USD/VND exchange rate pressure by year-end

The USD/VND rate remains under strong pressure towards the end of this year as a result of the contrasting monetary policies of the United States and Vietnam, while the amount of volatility may remain manageable.

According to KB Vietnam, the Fed's and the SBV's opposing monetary policies have widened the interest rate differential between the USD and the VND, increasing demand for keeping and acquiring USD and exerting pressure on the exchange rate.

Persistent Pressures

KB Vietnam said, the Fed's (continuing rate hikes and maintaining high interest rates) and SBV's (lowering interest rates four times in the first half of the year and possibly considering further cuts in the near future) divergent monetary policies are expected to continue throughout the year's final six months. This divergence is extending the interest rate differential between the USD and the VND, increasing demand for USD holdings and purchases and putting pressure on the exchange rate.

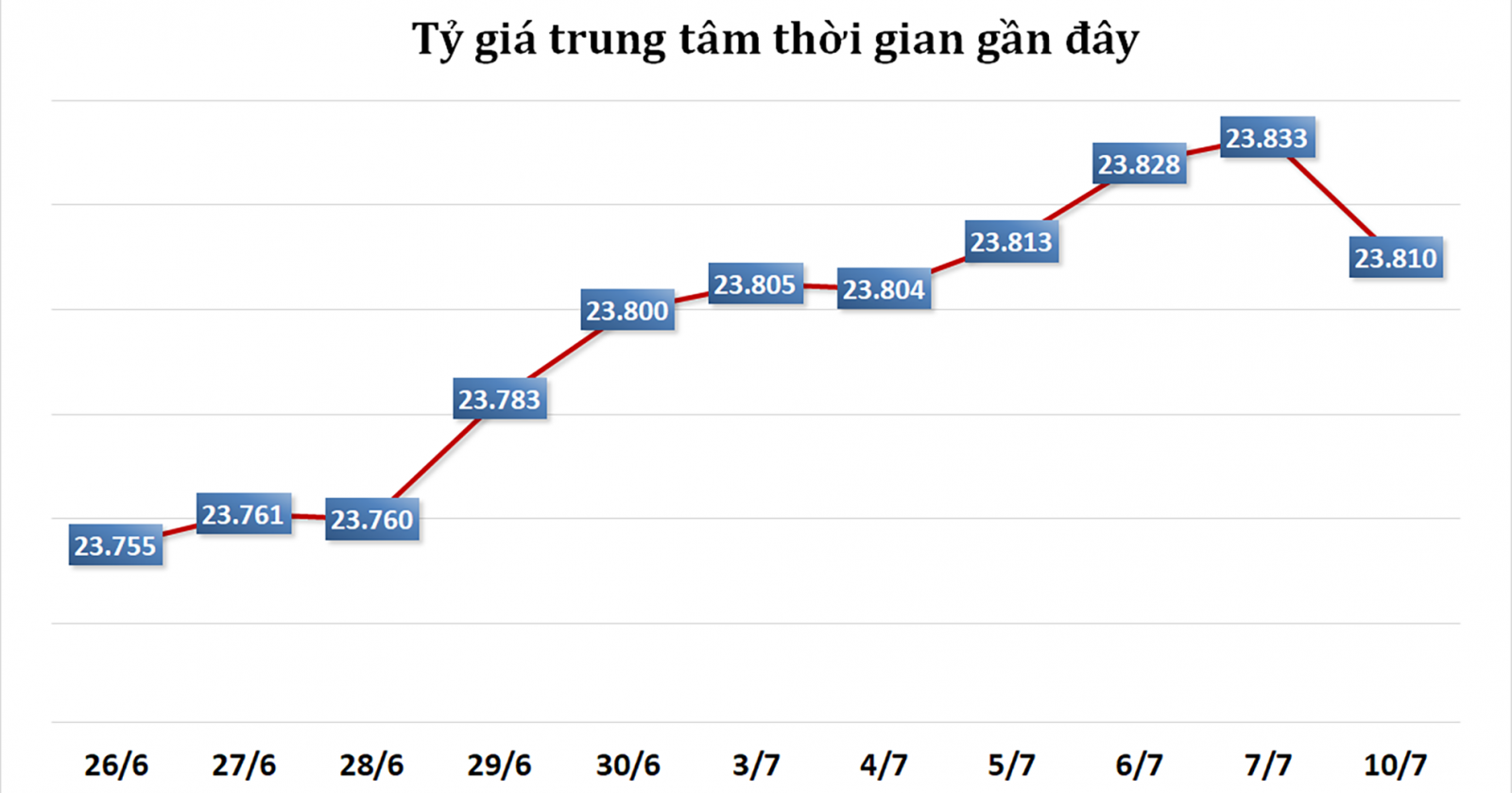

In actuality, the USD has recovered well in the worldwide market following the Fed's interest rate rise on July 26. The USD index is now hovering at 102.3 points, suggesting a 2.5% gain over the previous month. This USD rebound has also put major downward pressure on the indigenous currency. As a result, the VND/USD central exchange rate has risen by 100 VND over this period and by 66 VND from the Fed's interest rate hike till now. Banks' purchasing and selling prices of USD have likewise risen by roughly 70-80 VND/USD.

In addition to the pressure from the USD's resurgence, inflation is a hidden concern for the currency. According to analysts, the ongoing war between Russia and Ukraine has not been addressed and continues to pose a substantial risk to global raw material and commodity prices. Domestically, factors such as increased power prices and basic pay increases from July 1st are projected to have a negative influence on inflation, putting extra pressure on the currency.

VNDirect's experts also highlight several factors that could influence the USD/VND exchange rate in the second half of 2023, such as the possibility of the Fed keeping interest rates high until the end of the year to combat inflation, while the SBV considers lowering interest rates to support growth. Domestic inflation may also begin to climb in the third quarter of 2023.

Balancing Interest Rates and Exchange Rates

Nonetheless, economists expect a number of supportive factors for the year-end exchange rate. The economy's abundant foreign currency supply is due to a considerable trade surplus (reaching 15.23 billion USD over 7 months), continuous FDI capital disbursement (reaching 11.58 billion USD over 7 months), remittances, and tourist earnings.

The SBV recently bought a considerable quantity of foreign currency to enhance the national foreign exchange reserves, owing to the robust foreign currency supply. This is a critical resource for the SBV's engagement in market stabilization. Furthermore, the SBV's exchange rate management has grown more seamless and adaptable.

As a result, the majority of specialists and financial organizations expect that the exchange rate will fluctuate only slightly in the coming year. The VND is predicted to drop by 0.5% versus the USD in 2023, according to Dr. Cn Văn Lc, a member of the National Financial and Monetary Policy Advisory Council. Dr. V Tr Thành, another member of the National Financial and Monetary Policy Advisory Council, believes that preserving exchange rate stability is not a key worry in the current environment. He emphasizes that throughout the years, Vietnam has established a foundation with positive components for exchange rate stability.

Despite concerns about exchange rate pressures in the closing months of the year, securities firms only anticipated a 1-2% increase in the exchange rate for the current year.

Despite this, experts recommend that corporations use derivative products to protect against currency risks. Furthermore, state management agencies must create a balance between interest rates and currency exchange rates. Dr. Lê Duy Bnh, Director of Economica Vietnam, advises that, while using monetary policy tools to lower lending interest rates for the economy is necessary, it should be done with caution, taking into account other macroeconomic indicators such as the consumer price index, inflation, exchange rates, and budget deficits.