The USD/VND rate will remain under upward pressure

Due to the stronger USD as a result of the FED rate hike, the USD/VND rate will remain under upward pressure in the remaining months of 2022.

The USD/VND rate will remain under upward pressure in the remaining months of 2022.

>> Exporters advised to minimise headwinds of currency volatility

The FED has raised rates five times so far; the most recent 75-bps hike took place at the September 2022 monetary policy meeting. Thus, starting in 2022, the FED raised interest rates by 300 basis points, to 3-3.25%. It's expected that the FED will rise by another 75 and 50 basis points in the final two monetary policy meetings of the year to reach 4.4%.

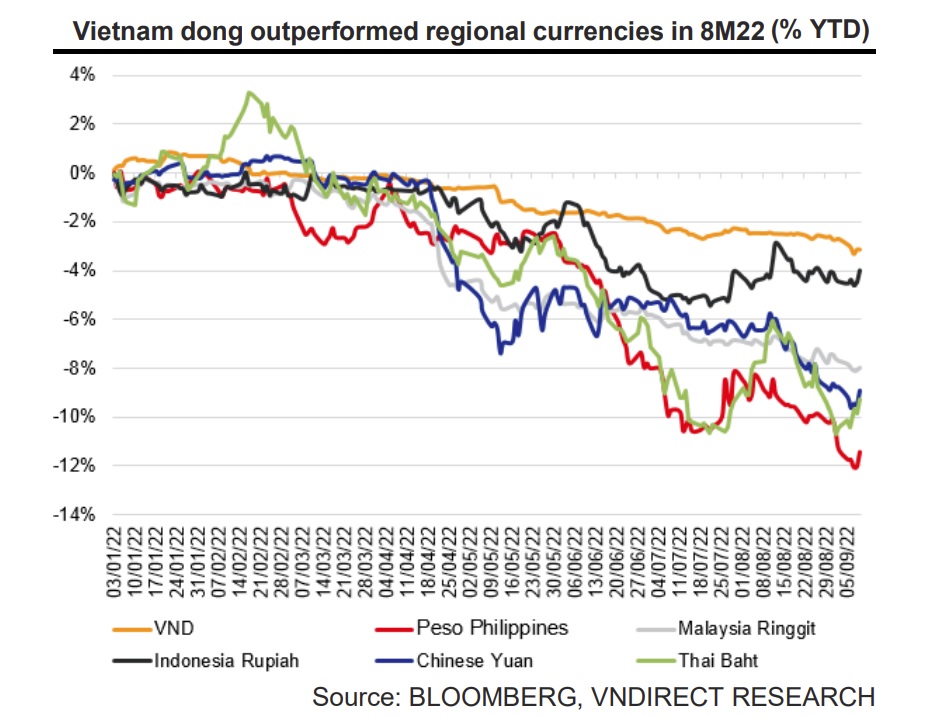

The FED rate hike helped the USD appreciate quickly. The DXY is currently at 114 points, its highest level since the end of 2002 (as of September 27). This has led to a decline in the value of other currencies. Due to Vietnam's stable macroeconomic environment, promising growth prospects, and low inflation, the VND is regarded as one of the most stable currencies when compared to the USD as of September 22nd, with a 3.67% YTD depreciation. Most regional currencies have depreciated by more than 4% against the US dollar since the beginning of 2022 (data as of 8 September 2022), including the Philippine Peso (- 11.4% vs. US$), Thai Baht (-9.9% vs. US$), Chinese Yuan (-9.5% vs. US$), Malaysia Ringgit (-8.1% vs. US$), and Indonesian Rupiah (-4.5% vs. US$).

Since 2H2021, the REER and NEER indexes have remained above 100, based on BVSC's computation of the nominal effective exchange rate (NEER) and the real effective exchange rate (REER). This shows that the VND is still strong and is appreciating in value as compared to the currencies of Vietnam’s trading partners.

The State Bank of Vietnam (SBV) raised policy rates on September 22. As a result, many important rates (discount interest rates, refinancing rates, and the maximum rate for short-term deposits) increased. In light of the fact that more than 90 other central banks have increased rates, the BVSC thinks the SBV's decision to do so is consistent with other central banks. Deposit rates will rise, which will aid in reducing inflation and stabilizing the macroeconomy.

>> State Bank of Vietnam faces pressure on exchange rate

Risks to the VND until the end of the year, if any, will mainly come from the USD’s movement, with DXY advancing rapidly - when the Fed is more hawkish and the US inflation becomes uncontrollable. The current DXY seems to reflect what is likely to happen – the Fed raises rates by 125 bps by the end of 2022 and by 25 bps in 2023. Should the Fed decide to raise rates higher than current expectations, this may affect the uptrend of the USD.

Mr. Dinh Xuan Hinh, analyst at VNDirect believes that the exchange rate will continue to be under pressure in the remaining months of 2022 due to the stronger USD in the context that the FED continues its roadmap to raise interest rates. However, the USD/VND rate still has many supporting factors, including stronger FDI inflows, an improving trade surplus (forecast to reach about USD8.9bn in 2022F), a balance of payments surplus, and sufficient foreign exchange reserves (equivalent to 3.3 months of imports).

In the above context, BVSC believes that the devaluation of the VND may reach a high of 4% in 2022, but such a devaluation is already in the uppermost range of the year. For 2023, BVSC believes that when the Fed ends the current monetary tightening cycle and the USD becomes more stable, the VND’s movement will return to the stable trajectory of previous years, within a range of /- 2%.