Turning point for BSR

The next phase of Bình Sơn Refining and Petrochemical JSC (UPCoM: BSR) will be marked by a considerable capital increase and its planned listing on Ho Chi Minh City Stock Exchange (HoSE).

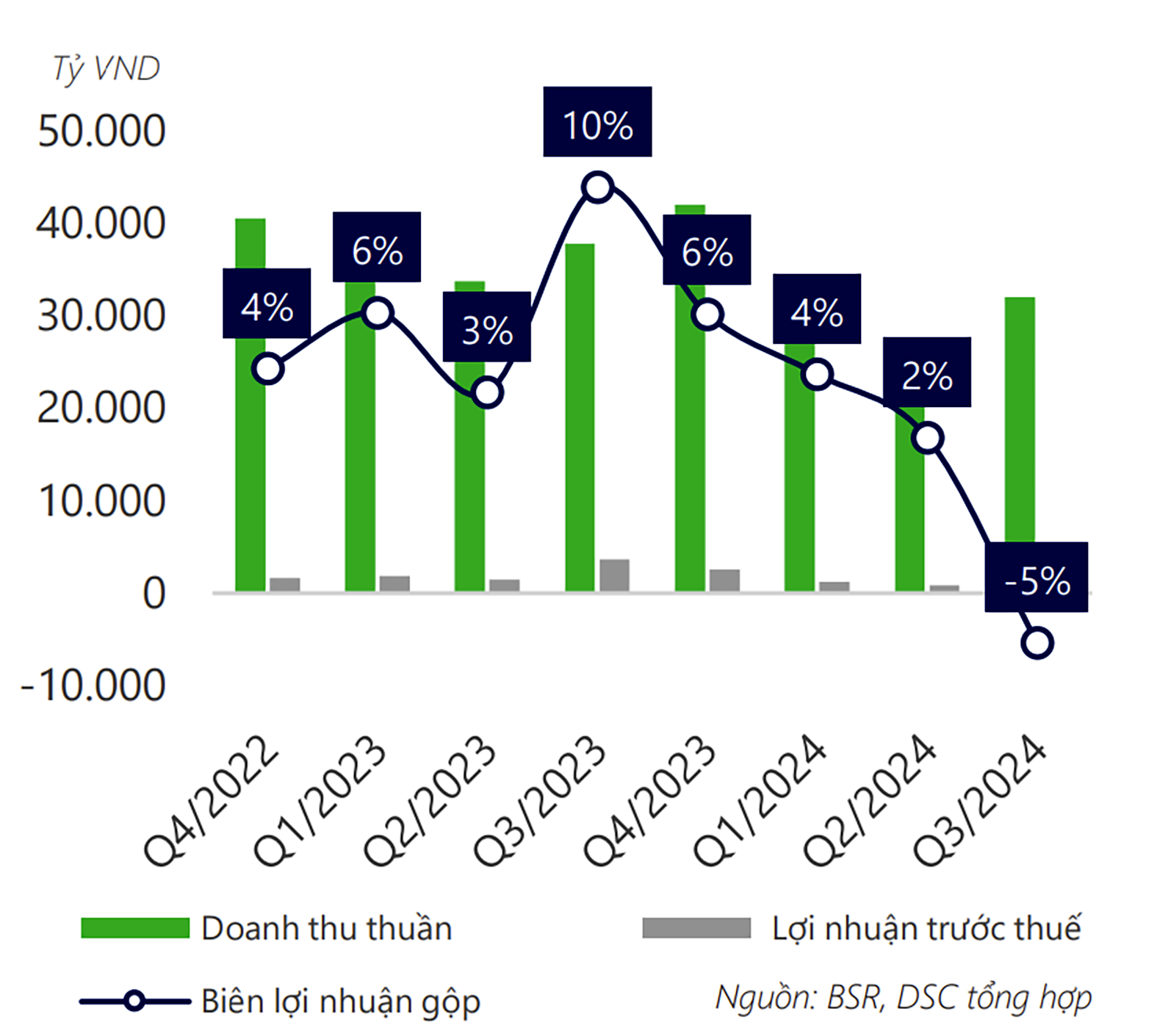

Net revenue and pre-tax profit of BSR over the quarters.

However, BSR faces significant challenges as crude oil prices are expected to drop due to OPEC loosening supply and President-elect Donald Trump accelerating shale oil extraction.

Accelerating to Escape Losses

For the first time in four years, BSR reported a quarterly deficit in its Q3 2024 financial report. BSR reported a net loss of VND 1,209 billion and net sales of over VND 31,946 billion for the quarter, a 15% decrease from the same period last year.

BSR claims that the primary cause of the net loss, which led in a 5% negative profit margin, was a decrease in Crack Spread—the difference between the pricing of refined petroleum's output product and input crude oil—when compared to the same time last year. For BSR, Crack Spread, a popular indicator of refinery profitability, fell by 35%, reaching its lowest level since 2022.

For the first nine months of 2024, BSR’s cumulative revenue reached VND 87,058 billion, a 17.47% decrease year-on-year, while cumulative profit dropped by 89% to VND 674.5 billion.

To recover from losses and prepare for its HoSE listing, BSR has increased its operational capacity, maintained inventory levels at reasonable thresholds to minimize risks, and adopted flexible sales policies to mitigate the impact of potential global oil price declines.

Listing on HoSE

BSR has been approved for listing on the Ho Chi Minh City Stock Exchange (HoSE). With over 3.1 billion shares, BSR is expected to debut on HoSE on January 17, 2025. On the stock market, BSR shares have risen by 23% since the beginning of 2024, with the company’s market capitalization reaching nearly VND 69 trillion.

BSR is projected to list on HoSE on January 17.

BSR currently manages and operates the Dung Quất Oil Refinery, Vietnam's first oil refinery. This project, initiated in 2005 with a total investment of USD 3 billion, commenced operations in 2009. The Dung Quất Refinery has a processing capacity of 6.5 million tons of crude oil annually.

A 2025 business plan has been authorized by BSR's management in order to successfully switch to HoSE. 2.5 million tons of diesel, 2.2 million tons of RON 95 gasoline, 0.6 million tons of RON 91/92 gasoline, and 0.6 million tons of Jet A1 fuel are all part of the 6.7 million tons of production output that the plan aims to achieve. Accordingly, it is anticipated that in 2025, BSR consumption will amount to 6.6 million tons. By being listed on HoSE, BSR will be able to draw in international investment for ongoing projects and establish itself as the biggest petrochemical and refining company in Vietnam on the stock exchange.

Challenges in Raising Capital

Alongside its HoSE debut in 2025, BSR’s plan to increase its charter capital to nearly USD 2 billion (approximately VND 50 trillion) has been approved by PVN and is under review by regulatory authorities. The company plans to issue bonus shares and pay dividends in shares from its development fund and undistributed post-tax profit, with a total bonus ratio of 61.5%.

BSR stated that increasing charter capital is a pressing requirement to meet funding needs for the Dung Quất Refinery expansion project. This critical project, approved by the Prime Minister, aims to enhance the refinery's production capacity to 171,000 barrels per day.

Financial experts emphasize the importance of charter capital for enterprises. Higher charter capital not only reflects a company’s financial capacity but also strengthens its ability to secure loans and expand operations. It is a crucial factor in assessing a company’s value. Foreign investors often consider charter capital when evaluating profitability and growth potential.

Although raising funds and listing successfully are important milestones, DSC Securities JSC thinks that enhancing BSR's business performance is more significant. As OPEC gradually reduces the supply of crude oil to satisfy the reviving demand on the global market, crude oil prices are now on a long-term downward trend. The recovery is expected to reach 5.86 million barrels per day by the end of 2025. There is a chance that crude oil prices would drop as a result of President-elect Donald Trump's plan to speed up shale oil extraction.

This presents a significant challenge for BSR in 2025, as its business model primarily benefits from the price difference between refined petroleum products and crude oil. It appears that BSR’s golden era may have passed.