What is causing the USD exchange rate to rise?

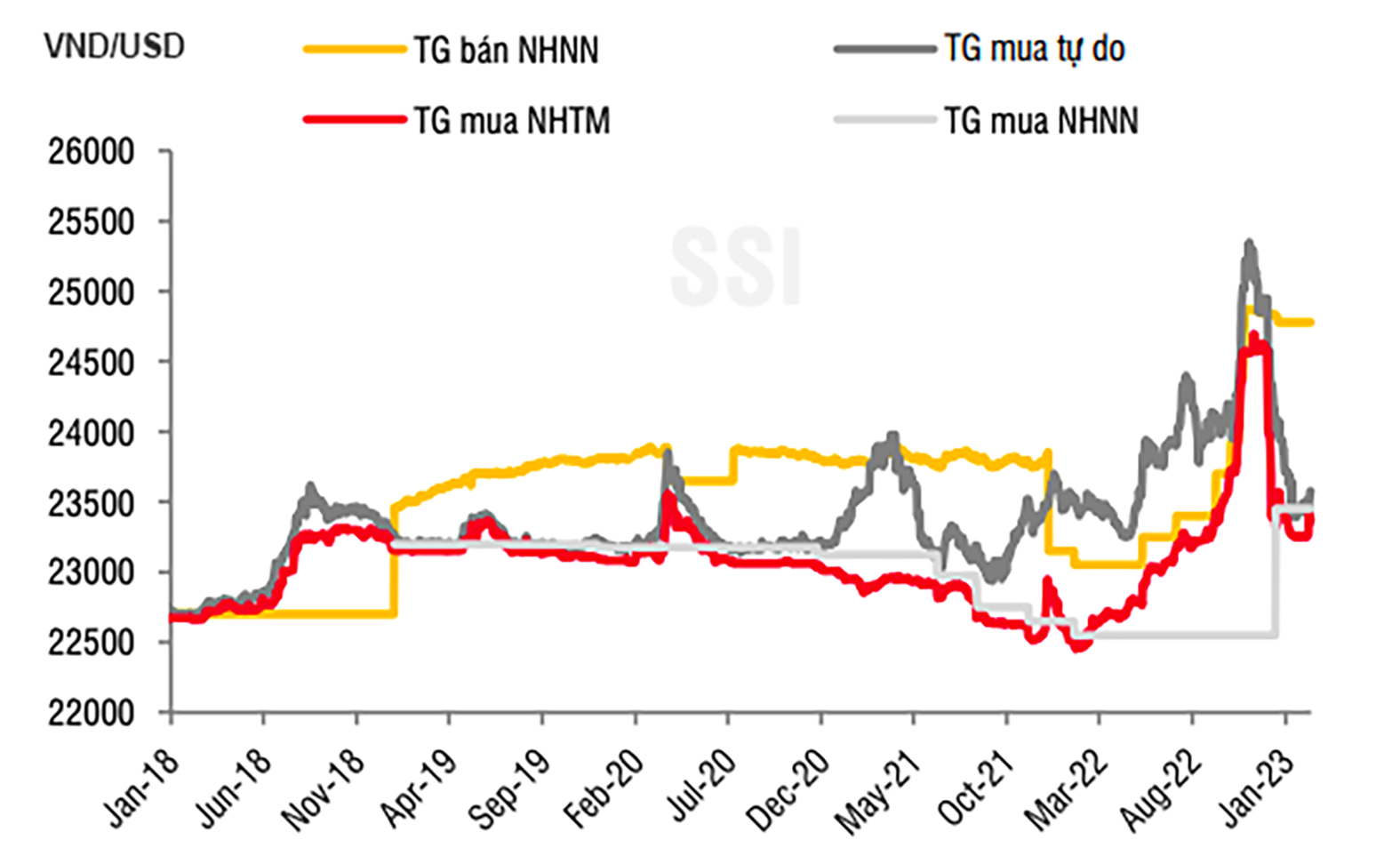

During the trading session on September 18, the VND/USD exchange rate posted by banks on the chart increased significantly, reaching the 24,500 VND threshold.

When compared to the previous weekend's foreign exchange rates of 24,055 VND/USD (for cash purchase) and 24,455 VND/USD, the quoted exchange rates on September 18 increased sharply to 24,160 VND/USD and 24,530 VND/USD, a 75 VND increase in both buying and selling rates.

According to data, the USD pricing at Vietcombank has climbed by more than 3% since the end of last year.

VietinBank, BIDV, and private banks such as Techcombank, ACB, Eximbank, and Sacombank have all boosted their purchasing and selling prices for USD at the same time, pushing the exchange rate beyond the 24,500 VND/USD mark.

According to surveys, the USD price on the open market is roughly 200-300 VND higher than the bank rate, trading at 24,250 - 24,350 VND/USD, up 70 VND in purchasing and 90 VND in selling from the previous weekend.

The State Bank of Vietnam (SBV) also increased the central exchange rate and the selling ceiling rate on September 18 to 24,046 VND/USD and 25,198 VND/USD, respectively.

According to Maybank Investment Bank (MSVN), the current pressure on the exchange rate, which is expected to peak in the third quarter of 2023, is the result of:

First, the USD-Index (DXY) surpassed 105 points, suggesting that the US economy is still growing despite tightening monetary policies and higher-than-expected basic inflation in August 2023 (0.6% MoM and 0.3% MoM).

Second, given the prevailing belief that the USD will rise, the low interest rate differential between USD and VND deposits (4%-5% in the US vs 4.5%-5.5% at Vietnamese state-owned banks).

MSVN, on the other hand, feels that the exchange rate is still under control and that monetary policy easing will continue.

According to this securities firm's analytical department, trade operations, as well as borrowing and repayment of bank loans, will expand in the remaining months of the year, implying that the foreign exchange market will stay under pressure.

"We have not observed direct intervention by SBV because the quoted USD selling rate remains relatively close to the market exchange rate (25,198 VND/USD vs. 24,430 VND/USD)." However, given the recent devaluation of roughly 3%, we expect that SBV will soon take significant moves to stabilize the market (based on around $95 billion in foreign exchange reserves). We continue our expectation that the VND would fall by 2%-3% this year. This little devaluation, together with the SBV's priority message to promote growth, leads us to expect that monetary policy easing will be maintained in the near and medium term. Long term, Vietnam's current account balance stays favorable due to trade surpluses and consistent FDI inflows as a result of the global supply chain shift, which will be the primary support factors for the VND," said MSVN analysts.

With the present quick exchange rate movement, the real VND/USD rate has met or exceeded international institutions' projections. According to Mizuho Bank, the VND/USD exchange rate will reach 24,500 and 23,800 in the third and fourth quarters of 2023, respectively.

Forecasts from Crédit Agricole CIB, Standard Chartered, and ANZ disagree. Crédit Agricole CIB forecasts the VND/USD exchange rate will reach 23,300 and 23,000 in the third and fourth quarters of 2023, respectively; Standard Chartered forecasts 23,600 and 23,400 - quite close to the current situation, though the market does not expect the exchange rate to reach 23,600 in the short term; ANZ forecasts 23,350 for the third quarter and 23,250 for the fourth quarter.

Meanwhile, Shinhan Bank forecasts that the VND/USD exchange rate would be 23,600 (23,500-23,700) in the third quarter, 23,500 (23,400-23,600) in the fourth quarter, and 23,537 (23,400-23,700) on an annual basis. Shinhan Bank anticipates that the USD/VND exchange rate would suffer short-term upward pressure in the second half of the year, commencing with the beginning of the third quarter, due to decreasing global demand, disappointing Chinese economic statistics, and a weak Chinese yuan. Following that, the USD/VND exchange rate is projected to fall as China's economic policies are adjusted and the global manufacturing sector recovers.

However, in the current context, exchange rate fluctuations are still a source of concern for domestic and international institutions and experts, as several factors indicate that the global macroeconomy is still facing multiple challenges, including inflation, rising energy prices due to supply concerns, and the impact of China's prolonged low growth expectations.