Should Vietnam tax gold investments?

Taxation on gold transactions is being discussed due to the temporary nature of present gold market control measures.

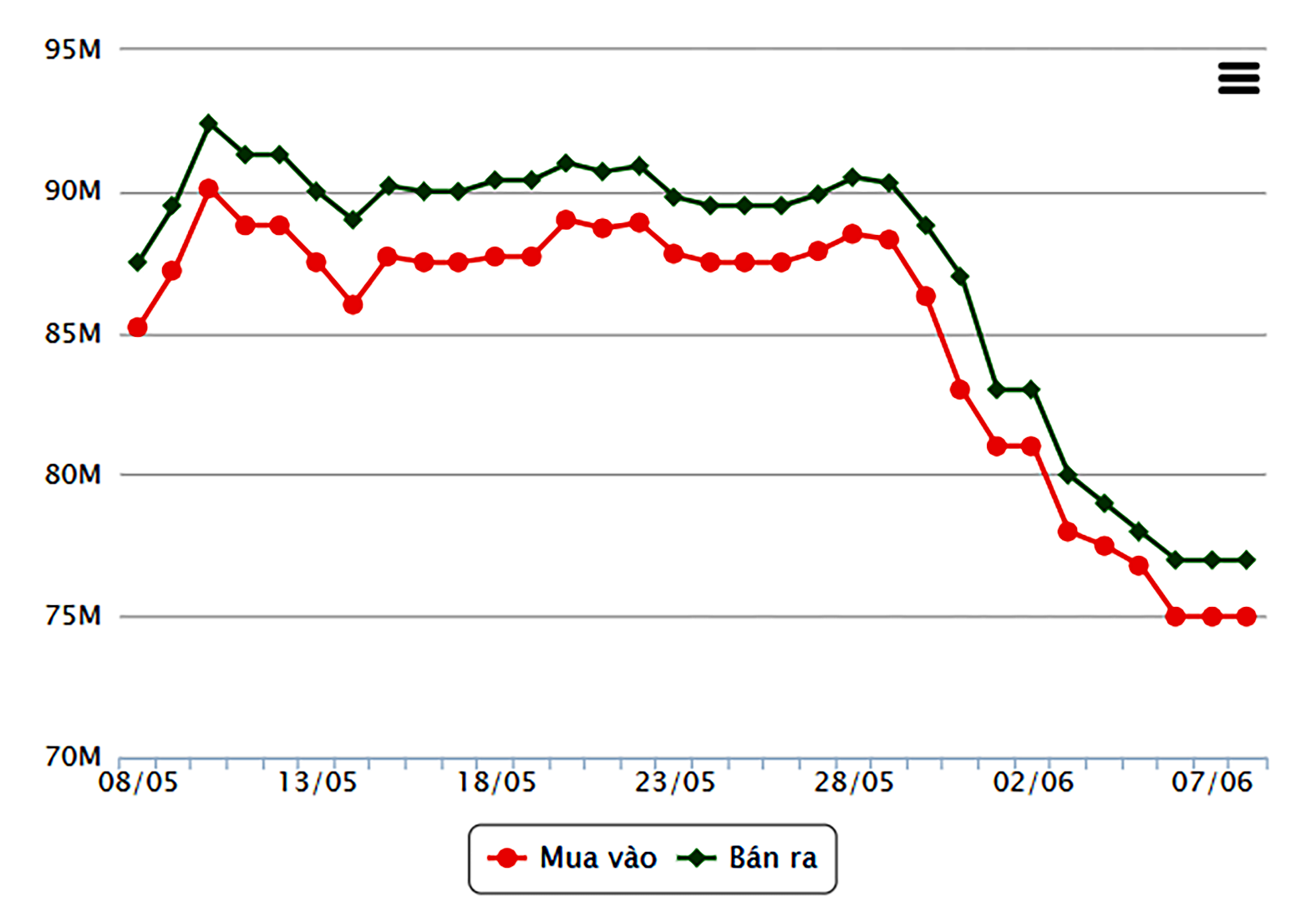

Gold prices have swung dramatically in the last month. For the domestic market, the price of SJC gold bar has risen by 22% since the beginning of the year, reaching a new record high of VND 92.4 million per tael at the beginning of May, increasing the gap with the global gold price and putting pressure on the exchange rate.

Gold price movements over the last 30 days. Source: VDOS

Temporary Profitable "Falls"

The gold market has been impacted in terms of pricing by the State Bank of Vietnam (SBV), which has organized nine gold auctions and changed the gold distribution plan through four state-owned commercial banks and SJC at a cheap price. With the SBV's selling price and an extra minor charge to compensate for transportation expenses, limit ed sales per customer, and only eligible individual purchasers, the price of SJC gold bullion has approached the worldwide gold price. The price gap between SJC gold bar and worldwide gold fell to its lowest point in three years, at 6.5 million VND per tael last week, compared to 20 million VND per tael the previous month.

According to Maybank Securities (MSVN), the SBV's a new approach has initially been effective in terms of delivering a higher amount (relative to prior auctions) and, more crucially, dramatically closing the gap between local and worldwide gold prices.

Furthermore, global gold prices sank 3.5% to their lowest level in a month at the end of last week as news surfaced that the People's Bank of China (PBOC) did not add gold to its 2,260-ton stockpile in May 2024, therefore breaking an 18-month unbroken buildup streak. This new development gives the SBV an edge following months of attempts to calm the local gold market.

The brief cooling of the gold market helps to alleviate exchange rate pressure. However, according to MSVN experts, it will continue to be a difficult battle in the coming period and will be heavily influenced by global gold price movements, as if the expectation of a global gold price increase remains strong, domestic buying demand will remain high. This will provide a serious challenge to the SBV's gold supply capabilities in the next term.

Long-term Solution

Concerns about market volatility have led many experts to suggest that the essential answer is to amend Decree 24/2012 on gold market management.

While the idea of a "national gold bullion brand" has garnered conflicting reactions regarding "eliminating monopolies" or retaining a brand with mechanisms to boost gold imports, experts must analyze, appraise, and employ tax instruments to control and interfere in the market.

SBV says it will consider amending Decree 24/2012

According to Prof. Vo Dinh Tri, a finance professor at IPAG Business School Paris (France), tax tools are a popular method for reducing demand for a certain item. In Vietnam, income from gold investments, generally known as capital gains, are now tax-free. Meanwhile, other profit-generating investments such as equities and real estate are taxed. Taxing earnings, or even inheritance taxes, as in some other nations, would push people to think more carefully about which assets to distribute.

"Even in times with extremely strong demand, the government might raise tariffs such as import and value-added taxes to curb demand. However, this strategy must be backed by control over the illegal market," says Prof. Vo Dinh Tri.

Prof. Nguyen Thi Mui, a member of the National Financial and Monetary Policy Advisory Council, recently stated at an SBV-organized gold management seminar that the regulatory body should propose a gold tax policy shortly. This method has the potential to reroute consumer investment flows and improve market fairness.

Professor Hoang Van Cuong, a member of the National Assembly, proposes a more precise solution: taxation gold based on the amount and purpose of purchase. Individuals buying gold as an asset in modest amounts may be tax-exempt and store it at the SBV. However, individuals purchasing big amounts for speculative purposes to distribute or "ride the wave" should be heavily taxed.

In a debate with the Business Forum, Dr. Dinh The Hien, a financial expert, noted that the present price disparity between local and foreign gold when converted remains significant. People buying gold at this price differential continue to pay high prices, therefore only when there is a solution to bring the gold price closer to the world price and link it to the global price could a solution to tax gold investments be considered.

"Whether the gold price fluctuates due to high or low international prices, the margin should only be considered within a few hundred thousand VND after all taxes and fees have been accounted for (similar to the gap before 2012), then taxing gold investments would truly be fair," says Mr. Hien.