The USD/VND uptrend would stall

Although the USD is expected to continue strong, the increase in USD/VND rate is expected to slow down in the second half of 2022.

A strong USD pulls the USD/VND exchange rate in the interbank market up by about 2.4% ytd

Importers, exporters impacted by exchange rate volatility

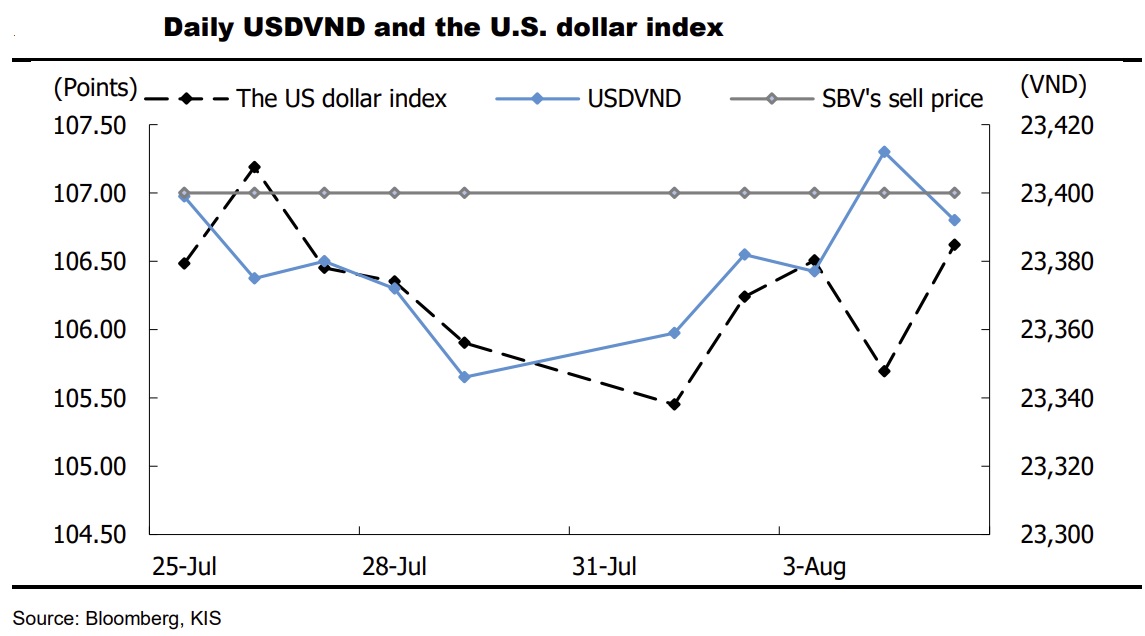

In the preceding week, the US dollar index (DXY) varied around 106.62. After several sessions in a row of declining prices from the previous week, the DXY has picked up its upward pace again. After recently released data revealed an unexpected rise in the US services sector in July, the DXY was kept in support. According to the Institute for Supply Management, a three-month decrease in the non-manufacturing PMI Index came to an end in July.

Furthermore, data showed that U.S. employers hired far more workers than expected in July, the 19th straight month of payroll expansion, with the unemployment rate falling to a pre-pandemic low of 3.5%. These said factors support the view that the U.S economy remained strong, leading to the higher possibility that Fed would be more hawkish than expected in September.

A strong USD pulls the USD/VND exchange rate in the interbank market up by about 2.4% ytd (0.4% mtd). Meanwhile, the State Bank of Vietnam set exchange rate for the US$/VND stood at 23,183, inched up 0.3% mtd (0.2% ytd) while the US$/VND exchange rate in the free market also edged up 0.8% mom (2.6% ytd).

USD/VND rate increased slightly even though the contraction was maintained throughout the previous weeks, following the contraction of DXY. Both DXY and USD/VND rate rebounded slightly after some positive economic data about the U.S market released with traded prices of DXY and USD/VND rate were around 106.62 (0.68% WoW) and 23,392 (0.20% WoW) respectively. In addition, stabilizing the USDVND exchange rate was likely the SBV's top priority as its selling price of the greenback was unchanged at 23,400.

>> Pressure to increase the exchange rate, will the State Bank take action?

Vietnam was among the top three countries with the least depreciation against the USD at around 2.29% so far this year, because SBV decided to anchor the selling price of the USDVND at 23,400 and increase the foreign currency sales to stabilize the exchange rate. In contrast, countries with the floating FX regime, such as Japan and European countries, depreciated sharply against the USD.

Since the beginning of 2022, most regional currencies have fallen by more than 5% against the US$, including Philippine Peso (-10.6% vs. US$), Thai Baht (-9.2% vs. US$), Malaysia Ringgit (-5.1% vs. US$), Chinese Yuan (- 5.9% vs. US$) and Indonesian Rupiah (-5.1% vs. US$).

Mr. Dinh Xuan Hinh, analyst at VNDirect said that there would be several factors supporting VND in the second half of 2022, including: stronger FDI inflows, improving trade surplus (forecast to reach about USD7.2bn in 2022), balance of payments surplus, high foreign exchange reserves (equivalent to 3.5-4.0 months of imports). Therefore, the uptrend of USD/VND would slow down in the second half of 2022.

“We forecast the USD/VND exchange rate to stay within 22,900-23,300 by the end of 2022, corresponding to an increase of no more than 2% compared to the end of 2021”, said Mr. Dinh Xuan Hinh.