Solutions to improve the quality of Vietnam corporate bonds

According to Mr. Phung Xuan Minh, Chairman of Saigon Ratings, 2024 is an appropriate time to gradually differentiate and improve the quality of listed bonds based on credit ratings (CR) and those without.

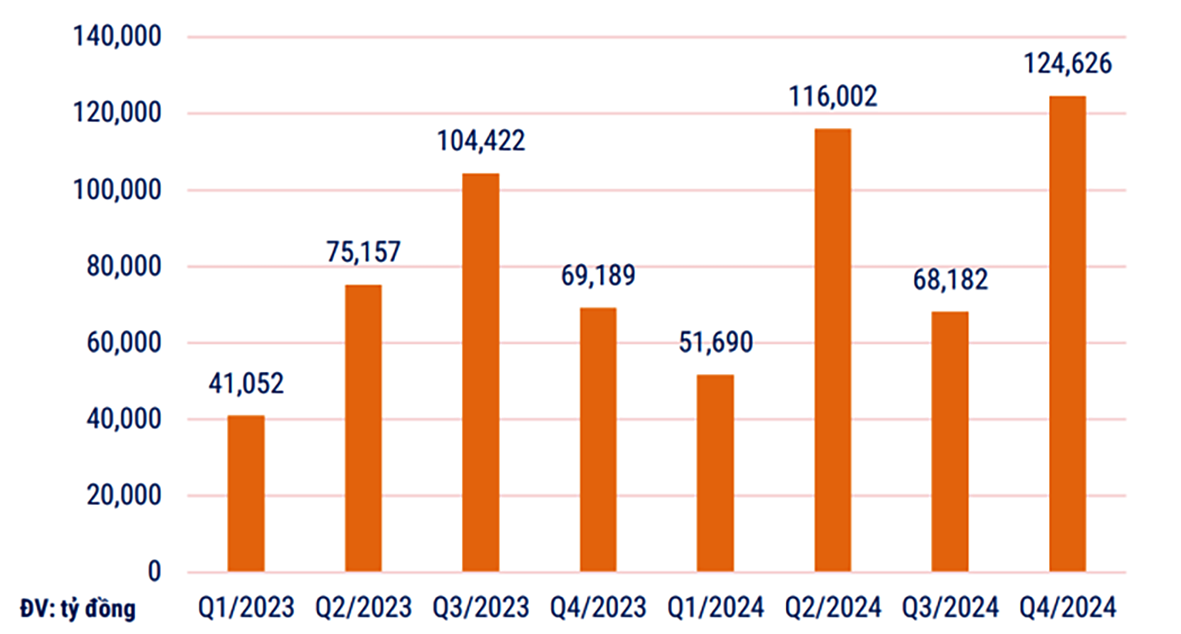

Corporate bonds maturing in the period 2023-2024. Source: HNX, VBMA

The government has enacted Decree No. 08/2023/ND-CP, which suspends the execution of the following provisions in Decree No. 65/2022/ND-CP until December 31, 2023.

For various reasons, 2024 is regarded as an appropriate moment for Vietnam to progressively proceed toward distinguishing and improving the quality of listed bonds, both with and without CR.

First, after ten months of implementing Decree 08/2023, professional individual securities investors have accumulated the required 180 days to meet the professional securities investor regulations in Decree 65, so the suspension of credit rating results regulations for corporate bond issuers does not need to be extended any further.

Second, the Ministry of Finance argued for not extending the suspension of the needed CR for privately-placed corporate bonds. Only two businesses were approved for CR in 2023, thus Decree 08 was required to suspend credit rating requirements for privately-placed corporate bonds until December 31, 2023. The Ministry of Finance has now licensed one additional firm, bringing the total number of enterprises capable of providing CR services to three. This is sufficient to satisfy the CR requirements of the enterprises that require them.

Third, while laws and decrees control public offers and private placements in the primary market, they do not address the secondary market. This results in privately issued- corporate bonds being "published," making the characteristics of publicly issued and privately placed bonds nearly identical. Specifically, after purchasing bonds, some securities companies and commercial banks offer and resell them to individual investors, or legitimize them through "strategic cooperation contracts" or "flexible savings," resulting in a significant amount of privately issued corporate bonds in the hands of non-professional investors.

"Having a CR is an incredibly crucial measure to separate and define the quality of bonds, regardless of whether they are compelled to have one or not." This is because it is the most effective and strong instrument for protecting the interests of both professional and non-professional investors, especially because financial firms continue to utilize several ways to avoid legislation, as I described before", Mr. Phung Xuan Minh said.