Rising USD/VND rates have mixed impacts on the economy

The USD/VND has risen over the past time. Until mid-September 2023, the VND is currently depreciating 2.5% YTD against the USD.

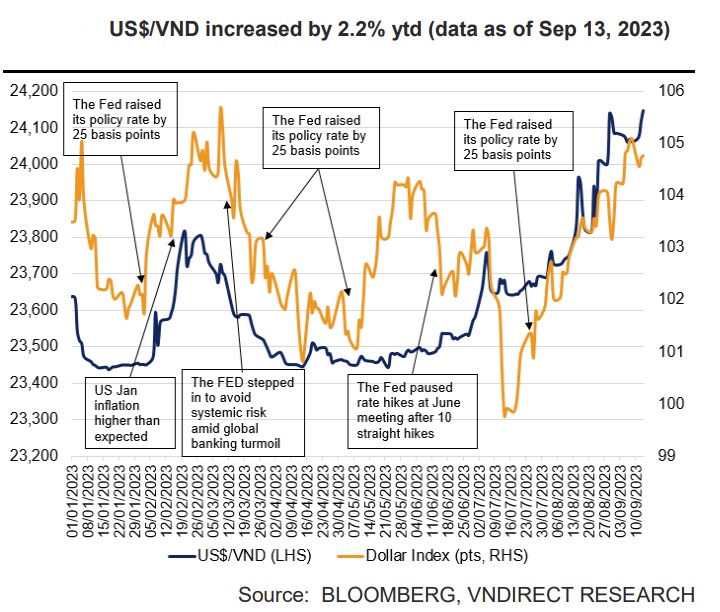

Stronger DXY has put more pressure on the VND exchange rate

>> What is causing the USD exchange rate to rise?

The Dollar Index (DXY) climbed to 104.8 points on September 13, 2023 (2.9% compared to the end of July). The rise in DXY was driven by: (1) a higher probability that the Fed could raise policy rates one more time this year due to stronger economic data; and (2) the U.S. government bond yields climbed higher as the U.S. government boosted the issuance of government bonds to cover the budget deficit.

Stronger DXY has put more pressure on the VND exchange rate as the interbank US$/VND exchange rate climbed to 24,147 on September 13, 2023 (1.9% compared to the end of July and 2.2% ytd). The pressure is further increased by: (1) China's monetary easing added more pressure to the CNY, and in the past, VND was highly correlated with the CNY; (2) domestic inflation picked up. Meanwhile, the US$ also appreciated against most regional currencies, notably the Philippine Peso (1.8% ytd), Thai Baht (3.2% ytd), Chinese Yuan (5.1% ytd), and Malaysian Ringgit (6.3% ytd).

Over the past time, the central rate has increased by VND 43, from VND 23,993/USD to VND 24,036/USD. The exchange rate at commercial banks increased by VND 187, from VND 24,061/USD to VND 24,248/USD. The VND is currently depreciating 2.5% YTD against the USD. However, compared with developments in other currencies in the region, the devaluation of the VND compared to the USD is not too substantial. The VND is currently stronger than many currencies in the region.

>> USD/VND exchange rate pressure by year-end

Rising exchange rates will increase debt repayment (especially for the private sector). It also increases the price of input materials for production and imported consumer goods, thus lifting domestic inflationary pressure. Therefore, the greater the exchange rate pressure, the less room there is for the SBV to continue reducing its policy interest rates.

Mr. Dinh Quang Hinh, senior analyst at VNDirect, believes that the SBV will pause its policy rate cuts at least until the first half of 2024 because the SBV needs to focus more on macroeconomic stability in the context of emerging inflation and FX pressure. He sees that the SBV still has a number of supportive factors to stabilize the exchange rate, including: (1) a high trade surplus; (2) resilient FDI and remittances; and (3) more foreign currency supply from equity sales to foreign investors. Limiting the VND/US$ exchange rate within an appropriate range (<3%) will help minimize negative impacts and improve the competitiveness of <3%) will help minimize negative impacts and improve the competitiveness of Vietnam’s exports.

“We believe that the moderate depreciation of VND against USD (<3%) will support export performance. In addition, we think that this is less likely to trigger strong foreign investment flows out of Vietnam”, said Mr. Dinh Quang Hinh.