What challenges for RAL?

Rang Dong Light Source and Vacuum Flask JSC (HoSE: RAL) is facing growing challenges as its market share continues to shrink.

RAL is accelerating business restructuring efforts.

In response to these difficulties, RAL has been actively restructuring its operations and making significant investments in technology—especially in the application of artificial intelligence (AI)—to enhance its competitiveness.

Mounting Challenges

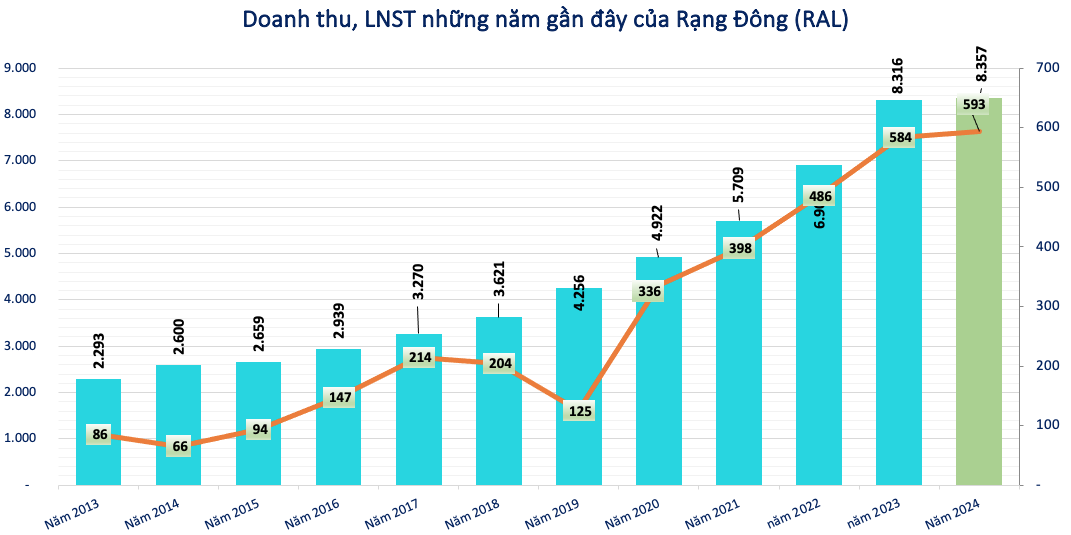

Founded in 1961 as Rang Dong Light Source and Vacuum Flask Factory, RAL now has a history of over 60 years. The company currently operates in three main segments: lighting, vacuum flasks, and smart solutions, supported by a widespread distribution system. However, RAL’s market share is gradually shrinking due to intensifying domestic competition and stagnating export markets. Most recently, RAL released its Q1 2025 financial results, which painted a bleak picture.

Specifically, RAL posted revenue of VND 1,528 billion, down 46% year-over-year. Net profit after tax reached nearly VND 101 billion, a 48% decline compared to Q1 2024. As of the end of Q1 2025, RAL’s total assets fell by 3% to VND 8,089 billion, while inventory rose by nearly 18% to VND 2,090 billion.

In a statement explaining the decline in business performance, RAL cited several reasons, including the "flood" of foreign goods—particularly from China, where excess production capacity has led to an influx of low-cost products into Vietnam—further intensifying competition.

In addition, international corporations with modern business models and online platforms have dominated Vietnam's market of over 100 million people, putting RAL at a disadvantage. The rapid transformation brought on by digital technology is directly threatening RAL’s relatively outdated business model.

To cope with shrinking market share, RAL’s management has liquidated financial investments, collected debts from partners, boosted sales efforts, and negotiated with banks to increase credit lines for production and operations. Nevertheless, the company's business outlook remains bleak, as reflected in its Q1 2025 results.

Besides underwhelming business performance, RAL is also burdened with a heavy debt load. As of Q1 2025, the company's total liabilities reached VND 4,684 billion—significantly exceeding its equity. Notably, short-term debt accounts for nearly 100% of total liabilities, indicating significant repayment pressure.

Additionally, RAL has expressed concerns about new tax policies. Specifically, the removal of lump-sum tax and the application of revenue-based tax calculations have led dealers to request direct discounts on product prices. RAL estimates this change could reduce the company’s revenue by approximately 10%.

Restructuring Efforts

RAL’s General Meeting of Shareholders approved a resolution targeting VND 6.1 trillion in revenue for 2025—a significant decrease from 2024. The pre-tax profit goal is VND 395 billion, down 37% and the lowest since 2019.

According to the management, this year's business plan is formulated amid market volatility and growing competition. Foreign products—especially low-cost Chinese goods—are flooding into Vietnam, while many manufacturers are shifting operations into the country, further escalating competitive pressure.

RAL’s export activities are also expected to face headwinds. Potential tariff increases by the U.S. may undermine prospects for RAL’s LED products in that market. Meanwhile, exports of its vacuum flasks to the Middle East are negatively impacted by Red Sea tensions and rising logistics costs.

To address these challenges, RAL will continue to invest heavily in technology, particularly AI, to boost competitiveness. As a result, retaining profits rather than distributing full dividends is considered necessary. Additionally, RAL has allocated more than VND 1,000 billion from its 2021 capital raising round to build a high-tech manufacturing facility at Hoa Lac Hi-Tech Park. As of March 2025, RAL had disbursed nearly VND 400 billion for this project. The project, which has a total investment of over VND 2,300 billion, began construction in October 2024 and is expected to be operational by early 2027.

The project has experienced delays due to a change in the governing authority from the Ministry of Science & Technology to Hanoi’s municipal administration. However, RAL sees a silver lining in the delay, noting that if the plant had commenced operations amid current weak demand, increased production would not have yielded efficiency or returns.

Due to the continued business difficulties and looming challenges, RAL's stock has dropped sharply to VND 97,000/share, its lowest in nearly six months. Since the beginning of this year, RAL’s stock has fallen over 30%, cutting its market capitalization down to VND 2,000 billion.