The upward pressure on the USD/VND rate is easing

The founder of FIDT, Mr. Huynh Minh Tuan, believes that various factors are presently supporting the moderation of the USD/VND exchange rate, and that it will not experience major pressure in the near future.

"Easing exchange rate"

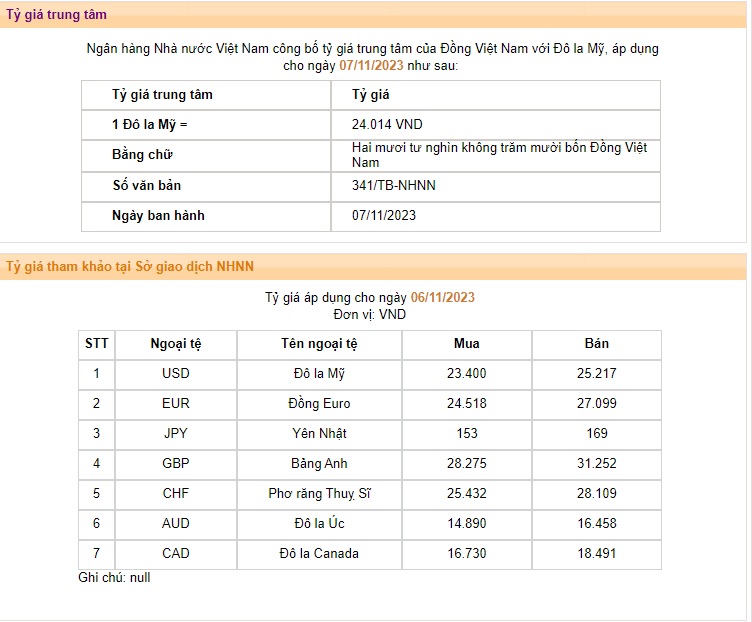

According to Mr. Huynh Minh Tuan, the interbank exchange rate dropped significantly in the early trading session this week, falling by 200 dong compared to the previous week's Friday afternoon session, with the central exchange rate ranging from 24,330 to 24,340 VND/USD. This is the most substantial decline seen in 2023, and it is also an uncommon occurrence in the past, signifying a big change.

The reaction of the foreign currency market indicates that the pressure on the exchange rate has been significantly reduced and that there is no longer a risk. Interbank interest rates are likewise relatively steady, with overnight rates falling below 1.0% and one-month rates falling below 2.0%. Interbank interest rates are projected to fall further, signaling further improvement in market liquidity circumstances.

In Mr. Tuan's view, the considerable drop in the USD/VND rates can be attributed to three concurrent factors:

First, last week's global economic developments greatly lowered global exchange rate pressure.

Second, the short-term global exchange rate trend has reversed, with VND/USD formally entering a reversal trend following the November 6 session.

Third, according to our sources, short-term USD inflows are also assisting the currency's fast depreciation. There is enough data to conclude that the short-term exchange rate pressure and liquidity limit ations (due to the State Bank of Vietnam's bond net withdrawal) have been alleviated.

With the more controllable currency rate trend, FIDT predicts that the State Bank of Vietnam's limit ation on net withdrawals will be maintained in the long term, measured in months, with few risks/events on the global horizon having enough weight to modify this situation.

Furthermore, there is substantial evidence to support this favorable prognosis for the exchange rate in the approaching time. Globally, the Fed's interest rates have obviously peaked, with a likelihood of more than 90% for an interest rate scenario in the 5.25 - 5.50 range continuing until Q2 2024 (with a potential 25bps decrease in Q2 2024). The remark from Federal Reserve Chairman Jerome Powell regarding the prospect that the rate hiking cycle has stopped further reinforces this likelihood.

Trend of selling government bonds: Global rates for government bonds have dramatically cooled, with volatility returning to equilibrium, and the potential of government bond yields comfortably remaining below 4.6% being monitored. Similarly, the global currency rate trend has officially reversed, becoming more balanced, with the VND following suit.

Signals in favor of the stock market

The global stock market traded flat with minor volatility, following three to four consecutive strong comeback sessions since the trading week began in early November.

The Dow Jones, S&P 500, and Nasdaq indexes all enjoyed a sideways trading session, with minor rises of 0.1%, 0.2%, and 0.8%. All three indicators gained significantly over the week.

The European stock market fell slightly throughout the session, bringing the weekly gains to an average of 3%.

Meanwhile, when global exchange rate pressures eased, the ASEAN region's growing markets, particularly China, South Korea, and Vietnam, demonstrated strong recovery rates. The robust rising trend persisted for the third session in a row. South Korea led the way with a 5.0% rise, due to a restriction on short-selling equities until the end of June 2024 to avoid excessive shorting of assets. Yesterday's session saw the Nikkei and Hang Seng maintain their robust gains of 2.4% and 1.7%, respectively.

In Vietnam, the VN-Index rose by 1.2% for the third straight session, totaling a 4.5% advance since the global pressure reversed. A notable feature is that the markets most hit by exchange rate pressure in September and October are recovering the fastest in the short run, with significant recovery momentum.

A significant drop in interest rates in Asian developing economies might be seen as a critical moment that must be constantly monitored. The observed trend indicates that exchange rate pressures in Asian currency groupings, including the VND, have greatly reduced. Following a week of substantial price hikes, the exchange rates of key Asian currencies, including CNY, TWD, KRW, SGD, and Southeast Asia VND, IDR, and THB, have reverted to safe levels in the near term.

With favorable global exchange rate conditions for similar currency groupings as VND, we believe there is sufficient data to ignore short-term exchange rate pressures on VND and the Vietnamese stock market.

Furthermore, the collection of indexes that are significantly connected with stock market liquidity, including 10-year government bond rates, has been on a downward trend since early November. This is a prominent tendency in the Asian economy, especially Vietnam. In terms of 10-year government bond rates in Vietnam, the present dip from 3.1% to 2.8% is a good signal boosting short-term liquidity in the Vietnamese stock market.

According to Mr. Tuan, the stock market will firmly ignore short-term exchange rate and liquidity challenges and function under normal conditions. Individual investors can keep their stock investments and look for chances in the market.