Short-term headwinds for gold prices

The rise in the US dollar in anticipation of a rate hike by the Federal Reserve (FED) could continue to weigh on gold prices.

SJC gold prices in Vietnam fell to VND 69.4 million per tael from VND 71 million per tael in this week.

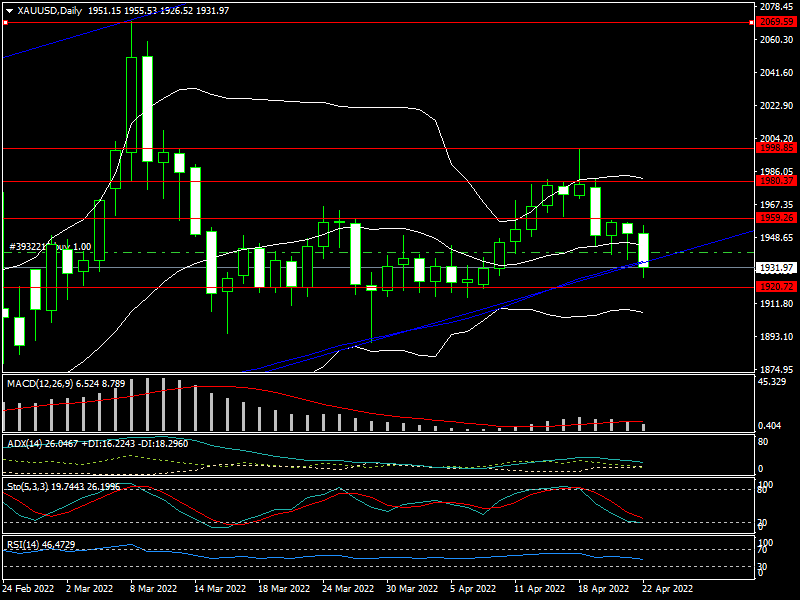

This week began with a lot of promise as gold prices tested resistance at $2,000 per ounce. However, it quickly became evident that the precious metal lacked the energy to break out as it faced a stronger dollar and rising bond yields. It dropped to $1,924 and closed at $1,931 this week.

SJC gold prices in Vietnam have fallen in line with international gold prices. It fell to VND 69.4 million per tael from VND 71 million per tael, with a low volume of transactions.

After hitting a brick wall late Monday, gold prices are down 1.7 percent for the week. While the price action is discouraging, it's impossible to be too pessimistic when looking at the current state of the financial markets. Gold is holding vital support as the US dollar index set a new two-year high, pushing above 101, and US 10-year bond rates are on the verge of breaking the 3% barrier for the first time since early 2018.

Bond yields and the US dollar have risen after FED Chairman Jerome Powell said that the US central bank is prepared to hike interest rates by 50 basis points next month. "The FED must employ all of its instruments to bring inflation and price stability under control," Powell said.

The gold market is facing some significant challenges. The fact that gold prices are still trading at a high level indicates that investors and analysts still believe there is value in the gold market.

Despite the challenges, there is plenty of bullish enthusiasm in the gold market, which will keep gold on the rise.

Mr. Colin, a forex analyst, stated that the gold prices have been consolidating and reaching new highs. Because of the stronger dollar, it is currently liquidating.

International gold prices dropped to $1,924 and closed at $1,931 this week.

"The FED's announcement of a rapid rate hike may continue to damage gold investors' mentality in the short run, causing gold prices to fall and consolidate below 2,000 USD/oz, maybe as low as 1,900 USD/oz. However, the Russian-Ukrainian conflict continues to be complicated, resulting in increased US and Western sanctions against Russia, further complicating the geopolitical and geoeconomic criss. Furthermore, when North Korea continued to test missiles, tensions on the Korean peninsula has risen, making the US and its allies more likely to have harsher countermeasures. In addition, rising Israeli-Palestinian tensions will exacerbate the Middle East crisis. All of this will only increase gold prices. So, any dips in gold and silver are buying opportunities”, Mr. Colin said.

There will be a slew of US economic data to be released next week, including updated 1Q22 GDP, durable orders, PCE, weekly unemployment claims, and so on. If these statistics bit expectations, the FED will raise rates as expected, putting downward pressure on gold prices; if they do not, gold prices will recover next week.

According to technical analysis, $1,920/oz will be a key support level for gold prices next week. Gold prices will recover to $1,950-1,980/oz if it remains above this zone. Gold prices, on the other hand, are on the verge of surpassing USD1,900/oz, or possibly $1,870/oz.