s total liabilities were VND 9.640 trillion—up by more than VND 8.8 trillion since the beginning of 2024. This amount is 36 times higher than POM’s equity.

In 2024, the company’s interest expenses totaled VND 663 billion, equivalent to over VND 1.8 billion in interest payments per day.

Currently, BIDV Ho Chi Minh City Branch and VietinBank Ho Chi Minh City Branch are POM’s largest short-term lenders, with outstanding loans of VND 1.687 trillion and VND 2.626 trillion, respectively. Additionally, POM has borrowed VND 300 billion from Dai Quang Minh.

Notably, most of POM’s assets are tied up in construction-in-progress costs for the blast furnace and EAF projects at Pomina 3, with a combined value of VND 5.723 trillion. This is a billet production project with a capacity of 1 million tons/year in the Phu My Industrial Park.

Due to its mounting debt and ongoing losses, the Ho Chi Minh City Stock Exchange (HoSE) has decided to forcibly delist nearly 280 million POM shares from May 10, 2024. The reason cited was the company’s failure to submit audited financial reports for three consecutive years, which falls under mandatory delisting criteria.

As of the trading session on March 25, POM shares were priced at only VND 2,000 each—below book value and among the lowest-priced stocks in the steel industry.

Restructuring Challenges

Although POM has officially announced an investment agreement with a Japanese partner, specifically at the Pomina 2 Phu My Plant, it has signed an investment cooperation agreement with its strategic partner, Nansei Steel Corporation of Japan. This marks a major step toward POM’s comprehensive restructuring strategy.

According to the agreement, Nansei will provide sufficient raw materials for Pomina 2 to operate at full capacity. The partnership aims to optimize the supply chain—from raw materials to production and distribution—enhancing POM’s operational efficiency.

At POM, the partnership with Nansei is considered a “fresh breeze” that could help stabilize production amid mounting losses and meet the rising demand in the steel market as the domestic real estate sector recovers.

In parallel with the Nansei collaboration, POM has also signed memoranda of understanding with other professional investors, aiming to restart the blast furnace project in early 2025. Although POM has not disclosed specific plans, a company representative said these moves are intended to get ahead of the expected resurgence in construction and real estate demand as public investment and infrastructure projects pick up again.

However, Vietnam’s steel market still faces significant challenges. Mr. Nghiem Xuan Da, Chairman of the Vietnam Steel Association, noted that the market remains volatile and fraught with difficulties, and the outlook for Q2 and Q3 of 2025 is still uncertain. Additionally, Vietnam’s steel industry is heavily affected by the Chinese market. With China’s real estate sector in a deep freeze and steel inventories running high, Chinese manufacturers are ramping up exports.

Vietnam is currently the largest export market for Chinese steel in Southeast Asia. According to Vietnam Customs data, the country imports more than 2.8 million tons of steel from China annually. Given the weak domestic demand and a still-sluggish real estate sector, the influx of cheap Chinese steel will put immense pressure on local producers. This is a key reason why domestic steel firms, including POM, are struggling to sell their products.

As such, restructuring remains an enormous challenge for POM under the current circumstances.