Stock Market Weekly Forecast: VN-Index still keeps recovering

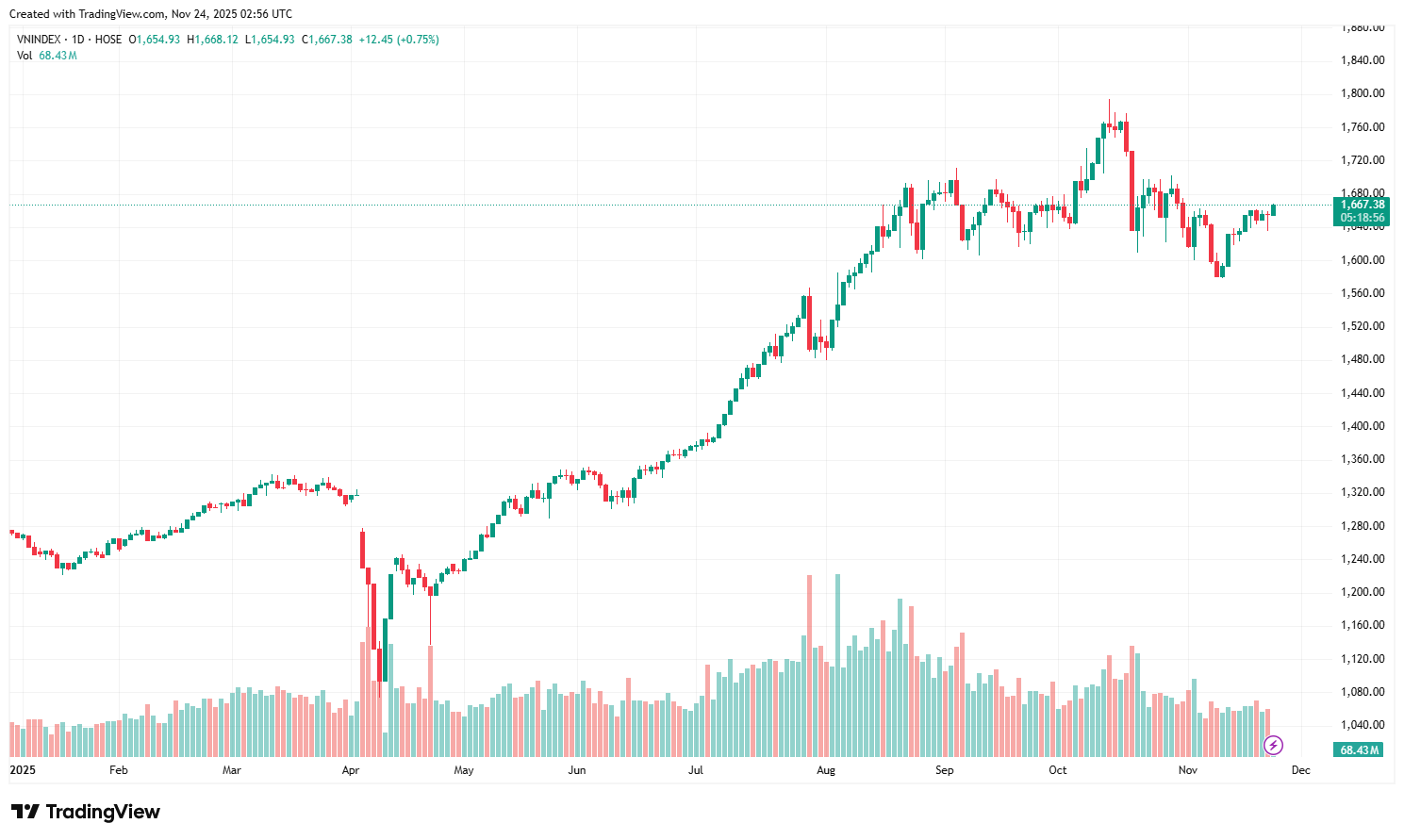

VN-Index is expected to head towards the nearest short-term old peak around 1,660 – 1,670 points in the coming sessions.

At the end of the last week, the VN-Index increased by 19.47 points (1.19%) compared to the previous week.

The VN-Index had a week of trading around 1,620–1,650 points in the expiry week of VN30 index futures contracts. The market opened the first trading session of the week in green thanks to strong demand returning to some stocks in the banking sector.

However, in the following sessions, cash flow continued to be differentiated between market sectors when selling pressure mainly came from large-cap stocks in the securities and banking sectors, causing the general index to continue to fluctuate in the 1,630-1,670 range. On the contrary, cash flow was more active in a few large-cap stocks (Vingroup, VJC and HDB) along with a number of other small and medium-cap stocks in industries that have not recorded a strong increase compared to the VN-Index in the past time, such as chemicals and technology.

In the last trading session of the week, the VN-Index opened down 9 points compared to the reference and quickly faced strong selling pressure from large-cap stocks such as Vingroup’s stocks and banking stocks. Supply quickly spread to other sectors, causing the VN-index to continue to widen its decline to 1,635 points. Red still dominated the market, with 60 stocks gaining points and 240 stocks losing points.

Liquidity in the morning's session increased slightly, with red continuing to dominate the market, showing overwhelming selling pressure. In the afternoon session, the VN-Index continued to maintain around the reference level of 1,635 points before strong demand returned in the Vingroup’s stocks and some large-cap stocks such as FPT, STB, VJC. Liquidity in today's session has not improved compared to the average of 20 sessions, showing the hesitation of investors in the market.

Foreign investors continued to be a minus point when they sold strongly during the session with a total net value of 587.81 billion, focusing on selling VIX, MBB and MWG.

At the end of the session, the VN-Index closed at 1,654.93 points, down 1.06 points, equivalent to 0.06%. At the end of the last week, the VN-Index increased by 19.47 points (1.19%) compared to the previous week.

The VN-Index ended the last trading session of the week with a hammer candlestick showing strong support from investors in the market. On the daily chart, the MACD indicator continued to move up, showing that the index is still maintaining its recovery momentum. However, the CMF and RSI indicators are both moving sideways after bottoming out and have not yet given a clear signal about a new trend.

On the other hand, VN-Index has also had 4 consecutive sessions of accumulation in the 1,650 – 1,670 range, so a new short-term trend may appear in the coming sessions, with the most notable support being the 1,620 – 1,630 range and the VN-Index's resistance being around 1,700 points.

On the hourly chart, the VN-Index continued to record a strong increase and surpassed the EMA20 line. At the same time, the MACD indicator has formed the first bottom and continues to move up, showing that the recovery demand is being maintained in the market. VN-Index is expected to head towards the nearest short-term old peak around 1,660 – 1,665 points in the coming sessions.

At the end of the last trading week, VN-Index sent a positive signal with an impressive recovery of more than 19 points, thereby significantly improving market sentiment. The important highlight lies in the differentiation when the cash flow does not spread widely but focuses strongly on large-cap stocks and codes with separate growth stories.

Based on this development, VCBS recommends that investors continue to maintain their holding positions in stocks that are maintaining an uptrend to optimize profits. At the same time, for new disbursement or surfing positions, investors can flexibly look for short-term opportunities following speculative cash flow. Trading focus is currently on market sectors that have attracted good liquidity in recent sessions, such as real estate, chemicals, and construction.